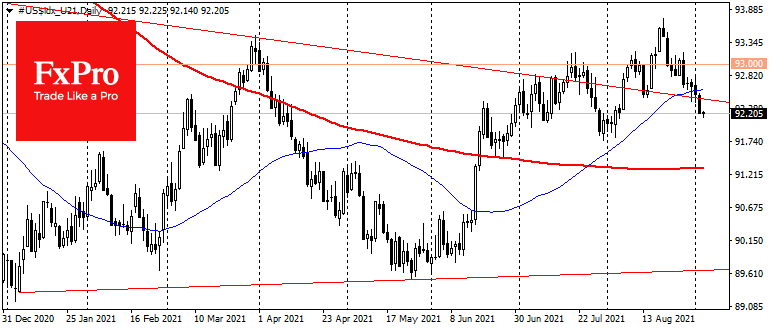

In August, technical analysis was increasingly pointing to a break of the last-year downtrend and an upward breakthrough from consolidation.

But it seems that now is the case that the fundamentals have been stronger. While Powell’s speech did not cause any turbulence in the markets, central bankers have perfectly learned to speak boring but shift the emphasis in the direction they want.

In the outgoing week, we have seen a return of outperformance in risk assets, with the high-tech Nasdaq leading among US equity indices and high-yield securities in bonds.

Buoyed by assurances that the Fed will not rush to raise rates and is not concerned about inflation, news slightly higher than expected did not cause a pull into the dollar and a reassessment of rate expectations.

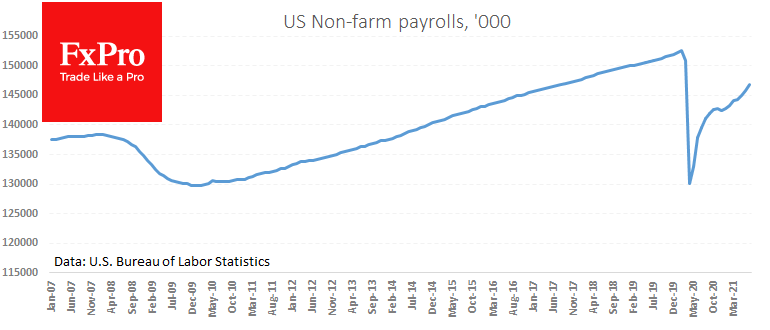

On average, market analysts expect the official report to show employment growth of 750k in August compared to 943k the month before. A violent dollar reaction is only to be expected if robust labour market indicators above 1 million are released.

Such an outcome would sharply increase the chances that later this September, the Fed will start tapering QE at a potentially high speed. Moreover, a rate hike in the middle of next year again becomes a realistic scenario.

However, early labour market indicators, from ADP and ISM employment components to weekly jobless claims, are setting up more modest expectations of 400-700K job growth, which promises to be bad news for the dollar, confirming the downtrend towards major competitors, most of which are taking a more hawkish approach to fighting inflation.

Source: FXPro