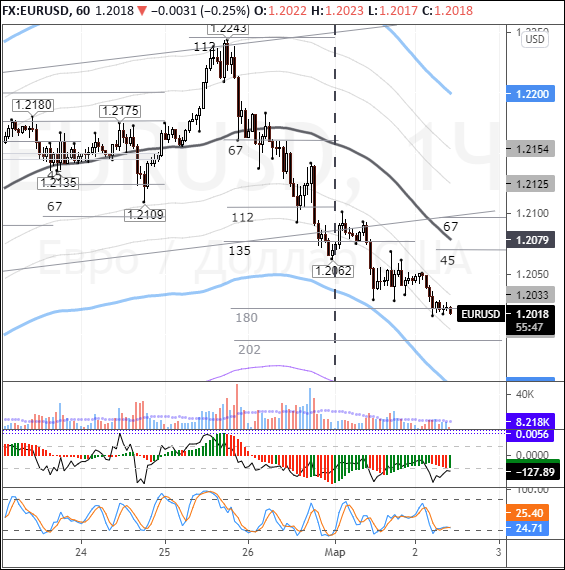

After the EURGBP cross fell to 0.8620, the single currency slipped to 1.2028. When the euro corrected against sterling to 0.8661, the euro stopped weakening against the dollar. During the North American session, the EURUSD pair was trading in the range of 1.2027-1.2068.

Today’s macro agenda (GMT 3)

- 16:30 Canada: GDP (December)

Current outlook

The euro fell to 1.2015 in Asian trading this morning, with all major currencies trading in the red. By the close of yesterday’s session, US stock indices ended in positive territory. There are no signs of panic trading on the stock market. Even though the 10-year US Treasury yields stands at 1.42%, investors are still concerned about rising inflation stateside, and are apparently waiting for a speech by Fed Chairman Jerome Powell, which is scheduled for Thursday.

Monday saw a great news flow for the euro bulls to win back Friday's losses. After breaking through 1.2088, downside risks to the level of 1.1880 are on the rise. The interim support will be at 1.1990. If the bears consolidate below 1.1880, they will set their sights on 1.1660. After Powell's speech, traders will shift their attention to Friday's non-farm payrolls report. Right now, three indicators are important for the Fed: GDP, the labor market and average inflation.