It’s the final week of the first half of 2023, but there’s no lull for markets.

It’s the turn of fresh CPI data to get traders worked up this week after the Aplethora of recent central banks meetings and decisions, even as markets keep an eye on any further threats to the current Russian administration after the weekend’s short-lived revolt by the Wagner Group.

Here’s what traders and investors can expect in the days ahead:

Monday, June 26

- EUR: Germany June IFO business climate

Tuesday, June 27

- EUR: ECB President Christine Lagarde speech

- USD: US June consumer confidence

- CAD: Canada May CPI

Wednesday, June 28

- AUD: Australia May CPI

- CNH: China May industrial profits

- FX Majors: Speeches by Fed Chair Jerome Powell, ECB President Christine Lagarde, BOJ Governor Kazuo Ueda, BOE Governor Andrew Bailey

- WSt30_m: Fed releases annual banking stress test results

Thursday, June 29

- JPY: Japan May retail sales

- AUD: Australia May retail sales

- SEK: Sweden Riksbank rate decision

- EUR: Germany June CPI; Eurozone June economic confidence

- USD: US 1Q GDP (final); weekly jobless claims; speech by Atlanta Fed President Rafael Bostic

Friday, June 30

- JPY: Tokyo June CPI; Japan May jobless rate and industrial production

- CNH: China June manufacturing PMI

- EUR: Eurozone June CPI; May unemployment

- GBP: UK 1Q GDP (final)

- CAD: Canada April GDP

- USD: US May PCE Deflator; personal income and spending; June consumer sentiment

Eurozone markets will be closely followed with the release of individual country inflation data before we get the region’s June CPI flash estimate on Friday.

The market eyes another drop in the headline while within the core, services inflation will grab the spotlight again due to some upside risks for the months ahead.

Markets have tempered ECB expectations due to flagging recent data like Friday’s disappointing PMIs, but policy makers are still keen on delivering more rate hikes in July at least.

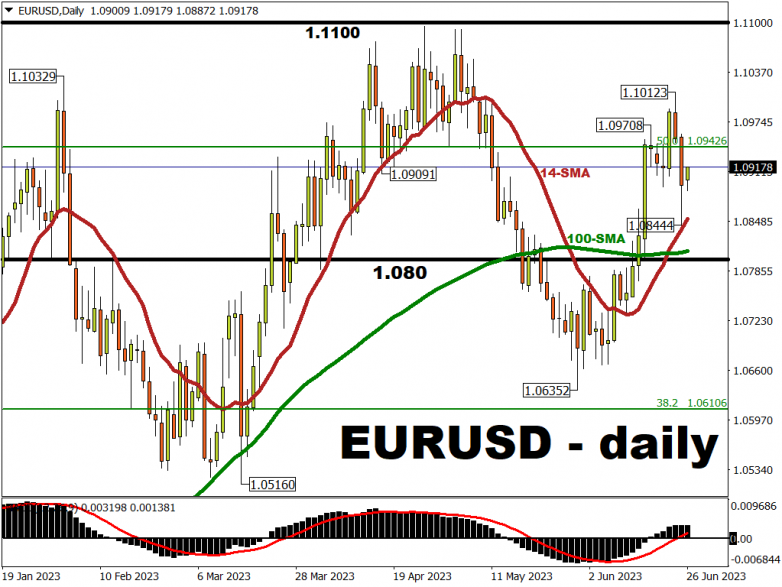

Weaker growth may eventually break core inflation pressures and weigh on the euro, potentially dragging EURUSD back closer to the 1.080 psychologically-important level.

Midweek, central bank heads gather for the annual pow-wow in Sintra, Portugal organised by the ECB.

This could be an opportunity for them to spell out their current reaction function and has historically seen some big announcements, by the ECB President at least.

Most policymakers profess to be data dependent now so any hints on how much more work has to be done will drive price action as we head into the summer months.

Across the Atlantic, the Fed’s preferred inflation gauge is due to be released on Friday.

Both the month-on-month as well as year-on-year PCE deflators for May are expected to ease slightly from April’s reading.

However, the core PCE deflator is forecasted to remain stubborn and match April’s prints.

That means bets for a July hike by the FOMC may strengthen a touch, especially as we get more Fedspeak on the wires.

Markets currently price in only around a 70% chance of a 25bp hike next month, taking rates to between 5.5-5.75%.

This stands in contrast to the FOMC’s recent new dot plot which forecast two more rate hikes.

The dollar rebounded last week but the longer run risks for USD still appear tilted to the downside, with the peak in the Fed cycle close and the global rate cycle showing signs of maturing.

That may ensure a supportive environment for EURUSD in the months ahead.