We knew it would be big, but most thought we might have to wait until the autumn to see double digit inflation in the UK. Then again, if you have had the pleasure of food shopping recently in England, we guess you might not be that shocked. Headline UK CPI hit 10.1% in July, the first time it has registered double digits in more than 40 years. The jump in the consumer price index, higher than analyst estimates of 9.8%, rose form 9.4% in June.

The data shines a very strong spotlight on the difficult task the Bank of England faces bringing inflation down. Prices pressures have spread across the whole economy, from high energy and fuel costs more broadly to other goods and services. With the core rate also jumping above 6%, the burden on policymakers is to tighten policy further. But it also points to worsening conditions for consumers going forward as the cost-of-living crisis deepens into higher winter energy prices.

Money markets now see rates going to 3.5% by March next year. This has shifted from around 2.7% late last month. The chances of a 50bp rate hike at the next Bank of England meeting in September have increased to around 80%. But front-loading by the bank into a recession only increases the chances of something going wrong and a potential “hard landing”. GBP/USD has marginally sold off since the CPI data this morning. The major is currently trading around the 50-day simple moving average at 1.2107. The May low at 1.2155 sits above here as another level of resistance. Solid support remains around 1.20 which encompasses last week and yesterday’s low.

Dollar bulls look to FOMC minutes

The greenback heads into today’s release of US retail sales and the Fed minutes just above long-term trendline support. After upbeat earnings by Walmart and Home Depot yesterday, investors are hoping the worst recession fears might be off the table now as the consumer holds up better than most feared. The proof may well be in today’s pudding with the July retail sales numbers.

The FOMC minutes from July will shed some light on the new meeting-by-meeting, data dependent stance the Fed has adopted. Another jumbo-sized 75bp rate hike last month took the policy rate into neutral territory. The key question is whether we get some push back against the easing cycle seen happening next year. This would help the dollar and see EUR/USD push towards the bottom of the recent range at 1.01.

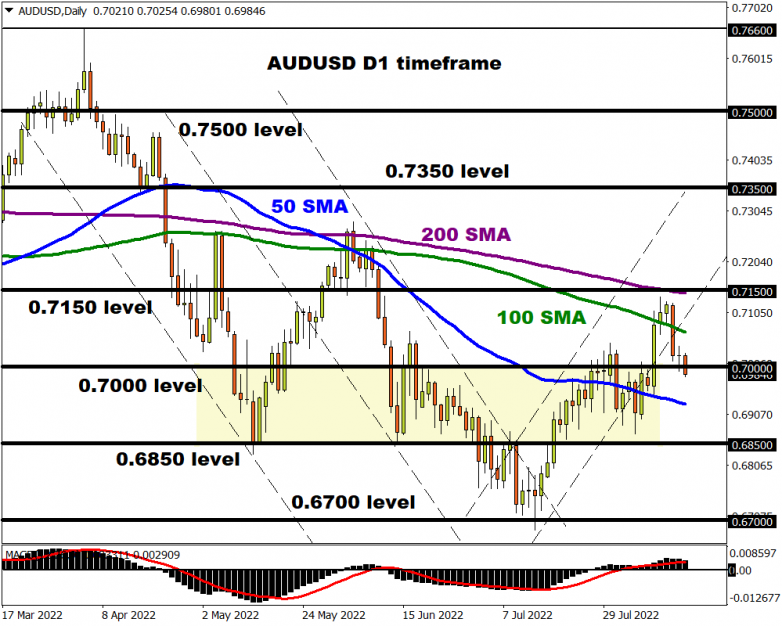

At the same time, AUD/USD is currently perched on the huge psychological 0.70 level. If Chinese growth prospects are revised lower while the Fed keeps rate hikes going, we may see a more protracted move down below this key marker. USD/JPY should be driven by moves in the US Treasury yields with bulls hoping to push up to 135 on the currency major.