This week promises to see a jump in volatility as the waiting finally stops and huge risk events pile up on top of each other:

Monday, June 12

- JPY: Japan PPI

Tuesday, June 13

- AUD: Australia consumer confidence

- EUR: Germany CPI, ZEW survey expectations

- GBP: UK jobless claims, unemployment

- OIL: OPEC monthly oil market report

- USD: US CPI

Wednesday, June 14

- EUR: Eurozone industrial production

- GBP: UK monthly GDP, industrial production

- USD: Fed rate decision, PPI

Thursday, June 15

- CNY: China retail sales, industrial production

- AUD: Australia unemployment

- CAD: Canada housing starts, existing home sales

- EUR: ECB rate decision

- USD: US initial jobless claims, retail sales, empire manufacturing

Friday, June 16

- JPY: BoJ rate decision

- EUR: Eurozone CPI (final)

- GBP: Bank of England inflation expectations survey

- USD: University of Michigan consumer sentiment

We have three major central bank meetings as the US Federal Reserve, the European Central Bank and Bank of Japan discuss policy and announce their respective rate decisions.

Ahead of that, we get the release of the latest US CPI data which will potentially direct price action and determine how the Fed reacts.

Other top tier economic releases include UK wage growth and employment figures, and US retail sales which will highlight how the all-important US consumer is coping with higher interest rates and still elevated inflation.

Stubborn US inflation to force Fed hike this week?

May’s US CPI print is seen rising only moderately to 0.2% m/m after the 0.4% move higher in April, with the annual headline reading falling to 4.1% from 4.9%.

Beyond such headline prints, it is the core which will be key. This is forecast to remain unchanged at 0.4% m/m and fall two-tenths to 5.3% y/y.

If the monthly figure rises more than 0.4%, then the dial for the consensus call of an unchanged FOMC call this week may shift towards a 25bp rate hike.

Economic activity in the US has continued to remain resilient with a still hot labour market while other central banks have stayed hawkish by surprisingly raising rates due to high inflationary pressures.

But the idea of the Fed “skipping” this meeting to assess the impact of 500bps of rate hikes in just 14 months, the most in over 40 years, has gained traction recently with a rate hike more likely at the Fed’s late July meeting.

There will surely be an intense debate on the FOMC with the bank wanting to remain data dependent and vigilant about hot inflation and the jobs market.

Markets expect two more 25-bps hikes by ECB

The ECB is a more obvious call for this week: nailed on to hike its benchmark rates by another 25bps.

Even though recent eurozone data may have disappointed, the ECB seems determined to squash high core inflation with higher interest rates.

Looking further down the line, markets price in at least one more 25bp rate hike by the European Central Bank after this meeting so will be led by the tone and any forward guidance from President Lagarde at her subsequent press conference.

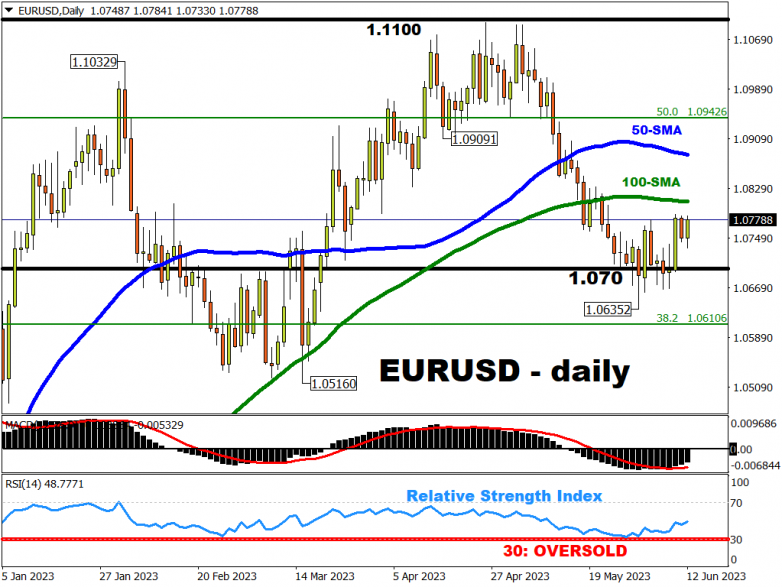

EUR/USD looks to have formed a strong base around 1.07 with the key cycle low at 1.06352.

A less hawkish Lagarde will see that troubled but a President warning of more hikes in the pipeline could see the 100-day simple moving average at 1.0807 challenged.