Rates as of 05:00 GMT

German elections

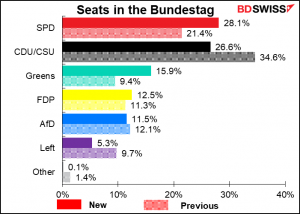

The German elections resulted in a close match between the Social Democratic Party (SPD) and the Christian Democratic Party (CDU/CSU). The Greens gained while the Left lost seats.

Given how close the SPD and CDU/CSU results are, both parties are likely to try to form a coalition. There’s likely to be months of haggling. Until then, the current government remains in power (with the CDU’s Armin Laschet as Chancellor, I imagine, instead of Angela Merkel).

The big risk for the market, a “red-green-red” alliance among the SPD, Greens, and The Left, is probably off the table – that three-way arrangement would only get 360 seat, six short of a majority. That’s a plus for the euro.

The most likely results are the “traffic light” coalition of the SPD, FDP, and Greens, or the “Jamaica” coalition of the CDU/CSU, Greens, and FDP. The SDP and the Greens are natural partners, as are the CDU/CSU and FDP. The problem for both groupings is how to convince the third party to join.

I think an SPD-led government is more likely, for two reasons: 1) politicians realize that much of the German populace is tired of the CDU/CSU, and 2) the price for the FDP to join with the SPD and Greens has already been established in previous negotiations: the Finance Ministry. Since an SPD/Greens/Left coalition doesn’t reach a majority, the FPD is in a good bargaining position.

The CDU-led “Jamaica” coalition is probably the market favorite, since it would be more of a continuation of the current policy, but not necessarily. People may assume that the “traffic light” coalition, which would be more willing to borrow to spur investment, would result in faster growth and therefore be better for Germany and the Eurozone economy.

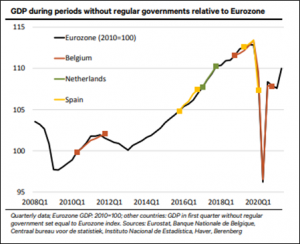

There’s no deadline for forming a coalition. How dangerous is the possibility of a long period with only a caretaker government? Not very, I imagine. This chart, courtesy of Berenburg Bank, shows GDP growth in countries during periods when they had no government vs overall Eurozone growth. The longest period was Belgium with an astonishing 714 days before agreeing on a new government. Conclusion: it didn’t matter. Growth was usually in line overall Eurozone growth, sometimes even stronger! (sometimes below, too.)

Of course, Germany isn’t Belgium and having Germany drift has bigger implications for the Eurozone than having Belgium drift. Nonetheless, it does suggest that Eurozone economic activity might not be affected that strongly by a protracted period of negotiations.

Market Recap

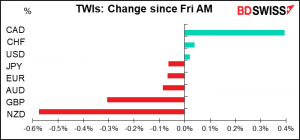

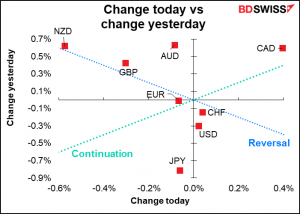

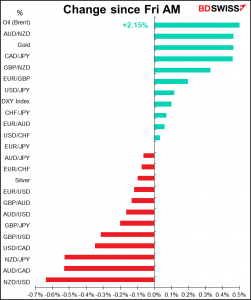

As you can see from the chart at the top, the German elections, while politically important, didn’t have much impact on the financial markets. The euro is little changed while the DAX index is indicated opening up 0.6%.

CAD was the best-performing currency, as usual following oil.

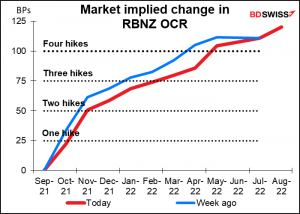

NZD was the worst-performing currency. The currency fell steadily during the European day Friday but has stabilized this morning. It seems that the market is reducing its estimate of the pace at which the Reserve Bank of New Zealand is likely to tighten policy.

GBP also lost ground as investors contemplated the empty shelves in supermarkets and empty tanks at petrol stations. There are reports that the government is considering drafting in the armed forces to drive trucks after at least half of the petrol stations outside of the motorway network ran out of petrol. The problem is not a shortage of petrol but rather a shortage of drivers to drive the trucks that transport it, since many of these drivers were Europeans who are now banned from Britain thanks to Brexit. So much winning!

Commitments of Traders Report

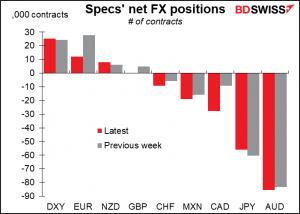

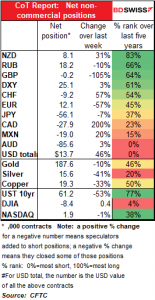

Specs keep adding to their long USD position (or short currency, whichever way you want to look at it). The biggest moves this week were a further reduction in EUR longs (cut by over half) followed by a big increase in CAD shorts (about 3x as big). CHF shorts almost doubled as well. GBP flipped from a small long to a tiny short. Only NZD longs increased and JPY shorts decreased a bit.

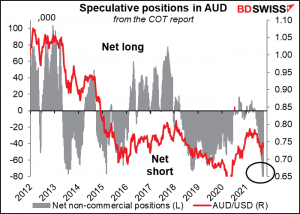

AUD shorts are the largest they’ve ever been (data back to 1993).

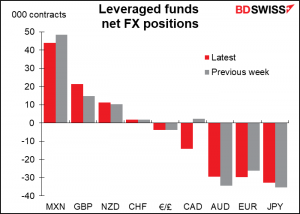

Hedge funds on the other hand increased their GBP longs and trimmed their AUD shorts. But they too went solidly short CAD.

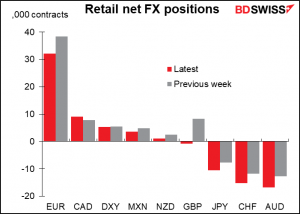

Retail also cut their EUR longs and went short GBP. They increased their JPY, CHF, and AUD shorts.

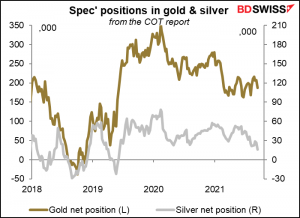

Speculators reduced their long positions in both gold and silver.

Today’s market

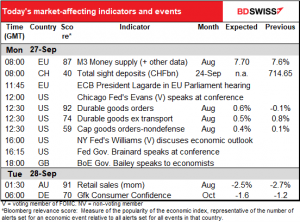

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The biggest issue today is US fiscal policy. As things stand, the government’s funding is set to expire at 12:01 AM local time on Friday, which would partially shut down the government if Congress doesn’t act. The Senate is expected to vote Monday evening on a measure extending the government’s funding through Dec. 3rd and suspending the debt limit into December 2022, but Republicans have promised to block it, leaving the matter unresolved.

The likely solution will be for the Democrats to split the bill extending the government’s funding from the bill suspending the debt limit. Republicans have said they’ll support the former bill but object to raising the debt ceiling, since (they say) the increase is only necessary because of Democratic spending decisions that were made without Republican support. This of course ignores the role that the totally unnecessary and unhelpful Trump tax cuts played in blowing up the deficit, not to mention the stupidity of opposing the COVID-19 relief bill earlier this year. However, that solution would only kick the can down the road a bit, since the debt ceiling problem still looms.

Just to complicate things, there are two other huge legislative packages moving through Congress this week: a roughly $1tn bipartisan infrastructure bill and an enormous healthcare, education and climate package whose proposed $3.5tn price tag and contents is proving difficult not only for Republicans but also within the Democratic party as well.

The indicators

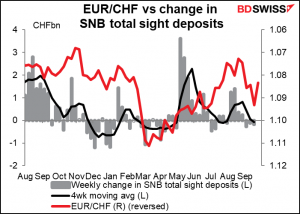

Nothing happening with Swiss sight deposits recently, but every week I look at the graph anyway. EUR/CHF has turned up recently; will the Swiss National Bank come in?

ECB President Lagarde will make an introductory statement at the Hearing before the Committee on Economic and Monetary Affairs (ECON) of the European Parliament. I would doubt if she will say anything market-affecting, but I have to include it in the calendar anyway.

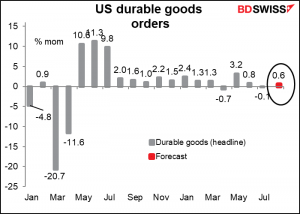

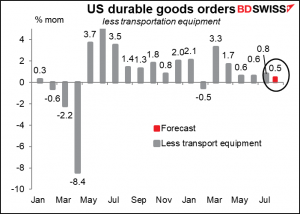

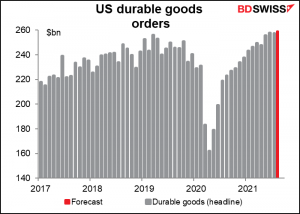

US durable goods may get a modest boost from aircraft orders, but on the other hand the auto industry has had to shut down production now and then because of a shortage of semiconductors.

It’s expected to be pretty much of a washout though as orders excluding transportation equipment are forecast to be about the same as with transportation equipment.

In any event, the headline figure is forecast to be 12.6% above pre-pandemic level and so yet another strong series that has yet to come down to earth. What happens when consumption and investment both return to more “normal” levels?

After that, it’s mostly just talk talk talk during the US day.

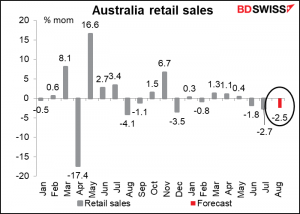

Australian retail sales overnight are no big thrill since much of the country was still in lockdown during the month. The fact that sales fell for the third month in a row doesn’t tell us much except that activity tends to decline when people are confined to their houses, something which we all know all too well from personal experience. (Within retail sales, food sales tend to increase, but that’s another story.)

Source: BDSwiss