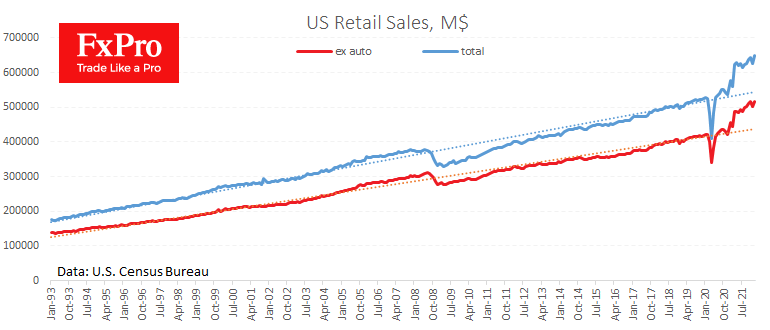

The nominal sales charts clearly show a break from the long-term uptrend from mid-2020. But also, a scenario of a return to the pre-2008 norm cannot be ruled out. In this case, a higher price growth rate could well coexist alongside a booming economy and a tight monetary policy where the key rate exceeds inflation by 1-2 points.

Inflation numbers above expectations are seen as support for the dollar, and retail sales and a strong labour market can also fuel equity purchases, improving global risk appetite.

Rising retail sales reduce fears that an impending interest rate hike from the Fed could push the economy back into recession in the coming quarters. WSJ’s observations in the latest article show that rate hike cycles only come to an end when the economy turns to recession.

Source: FXPro