The greenback has eased back this morning, after reversing most of its losses seen around the mixed NFP report last Friday.

The US dollar’s recent declines came as risk sentiment has turned sour on lower than expected Chinese trade data & Moody’s downgrade of 10 US regional banks.

This all comes on the back of last week’s US debt downgrade, coupled with the Treasury’s announcement that it will be increasing its bond issuance in the coming months. The dollar has been attracting some safe haven flows, as riskier assets such as stocks suffer.

The market’s collective attention is turning towards tomorrow's US inflation data which is the first CPI report of two ahead of the next FOMC meeting in September.

That could result in summer markets shrugging off the figures while they await the timelier report one week before the 20 September Fed rate decision.

Markets are fairly convinced at present that Chair Powell is pretty much done with tightening rates. But the disinflation needs to continue, and it may get a jolt on Thursday due to base effects in the headline number causing a slight rise.

Key will be the monthly core CPI reading that is expected to match the previous month at 0.2%.

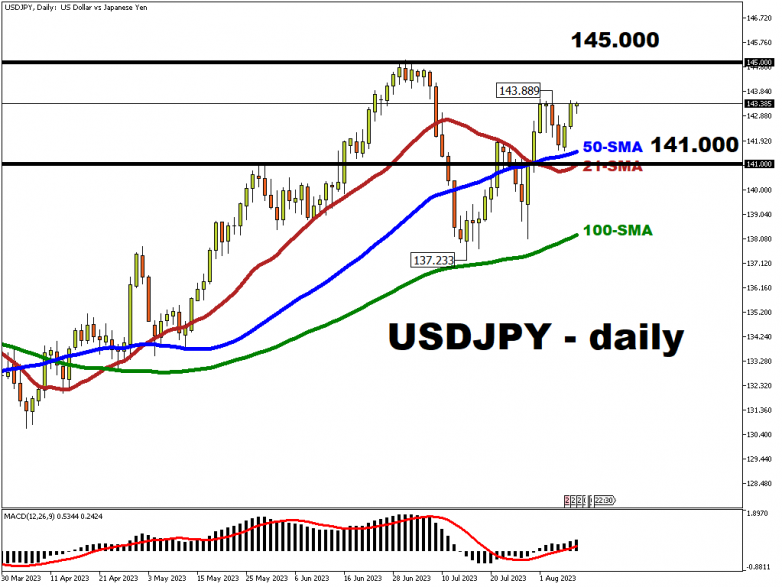

USD/JPY through 143

Still-elevated Treasury yields have helped USD/JPY stay above 143 psychological level. With the Bank of Japan normalisation still looking some way off to temper bearish pressure on the yen, the major is the most exposed pair to bond market volatility.

Last week’s high at 143.889 is a bull target ahead of 145 level which was the previous “line in the sand” for potential Japanese FX intervention.

Initial support is at the 50-day SMA at 141.582.

EUR/USD’s third correction

The world’s most traded currency pair has been going through its third notable correction of the year.

The ones in February and May were worth over 4% each. The current pullback after topping out at 1.12757 in mid-July was as much as 3% so far.

These corrections come chiefly due to heavy one-way positioning as most Wall Street strategists forecast EUR/USD to be higher by year-end with the current consensus around 1.12000.

The market has taken around 15bps out of the expected ECB tightening cycle over recent week.

But last week’s core inflation figures were still high which implies that September ECB meeting should still be considered “live” for a 25bps rate hike.

The 50-day SMA is set to provide an immediate support at 1.09524. Resistance levels sit at 1.10000 and then 1.10450.