Markets continue to struggle as price pressures remain elevated and central bankers are keen to assert their inflation fighting credibility.

These themes look set to remain even in a holiday shortened week in which the US celebrate Independence Day on Monday:

Monday, July 4

- AUD: Australia June inflation gauge

- EUR: Germany May trade data

- CHF: Switzerland June inflation

- CAD: Canada June manufacturing PMI

- US markets closed for Independence Day

Tuesday, July 5

- CNH: China June Caixin Services PMI

- AUD: Reserve Bank of Australia rate decision

- EUR: Eurozone June services PMI

- USD: US May factory orders and durable goods

Wednesday, July 6

- GBP: Speeches by Bank of England Chief Economist Huw Pill, and Deputy Governor Jon Cunliffe

- EUR: Eurozone May retail sales, Germany May factory orders

- USD: FOMC minutes, June services PMI

Thursday, July 7

- AUD: Australia May trade balance

- EUR: ECB meeting minutes, speeches by ECB Governing Council members, Germany May industrial production

- USD: US weekly initial jobless claims

- US crude: EIA weekly US crude inventories

- USD: Fed speak – Fed Governor Christopher Waller, St. Louis Fed President James Bullard

Friday, July 8

- CAD: Canada June unemployment rate

- USD: US June nonfarm payrolls

Two noteworthy releases come in the form of the monthly non-farm payrolls report and the minutes from the June FOMC meeting.

Of course, this was an historic event where Fed policymakers hiked rates by 75bps in response to the May inflation data and expectations in the Michigan consumer survey. We have heard from several Fed officials since the meeting, but any more detail on the path of policy tightening will be closely followed.

The new jobs report will likely continue to signal a tight labour market which supports the case for further Fed tightening.

There are currently around 11 million job vacancies, which is the equivalent to nearly two vacancies for every unemployed American. The headline print is expected in the 250k-300k range, and that should be enough to keep unemployment rate low at 3.6% and wage growth solid. The pace of job gains is moderating but only a shocking miss would get the attention of the Fed and slow the dollar’s ascent.

Globally, seven central banks will announce policy decisions with top billing going to the RBA.

The Australian central bank has abruptly shifted into full “inflation-fighting” mode in recent months and lifted rates by 75bps over its prior two meetings.

A half-point move is expected early on Wednesday as policymakers continue their “front-loading”. The energy crunch points to continued inflationary pressures, while the labour market remains tight.

Even so, the aussie won’t get a lot of love from the hike as general market dynamics batter the cyclical currency.

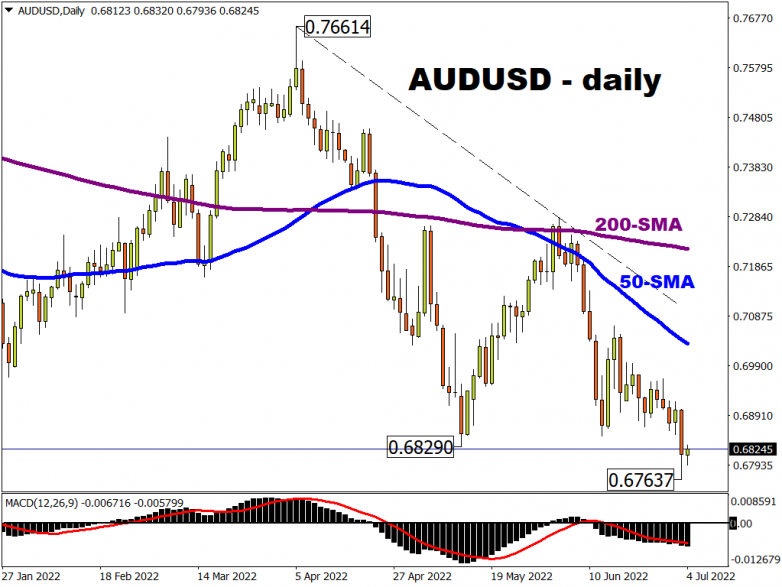

AUD/USD crashed through the recent cycle low at 0.6829 on Friday and sellers are looking at levels below 0.67 as next support.