Equity bulls were nowhere to be found on Monday as investors turned cautious ahead of another eventful week for financial markets.

Despite only being the second full trading week of 2021, there was plenty on the plate that kept market players on their toes. Fed officials were under the spotlight at the start of the week, especially after Atlanta Fed President Raphael Bostic stated that US interest rates could be hiked by mid-2022 or early 2023.

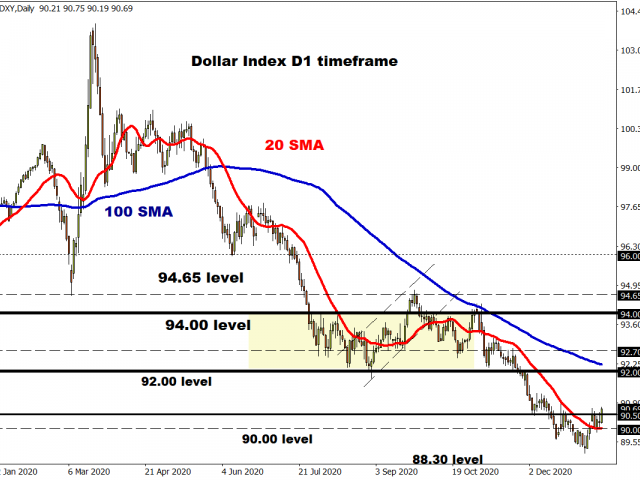

Focus shifted towards the Dollar as rising US government yields injected DXY bulls with enough inspiration to punch above 90.50.

Although the Dollar is experiencing a technical rebound, the upside may be capped by the ‘reflation trade’ and the Fed's ultra-accommodative monetary stance.

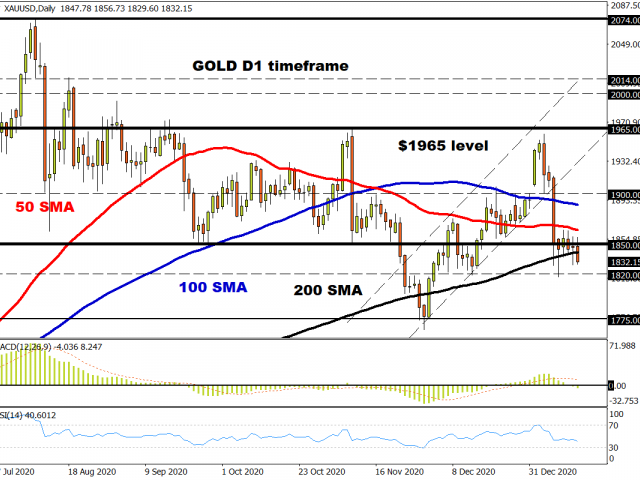

Our technical outlook focused on Gold, which displayed cracks under the Dollar’s rebound. After struggling to shake off the nasty hangover from last Friday’s selloff, the metal found itself under the mercy of an appreciating Dollar. Overall, it was a choppy trading week for Gold as prices struggled to break away from the sticky $1850 level.

Could the precious metal be waiting for a fresh fundamental catalyst?

Fears around growing political risk gripped sentiment on Tuesday after Democrats introduced a resolution to impeach U.S President Donald Trump for a second time. Trump was later impeached by the House on Wednesday, marking a first in history as no president has ever been impeached twice.

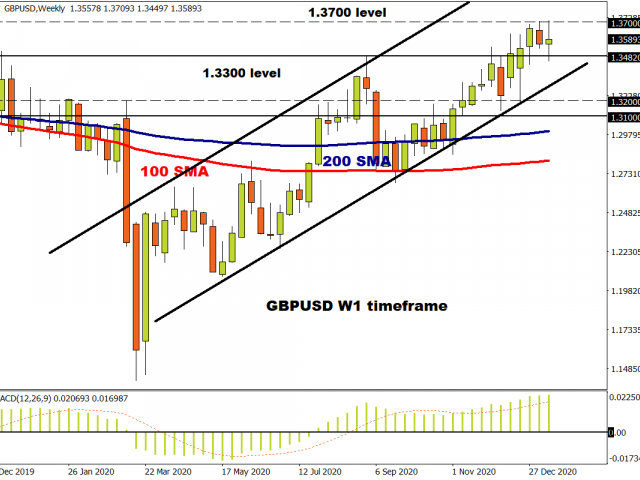

In the United Kingdom, Governor Bailey downplayed talk of negative interest rates as he believed ‘there are still lots of issues’ with cutting rates below zero. Buying sentiment towards Sterling improved following the statement with the GBPUSD pushing against the stubborn 1.3700 resistance level. A weekly close above this level may open the doors to further upside in the week ahead.

In our earnings preview, we covered JPMorgan and possibility of delivering positive results on trading revenues. On Friday afternoon, the bank posted much stronger-than-expected fourth-quarter earnings as investment banking profits surged. Earnings per share smashed expectations by rising $3.79, exceeding the $2.62 per share forecast while revenues hit 30.16 billion exceeding the $28.65 billion estimate.

Despite the earnings beat, JPMorgan shares retreated from near all-time highs. Although prices are trading around $138.22 as of speaking, the bank’s shares are still up almost 9% year-to-date.

As the week slowly came to an end, the mood across markets was mixed as investors waited for US President-elect Joe Biden to reveal his plans for a COVID-19 relief package. It was no surprise that markets offered a muted reaction to his $1.9 trillion fiscal stimulus plan given how a lot of the optimism surrounding another injection of fiscal stimulus was priced in.

The week ahead promises to be filled with fresh volatility and market action as investors grapple with the growing list of themes influencing global markets.

Expect global equity bulls to find support from the ‘reflation trade’ while fears around surging coronavirus cases and lockdown restrictions may spur appetite for safe-haven assets. In the currency markets, it will be interesting to see whether the Dollar will appreciate further and if Gold is able to find a fresh catalyst to breakout or down.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.