Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 18 June 2025.

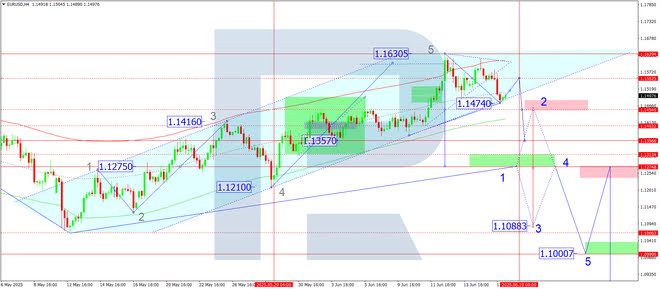

EURUSD forecast

On the H4 chart, EURUSD completed a downward wave to 1.1474. Today, 18 June 2025, the market is expected to correct towards 1.1555, defining a new consolidation range around this level. Once the correction ends, the price could begin a new downward wave towards 1.1355, the local target.

The Elliott wave structure and the growth matrix with a pivot at 1.1400 confirm this scenario. This level acts as a key reference for the fifth growth wave of EURUSD. The price has completed the first segment of the downward wave to the central line of the price Envelope at 1.1474. Today, a corrective move to 1.1555 is likely, followed by a decline to its lower boundary at 1.1356. The market appears to be forming the first wave of a larger downtrend towards 1.1275.

Technical indicators for today’s EURUSD forecast suggest a corrective rise to 1.1555.

.png)

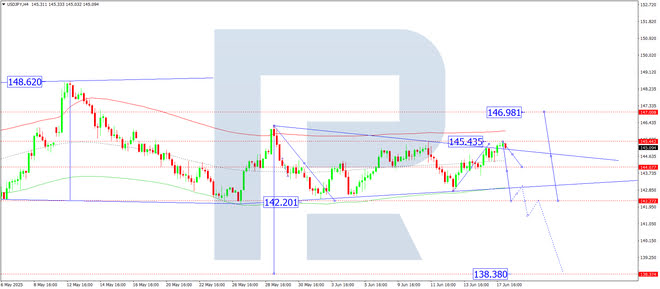

USDJPY forecast

On the H4 chart, USDJPY completed an upward wave to 145.43, shaping a Triangle pattern. Today, 18 June 2025, a downward wave towards 144.00 is expected. A compact consolidation range may develop around this level. A breakout to the downside could send the price to 142.20, with a possible continuation of the trend to 138.38, the local target.

The Elliott wave structure and the decline matrix with a pivot at 142.20 support this outlook, which is seen as key in the current wave. The market is forming a consolidation range around the price Envelope’s central line at 144.00. Today, a move down to the lower boundary at 142.20 is possible. Alternatively, a breakout above 145.45 may extend the wave to 148.98, though this would only be considered a correction within the broader downtrend, which is expected to resume to 136.00 after completion.

Technical indicators for today’s USDJPY forecast suggest the beginning of a downward wave to 142.20.

.png)

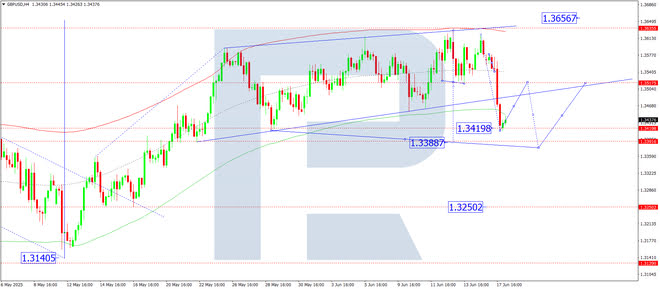

GBPUSD forecast

On the H4 chart, GBPUSD completed a downward wave to 1.3420, the local target. Today, 18 June 2025, a corrective rise to 1.3515 is expected, followed by another move down to 1.3390, the first target.

The Elliott wave structure and the decline matrix with a pivot at 1.3515 support this scenario, which is central to the current wave structure. The market is shaping the first wave of a decline to the lower boundary of the price Envelope at 1.3390. The price has declined to 1.3420. A corrective move to the central line at 1.3515 is expected today, after which the market may resume its fall towards 1.3390.

Technical indicators for today’s GBPUSD forecast suggest a growth to 1.3515.

.png)

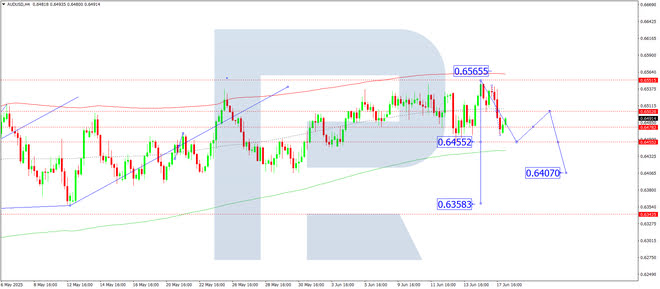

AUDUSD forecast

On the H4 chart, AUDUSD completed a downward wave to 0.6465. Today, 18 June 2025, a corrective rise to 0.6500 (testing from below) is expected. Afterwards, the market may resume its decline towards 0.6455, the first target.

The Elliott wave structure and the decline matrix with a pivot at 0.6500 support this scenario. It is key in the current wave structure. The market is forming a wave towards the lower boundary of the price Envelope at 0.6455. Once reached, a rebound to the central line at 0.6500 may follow.

Technical indicators for today’s AUDUSD forecast suggest a potential rise to 0.6500 and then a decline to 0.6455.

.png)

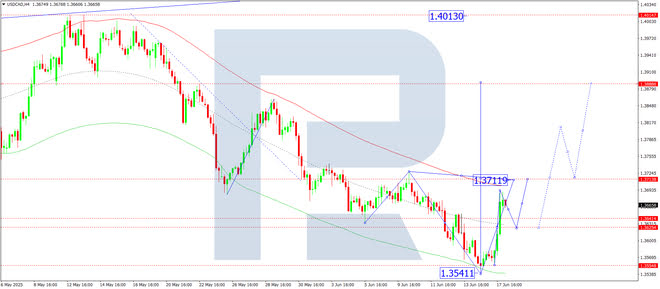

USDCAD forecast

On the H4 chart, USDCAD completed an upward wave to 1.3690, the local target. Today, 18 June 2025, a correction to 1.3625 is expected. After the correction, the market could resume its rise towards 1.3711, the first target.

The Elliott wave structure and the growth matrix with a pivot at 1.3625 confirm this scenario as key in the current USDCAD wave. The market has reached a local peak and may now correct to the price Envelope’s central line at 1.3625 before resuming growth to its upper boundary at 1.3711.

Technical indicators for today’s USDCAD forecast suggest a pullback to 1.3625.

.png)

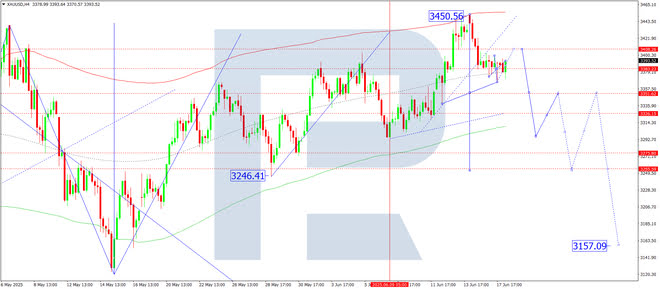

XAUUSD forecast

On the H4 chart, XAUUSD continues consolidating around 3,388 without a clear trend. Today, 18 June 2025, a compact range has formed around this level. If the market breaks upward, a correction to 3,410 is possible. A downward breakout may trigger a continuation of the first wave down to 3,350.

The Elliott wave structure and the decline matrix with a pivot at 3388 confirm this scenario as central to the XAUUSD wave. The market has formed a downward wave to the price Envelope’s central line at 3,388. A breakout could extend the decline to the lower boundary at 3,350.

Technical indicators for today’s XAUUSD forecast point to a continued downward wave to 3,350.

.png)

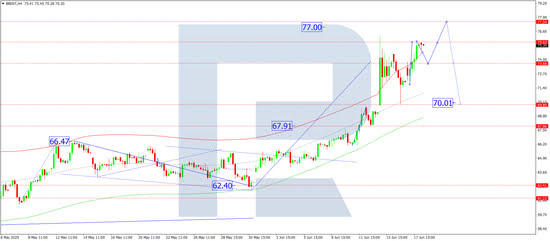

Brent forecast

On the H4 chart, Brent crude continues developing a consolidation range around 73.66. Today, 18 June 2025, the market expanded the range upward to 75.62. A pullback to 73.66 (testing from above) is expected, followed by growth to the first target of 77.50.

The Elliott wave structure and the growth matrix with a pivot at 67.90 support this scenario as central to Brent’s wave. The market is building a wave towards the upper boundary of the price Envelope at 77.50. After reaching this level, a correction to the lower boundary at 70.00 is possible.

Technical indicators for today’s Brent forecast suggest a correction to 73.66 followed by growth to 77.50.

.png)