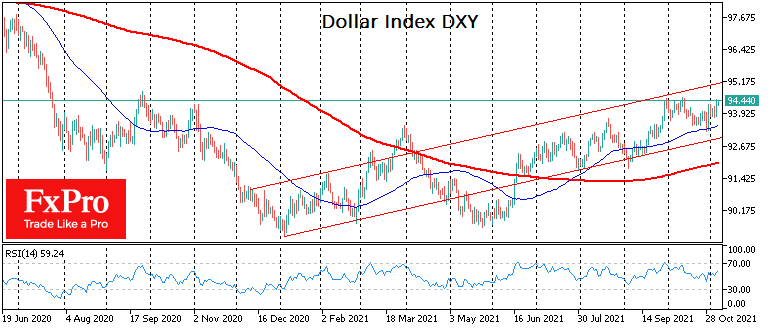

Today’s October employment data could strengthen the dollar bulls’ position by highlighting wage and hiring growth acceleration. Indirect indicators point to a high chance of such a scenario.

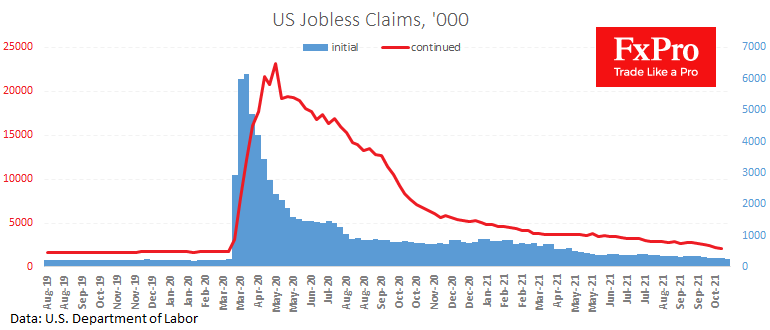

The number of new jobless claims in the USA has fallen steadily since October. Americans were in no hurry to go to work with the removal of the benefits supplements in September. In October, however, this process became more evident. The number of initial claims as of October 30 was 269K against 364K in the final week of September. The number of continued claims fell by 706K to 2.105M, although there was little change for September.

The fall in the number of insured unemployed is setting up an NFP gain of over 700K, against average market expectations near 450k. A positive surprise in the data promises to be a significant fundamental buying factor for the US currency, which has recently played the leading role amongst lagging majors.

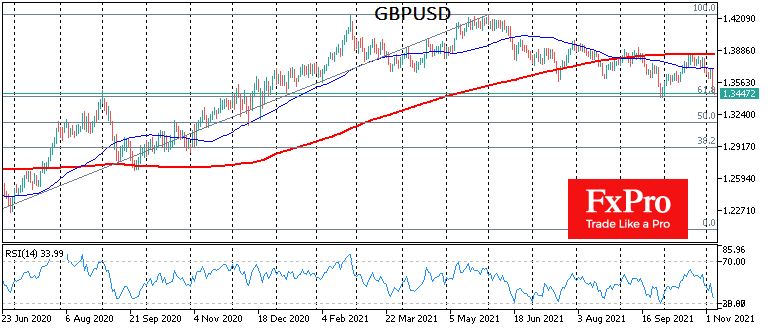

On Thursday, the pound lost 1.4% as the Bank of England surprised the markets with its softness by keeping its rate and asset purchase parameters unchanged.

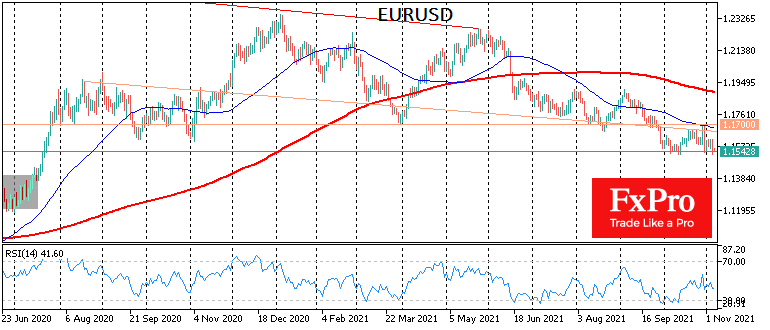

At the end of last week, the euro marked a decline of more than 1%. Since the end of September, the sharp weakening saw the yen bulls capitulate, sending USDJPY to the area of highs in the last five years.

In all cases, central bankers prefer to maintain pressure on bond yields despite high inflation, as they fear disrupting unsustainable economic growth.

Robust labour market data will allow the states to regain their status as the engine of economic growth for the developed economies, creating attractive conditions for further dollar strength. This trend has been rising since the start of the year. If markedly different from expectations, the employment news has enough potential to push the dollar index to renew more than a year high.

A strengthening of the DXY by just 0.2% to 94.56 would be a renewal of the highs since September 2020, and a move above 94.8 would return the Dollar to its highest levels since last July. We could then see a sharp increase in buying of the US currency and a more active upward trend, which could mirror the declines of June-July last year.

Source: FXPro