EUR/USD Surveys

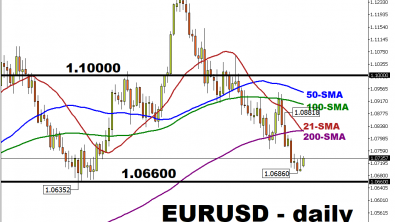

Analysis of the main currency pair EUR/USD

The currency pair EUR/USD by far is the most popular one nowadays, including inseparably linked with it EUR/USD forecast. This currency instrument of binary options is more suitable for those traders who prefer to trade following the EUR/USD news. If you trade using this currency pair you should be aware of the economic picture both in Eurozone and USA, and be aware of declarations made by chiefs of monetary policy regarding economic climate and national currency in the above mentioned countries. The U.S. central bank is the Federal Reserve (Fed), the eurocurrency policy in turn, is guided by the European Central Bank (ERU).

EUR/USD Currency Pair - the Most Popular in the Forex Market

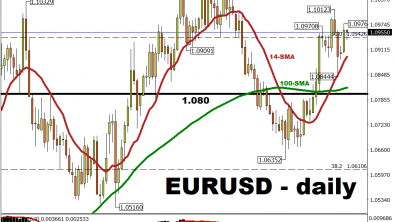

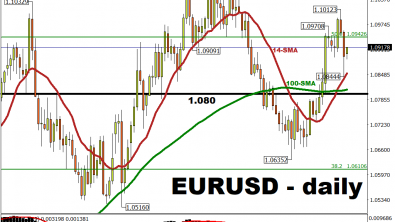

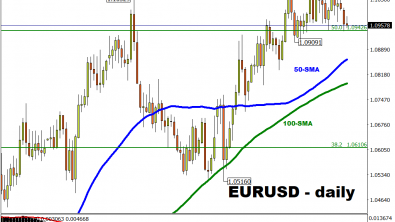

EUR/USD currency pair is best lends itself to EUR/USD technical analysis at the time, when the working hours of North American and European stock markets concur with. Just then the exchange market is most volatile and active, fact that creates conditions for the opening of positions with a high probability of success for traders. It should be noted that due to the global popularity and correlations between currencies, Forex EUR/USD currency pair fluctuates quite strongly, and you can also trade successfully out of mentioned range of increased business activity.

Binary options traders who prefer the fundamental analysis, pay attention to EUR/USD news published in authoritative newspapers and trade accordingly, relying on these data. Among such EUR/USD news and analysis could be decisions on interest rates, as well as political or economic events that may affect the price of these two major currencies. For the binary options traders an idea appeared in advance of how an event might affect the dynamics of the currency pair is an obvious and, most likely, profitable trading opportunity. The main nuance of EUR/USD daily forecast as well as when trading with this currency pair, is that on its price fluctuations influence a variety of political and economic factors.

EUR/USD Characteristics

Especially one thing should be taken into account, that the euro is the official currency of many states, therefore it is important to understand that change of situation in any of EU country might have impact on this currency pair and results of sequential EUR/USD Forex analysis.

The bidders should remember one important thing, that this currency pair (as well as associated EUR/USD signals) might change very quickly its direction and range, therefore is needed to react promptly on such changes.

Despite the rather large fluctuations (owing to fact that many major traders open positions in different directions) of Forex euro/dollar when trading with this currency pair, the trend following is more efficient operation, but scalping will bring a minor success.