The euro advanced 0.33% to 1.1345 against the dollar on Wednesday, December 29. An upturn in UST yields strengthened the dollar and put some pressure on the single currency. Before the rise, the EURUSD pair dropped to 1.1274, and gold fell to $1,789.49. The 10-year UST yield widened to 1.56%.

News about China Evergrande Group could exert a negative impact on risk-sensitive assets. The company missed coupon payments on its $255 mln offshore bonds. The holding missed interest payment on a $50.4 mln coupon maturing in 2023 and $204.8 mln on a coupon maturing in 2025. Both issues provide for a 30-day grace period until default is announced.

EURUSD pared intraday losses from a weekly low and surged to a fresh intraday high of 1.1369. All major currencies rebounded, including gold. There were no drivers behind these gains. Sharp price fluctuations were seen within a narrow range ahead of the New Year.

Today’s macro agenda (GMT 3)

10:00 UK: Nationwide house price index (December)

11:00 Switzerland: KOF leading indicators index (December)

16:30 US: initial jobless claims (week ended December 24)

17:45 US: Chicago Fed national activity index (December)

Current outlook

By the time of writing, the euro was trading at 1.1316. Major currencies are trading in the red against the US dollar. The largest losses can be seen in the euro (-0.27%) and the Swiss franc (-0.29%). The market continues to experience sharp gyrations amid thin volumes ahead of the upcoming holidays and a blank economic calendar.

With 2022 right around the corner, investors are gearing up for a year of high inflation, Covid-related uncertainty, and tightening of monetary policy by the US Federal Reserve.

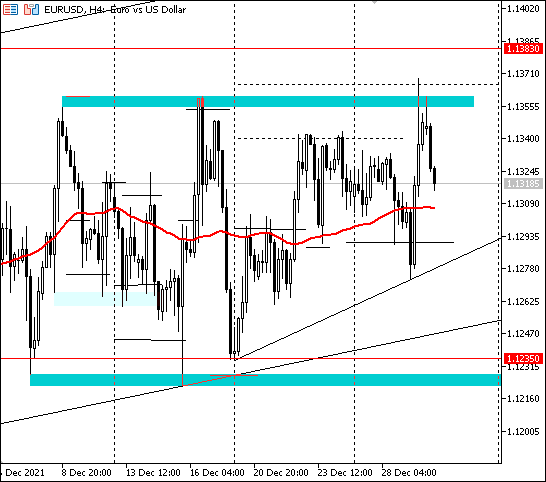

Price action continues to hover in the monthly range of 1.1225-1.1385. The FX market will likely remain rangebound until the New Year. Investors and traders will come back to the market after the holidays on January 3.

Bottom line: the single currency traded higher on Wednesday. There was no news behind the recovery of the EURUSD pair. From a high of 1.1369, the pair retraced to 1.1318. Price action is still locked in the monthly range of 1.1225-1.1385. The FX market will likely continue to see rangebound trading until 2022.