The world’s most traded currency pair has had a nightmare summer. EUR/USD is heading for eight consecutive weeks of losses, which was last seen in 2014.

The region’s economy remains fragile while US data continues to stay resilient.

Higher oil prices and disruption to LNG supplies is also not good news for the eurozone.

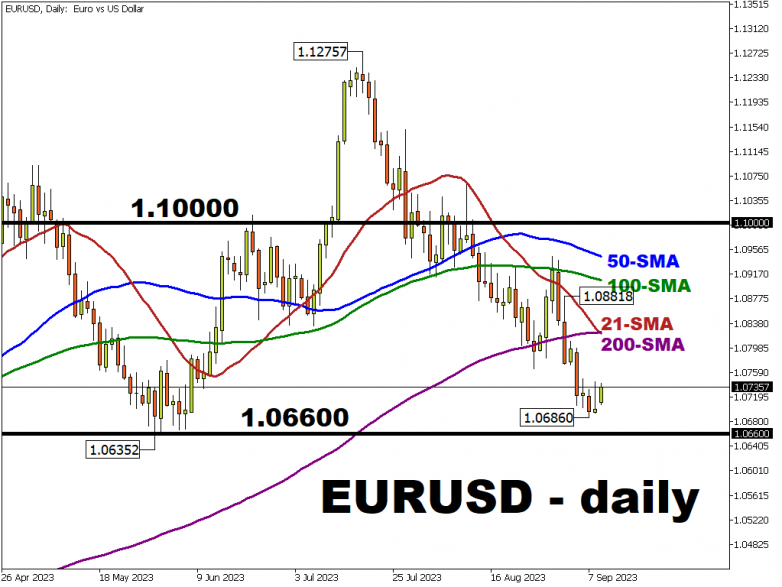

On the charts, EUR/USD broke decisively down through the 200-day simple moving average at the start of the month. The August low at 1.0765 was taken out last week with prices now looking for support from the late May and early June lows just below 1.07. Pressure could build further if USD/CNH pushes up to the 7.40 zone.

Events Watchlist

- Tuesday, September 12th: UK Jobs Data

Wage growth and the vacancy/jobless ratio are key inputs into the Bank of England’s rate decision in two weeks’ time. The former is at record levels above 8% in the private sector but there is hope that this has peaked. Markets currently price in around one and a half more 25bp rate hikes by February, so a peak rate around 5.60%.

- Wednesday, September 13th: US CPI

Inflation remains the key conundrum for the Fed as it keeps tab on a relatively robust economy with recent upside data surprises. CPI has decelerated from a peak of 9.1% in June 2022 but is expected to stick around 3% as energy keeps prices buoyant while offsetting falling shelter and food costs. Stronger data could tip the balance in favour of a November Fed rate hike and fuel more dollar gains.

- Thursday, September 14th: ECB Meeting

This meeting is a very close call with the market currently thinking there is around a 40% chance of a 25bp rate hike. The lagged effect of prior rate rises plus deteriorating economic activity argue in favour of a pause. But will the hawks and their fear of stopping too early win out with their concerns about high inflation trumping weaker growth?

Here’s comprehensive list of other key economic data and events due this week:

Monday, September 11

- USD: 3/6 Month Bill Auction

- NZD: Electronic Card Retail Sales MoM/YoY (Aug); Visitor Arrivals YoY (Jul)

- EUR: Industrial Output s.a. MoM/YoY (Jul)

Tuesday, September 12

- GBP: Employment Change (Jul); Claimant Count Change (Aug)

- EUR: ZEW Survey – Economic Sentiment (Sep)

- AUD: Westpac Consumer Confidence (Sep)

Wednesday, September 13

- USD: CPI MoM/YoY (Aug); Core CPI MoM/YoY (Aug)

- EUR: Industrial Production s.a. MoM (Jul)

- GBP: GPD MoM (Jul); Manufacturing Production MoM/YoY (Jul)

Thursday, September 14

- USD: Core PPI YoY (Aug); Retail Sales MoM (Aug)

- EUR: ECB Interest Rate Decision; ECB Rate on Deposit Facility; ECB Press Conference

- AUD: Unemployment Rate s.a. & Unemployment Change (Aug)

- NZD: Business NZ PMI (Aug)

Friday, September 15

- CNH: Industrial Production YoY (Aug); Retail Sales YoY (Aug)

- EUR: FR & IT CPI – EU norm YoY (Aug); EcoFin Meeting

- GBP: Consumer Inflation Expectations

- USD: Michigan Consumer Sentiment Index (Sep); Industrial Production MoM (Aug)