Major currencies closed lower by the end of the week, except for sterling. The list of underperformers included the Australian dollar (-1.24%), the New Zealand dollar (-1.07%), the Swiss franc (-0.72%), the Japanese yen (-0.55%), the euro (-0.68%), and the Canadian dollar (-0.60%).

On Friday, January 7, the euro advanced 0.58% against the dollar to 1.1361. The NFP report let down investors with a low headline number. In December 2020, the US economy created 199k jobs vs. 400k expected. That said, other parameters of the report turned out to be upbeat, making it an overall positive print.

Notably, the unemployment rate fell to 3.9%, while average hourly earnings (wage push inflation) surged 0.6% MoM and climbed 4.7% YoY. The participation rate improved to 61.9%. The October employment report was upwardly revised to 648k from 546k, and the November reading to 249k from 210k. The total upward revision amounted to 141k.

Following the release, EURUSD shot up to 1.1365, while the DXY dropped to 95.70.

Today’s macro agenda (GMT 3)

12:30 Eurozone: Sentix investor confidence index (January)

13:00 Eurozone: unemployment rate (November)

Current outlook

Major currencies are trading in the red, with the exception of the aussie. The market is recovering after Friday's NFP report. The report fell short of expectations despite some robust data points.

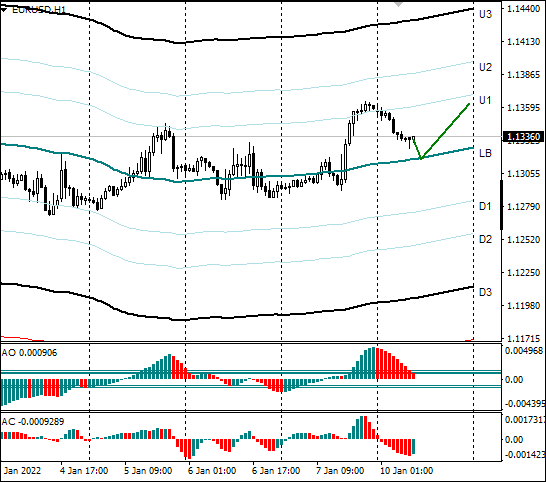

The dollar on Monday has been clawing back Friday's losses from early morning. The key pair dropped to 1.1326. The pullback was 50% of the upward move from 1.1292 to 1.1386.

Price action continues to hover within the November 30, 2021 range, with the bounds narrowing to 1.1270 - 1.1385. Given uncertainty over expectations for a Fed rate hike in March, as well as the rapid spread of Omicron, the sideways trend will likely persist for several more days.

On Monday, the euro could correct down to 1.1315 (LB) with subsequent recovery to 1.1365 by the opening of Tuesday’s North American trading session.

This week’s economic calendar looks thin. The 10-year UST yield remains the key driving force for all risk-sensitive assets. Jerome Powell will appear tomorrow before the Senate Banking Committee for a hearing on his nomination for a second term as Fed Chairman. Also on Tuesday, ECB President Christine Lagarde is scheduled to deliver a speech.

Bottom line: the euro closed Friday trading to the upside. Price action recovered after the release of a sluggish December NFP headline number. This week’s economic calendar is on the thin side. The 10-year UST yield is still the key driver for all risk assets. On Monday, the euro is expected to undergo a downward correction to 1.1315 (LB), then recover to 1.1365 by the opening of the North American session on Tuesday.