It’s all about the FOMC meeting today and whether the world’s most powerful central bank backs up market pricing after several recent media articles pointed to policymakers wanting to move rates by the largest amount since 1994.

Another U-turn tonight by not actually hiking by this size will be a dovish surprise to traders keen to see what the Fed has in store to battle rampant inflation.

The Fed typically delivers what is discounted in markets and doesn’t generally like to disappoint.

The FOMC is recognising that it is significantly behind the curve and needs to do more to get inflation under control. The much higher-than-expected US CPI data on Friday put the cat among the pigeons, shaking markets and investors who were hoping to at least see price pressures easing slightly. Long-term inflation expectations are worryingly high while the month-on-month readings are rising again with broad-based increases including multi-decade high shelter and rent costs.

There will be focus on the Fed’s economic forecasts and “dot plot” at tonight’s meeting.

Consensus sees higher inflation and lower growth projections. Money markets see the US Fed Funds rate around 3.7% by year-end. This is from the current level of between 0.75% and 1%.

Hints from Jerome Powell during the press conference around what the Fed plan to do after the summer will also be key.

This should all help support the dollar, though the bar for an even bigger hawkish surprise does look high at this point.

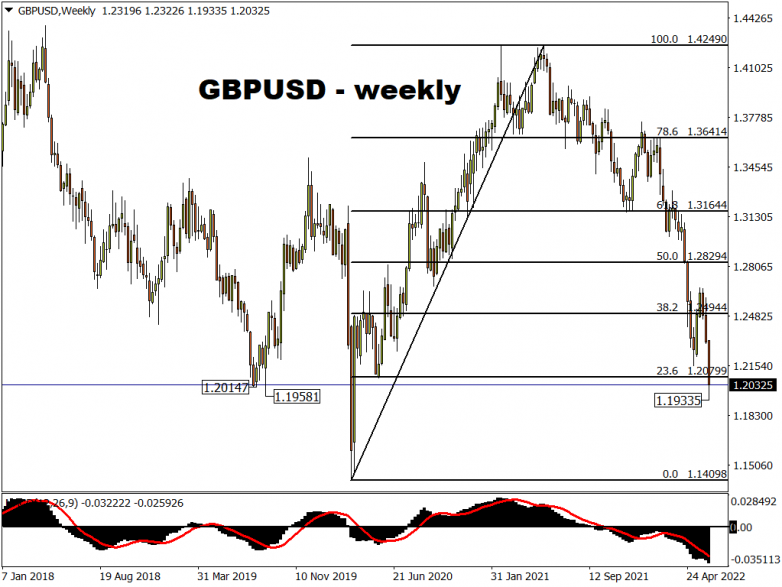

GBP loses big into risk events

Sterling has tumbled for three straight sessions, losing over 4.5% of its value against the dollar since the red-hot US inflation numbers and is the worst performing major this week. Worries about the cost-of-living crisis and household spending are seeing investors deliberate as to whether the Bank of England pauses its rate hikes in the coming months. Real wages are contracting, and we have had mixed employment and GDP data this week.

Tomorrow’s MPC meeting will confirm if the recent weakness in the pound is validated.

Markets are expecting at least a quarter point rate hike tomorrow but are still seeing nearly two 50bp hikes across the next four MPC meetings. The recent Government fiscal package is expected to delay any fall in inflation but support low-income households and help the economy.

After struggling to move above resistance at 1.26670, GBP/USD has broken lower through the prior cycle low at 1.21553.

A solid weekly close below the 23.6% Fibonacci retracement line from cable’s March 2020-May 2021 ascent, with various daily support levels seen around the 1.19-1.20 levels, could see GBP/USD hurtling to levels not seen since the onset of the pandemic, when it bottomed out at 1.14098.

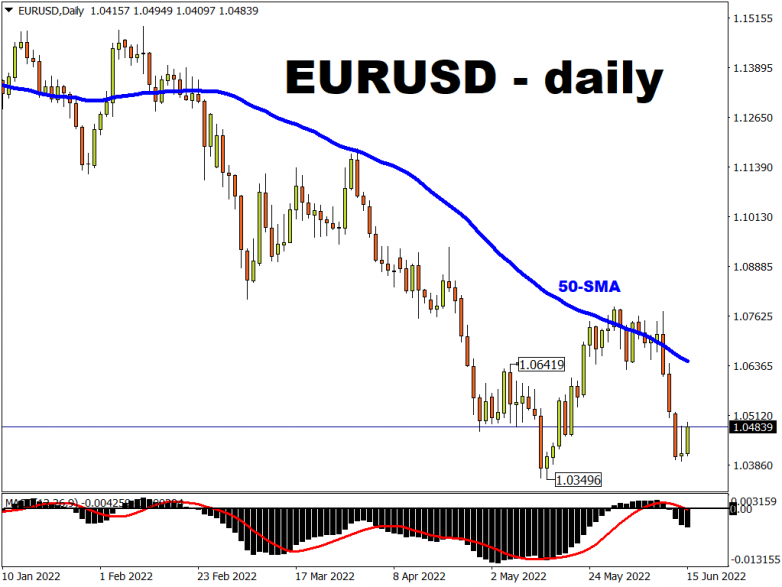

EUR/USD finds a bid as markets ready for “ad hoc” ECB meeting

It’s being widely reported that the ECB will meet later this morning in order to discuss current market conditions.

ECB officials have been on the wires this week with ultra-hawk Knot stating that the bank will respond if widening yield spreads (between the core and the periphery) threaten the transmission of monetary policy. The yield on the benchmark 10-year Italian bond reached 4% earlier this week, its highest since 2014. Its spread against the German equivalent is at a two-year high.

The market will be keen to see details on how the ECB intends to extinguish stress in borrowing rates.

Key support in EUR/USD sits at 1.03496. Resistance above is 1.06419.