After you have chosen a broker, you should determine an account type which trading conditions will be the most suitable for you. Trading account is your personal trading space at the broker where are placed your funds for maintaining a trading activity in the financial markets.

Step 1. Choose an account type

According to functions and parameters trading accounts are divided on several types and the main are standard dollar accounts, cent micro-accounts, professional ECN-accounts, investment PAMM-accounts, and also demo (virtual) accounts. If you just started trading on Forex, we recommend you to create a start educational demo account, there the trading is held using not real, but virtual funds. Such accounts are provided by most of the brokers interested in creation favorable conditions for beginners.

In accordance with your plans, you have an opportunity to register any of the following accounts:

-

Standard account - the most widespread type of the real accounts with classical trading conditions without any additional transaction commissions, with two execution modes: Instant execution or Market execution. Accounts of this type can be subdivided into subspecies depending on the base currency of the account and some separate options (for example, Swap-Free accounts).

-

Cent accounts - so-called micro deposits, the base currency of which is presented by cents or euro cents. On cent accounts, as well as on standard accounts, the trader can select fixed or floating type of spread. Usually there are no additional commissions, the leverage is higher (in comparison with standard accounts) and the order size (lot) is smaller, that's why cent accounts are the most suitable choice for beginners.

-

ECN accounts - is aimed at professional market players and the execution of transactions happens slightly quicker, than on the standard account, because the orders are placed directly in the interbank network. ECN accounts can have requirements for the amount of the minimum deposit necessary to open the account and the commission for each transaction.

-

PAMM-accounts - this account type is intended for investment and income provision without personal participation in trading activities. The investor enlists money for the PAMM-account, after which they are managed by the professional trader with rich trading experience and sufficient skills of Forex work to guarantee the investor stable profit.

-

Demo account - a complete analog of real accounts. The only difference lies in the fact that business is done using not real, but virtual means. The client can open an educational account of any order execution type and trading conditions, which will completely correspond to the parameters on the real accounts. Demo accounts are convenient, first of all to traders, who is taking the first steps on Forex. Beginners obtain the possibility to improve initial skills and accustom with a trading platform without any threats for capital.

For obtaining the detailed information you can use the Accounts catalog on GuruTrade, where are specified all available types.

Step 2. Choose base account currency

Experienced traders for their trading accounts usually choose those currencies, which are often presented in the most popular currency pairs: USD (US dollar), EUR (Euro), GBP (British pound), CHF (Swiss franc), JPY (Japanese yen), AUD (Australian dollar). Thus, many traders prefer to work on accounts with base currency USD and with currency tools in which the American dollar acts as quoted currency. It simplifies preliminary calculations of transaction parameters in comparison with a situation when as the base currency of the account is used, for example, the euro. In that case, before a transaction, it is necessary to make the recalculation of its parameters taking into account another nominal of a basic monetary unit, spending more time for this procedure and increasing possibility of mistakes.

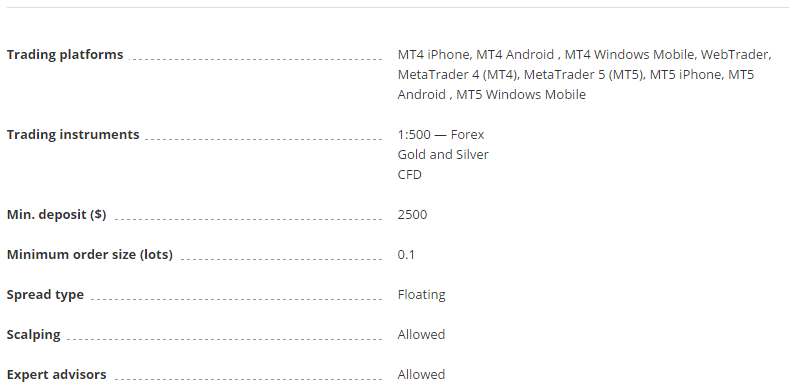

Step 3. Get acquainted with trading conditions

Do you want to trade with fixed spreads and to use trading advisors? Are you interested in the smallest of possible amounts of the transaction and the maximum leverage? If these or any other trading conditions are the most important for you - thoroughly study the trading parameters for each account type offered by brokers. Check, whether a set of available tools on the chosen account, arranges you, and also whether values of the Margin Call levels (a situation when maintenance of necessary amount of a margin requires account replenishment) and Stop Out (a threshold of forced closing of all orders on the account) suit you.

To look through the detailed characteristics of trading accounts, go to the Accounts catalog, choose a necessary account and go to the page with its description.

Step 4. Find out, whether there are no restrictions on funds withdrawal

The main goal of every trader is profit earning. Sooner or later every successful client starts thinking about a transfer of the gained income from the trading account to the personal bank or any payment system account. If you don't want to experience any difficulties concerning money transfer, choose familiar payment system from the list of available deposit/withdrawal methods. Sometimes brokers mention in the trading conditions, restrictions concerning the amount available for withdrawal. Similar limits can be set by payment services or systems, expressed by the minimum amount of transaction. Find out, whether the broker doesn't set restrictions on withdrawal amounts for a certain period (for example, weekly or monthly limit).

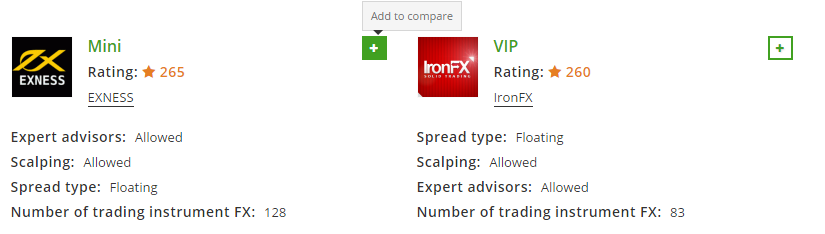

Step 5. Compare selected accounts and choose the best one

Selecting the most advantageous trading conditions, you will surely stop directly on several trading accounts. The function of trading accounts comparison available on GuruTrade will help to simplify the procedure of choice. To carry out a comparison of the trading accounts selected by you, use the button “Add to compare” in the Account catalog, and then - “Compare accounts”:

You can add the account for comparison from the page of the trading account description.