Forex Technical Analysis & Forecasts

Technical analysis is an effective tool of trading

Even inexperienced traders know that serious analytical research is a guarantee for successful trading on the foreign exchange market. The Forex technical analysis assumes the market’s behavior investigation in the past, for the purpose of determination the trader’s optimal behavioral model and trading strategy. The Daily Forex technical analysis rely on assumption that the market possesses its own memory, hence, the future price move can be determined, grounding on the objective laws of the price behavior in the past.

Technical Analysis - its Essence and Mission

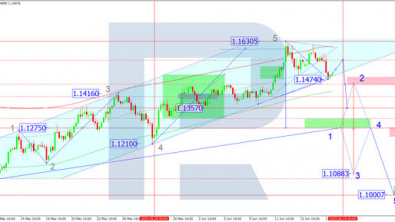

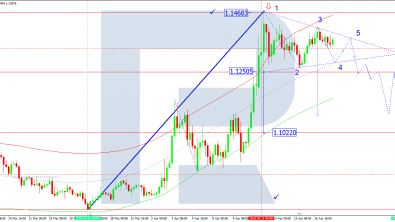

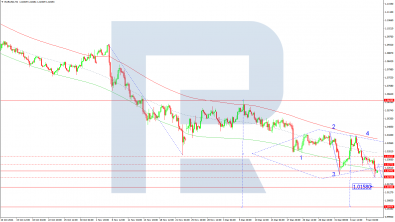

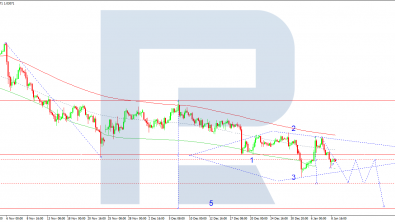

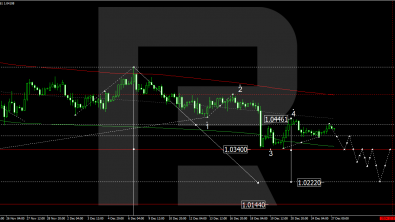

Practically any trader knows that the Forex technical analysis is a wide-spread method in order to forecast the price change. The Daily Forex technical analysis is built by the trader on the charts of quotations change for certain periods of time. In other words, the Forex technical analysis means the quotation’s history research, by the instrumentality of which the users might determine the possible trend’s direction in the future.

The Most Important Types and Elements of Technical Analysis

The present free Forex technical analysis is divided into several types. One of the most popular is the candlestick analysis. Its essence is to find in the quotation’s history the standard reversal patterns or trend continuation (“Head and Shoulders”, “Wedge”, “Double Top”, “Triangle”, etc.). Appearance of any of the above mentioned figures on the chart means that the trader might forecast the future price move, as well as its possible breakout. Regarding the auxiliary elements of the present type of analysis, the Forex technical analysis indicators are the most significant ones, which can be found on any platform. There are various types of indicators therefore any trader may work out its own trading strategy for any instrument, grounding on the data of one or another indicator. Exactly the Forex technical analysis & forecasts worth recommending for the novice traders, as its various automatic programs, indicators and expert advisors might be helpful and useful.