US inflation numbers this week should certainly provide more thrills and spills for traders. This is especially likely after Friday’s July US employment data was a blowout across the board.

Here are the key economic events and US earnings that we’re keeping an eye on this week:

Monday, August 8

- AUD: Australia July foreign reserves

- NZD: New Zealand 3Q 2-year inflation expectation

Tuesday, August 9

- AUD: Australia July household spending, August consumer confidence

- Coinbase 2Q earnings

Wednesday, August 10

- CNH: China July CPI, PPI

- USD: US July consumer price index (CPI), speeches by Chicago Fed President Charles Evans, Minneapolis Fed President Neel Kashkari

- US crude: EIA weekly oil inventory report

- Disney 2Q earnings

Thursday, August 11

- AUD: Australia August consumer inflation expectations

- USD: US weekly jobless claims, July PPI, speech by San Francisco Fed President Mary Daly

Friday, August 12

- GBP: UK June GDP, industrial production; 2Q GDP, external trade

- EUR: Eurozone June industrial production

- USD: US August consumer sentiment

Our last sentence in last week’s report was fortunately on point,

“But a resilient jobs market may postpone the prospect of a ‘real’ recession for now, underpinning some support for the dollar.”

Sure enough, both the greenback and treasury yields shot higher after the closely watched US jobs report showed employers added 528,000 jobs, more than double the 250,000 expected by economists, and up sharply from the revised 398,000 in June. Unemployment ticked down to its multi-decade low while wage growth accelerated.

Fed funds futures now show that markets are forecasting US rates to hit 3.6% in February next year, up from an estimate of 3.4% prior to the data release.

The rate range currently stands at 2.25% to 2.5%. Crucially, the September FOMC meeting has now swung in favor of a jumbo 75 basis point rate hike with markets pricing in a 75% chance of a third big rate rise, from 36% before the data release.

We note that we still have over six weeks until the next FOMC meeting, and another non-farm payroll release to come. Of course, one report doesn’t make a market, but the red-hot labour market doesn’t seem to be cooling any time soon. For example, payrolls over the last three months have averaged 473,000.

That is not what happens in a recession, “technical” or otherwise.

The Fed will be hoping we can avoid another leg higher in this week’s inflation numbers, the like of which we saw in the previous data.

As things stand, the median estimate in a Bloomberg survey stands at 8.7% for the July CPI year-on-year advance, which would be lower than June’s 9.1% print.

Certainly, the drop in gasoline prices should provide some relief but the core readings will still be elevated around 6% on an annual basis. That is a long way back to the Fed’s target of 2% and in this environment, the dollar may well attract more buyers in the interim.

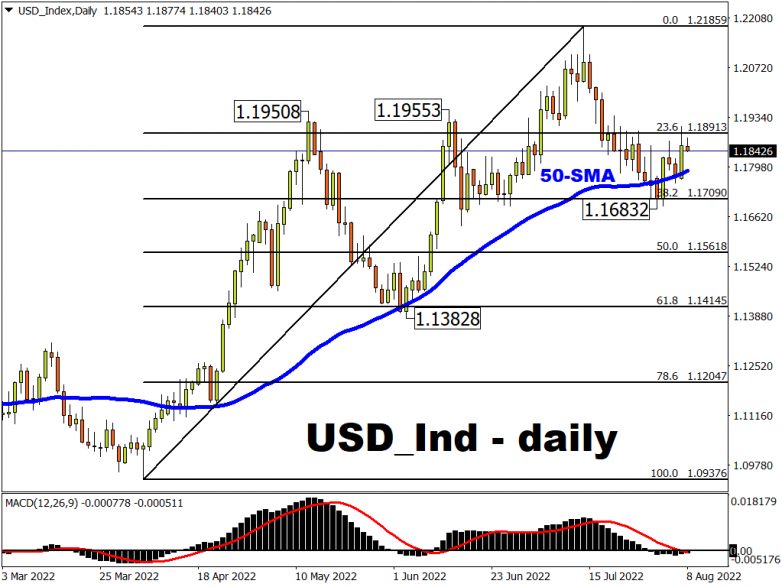

With all that in mind, a hotter-than-expected July US CPI print may prompt the equally-weighted USD index to revisit the twin peaks around 1.195, based on the narrative that the Fed will be emboldened to set off even more jumbo-sized rate hikes before 2022 is over.