China has officially posted an annual GDP growth of 2.3% in 2020, making it one of the few economies that recorded an expansion amid the global pandemic.

This is a remarkable achievement for the world’s second largest economy, considering that other major economies are still battling with extended lockdowns and are facing the threat of a double-dip recession.

Following such a headline, only benchmark indices in China and Hong Kong are climbing, while the rest of Asia is in the red. The Hang Seng index is making further strides in breaking out of its multi-year downtrend, though it remains some 13.65 percent away from its record high set in January 2018 and needs to post a higher high above 29,122 to confirm the breakout on the weekly chart.

Here are other key events for the global markets this week:

-

Monday, 18 January: US markets closed

-

Tuesday, 19 January: Netflix Q4 earnings (after US markets close)

-

Wednesday, 20 January: Joe Biden presidential inauguration

-

Thursday, 21 January: ECB rate decision

- Friday, 22 January: US, Euro-area, UK Markit PMIs

Tuesday, 19 January

Netflix is set to announce its Q4 earnings after US markets close on Tuesday, with the pandemic darling’s stock prices needing a boost. Stock prices have dropped by nearly 8 percent so far in 2021, and is still keeping to the same range since July, with its 50-day and 100-day simple moving averages (SMA) now flat.

Still, the streaming giant has ambitious plans: it’s set to release 70 original films in 2021, and that doesn’t include documentaries.

It remains to be seen how much this lineup of new titles can add to Netflix’s subscribers tally, which is expected to have crossed the psychologically-important 200-million mark during the final three months of 2020.

Wednesday, 20 January

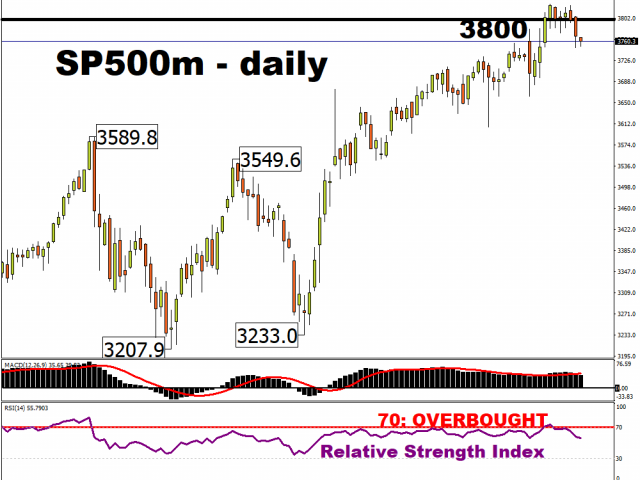

As the world hopes for a peaceful transition during Joe Biden’s presidential inauguration on Wednesday, equity bulls may have to bide their time before pushing benchmark indices higher.

Investors have been rather sanguine in their initial assessment of Biden’s fiscal stimulus plans, and are wary about the new regulations that a Democratic president may herald for markets and businesses.

Since Biden announced his US$1.9 trillion proposal this past Thursday, all three major US equity benchmarks posted losses before the long weekend. US stocks had appeared exhausted last week and are in need of fresh catalysts, with the futures contract kicking off the week with a risk-off tone at the time of writing.

Thursday, 21 January

The European Central Bank is unlikely to make any major changes to its policy settings on Thursday, keeping its benchmark interest rate at minus 0.5 percent. However, the ECB is expected to reiterate its commitment to supporting the EU economy, even as it battles renewed and extended lockdown measures which are set to result in a GDP contraction for the current quarter.

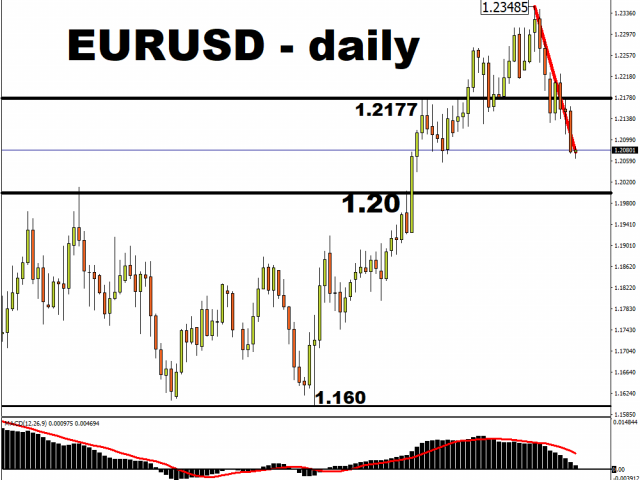

The Euro’s fortunes have very much been dictated by the US Dollar of late, with most G10 currencies posting year-to-date declines against the Greenback.

The Euro, which accounts for 57.6 percent of the Dollar index (DXY), may have little leg to stand on for the time being, and may have to wait for US yields to subside before enjoying some reprieve against the Dollar’s 2021 rebound.

Friday, 22 January

Major economies are due to have their respective purchasing manager’s indices (PMI) released by Markit on Friday.

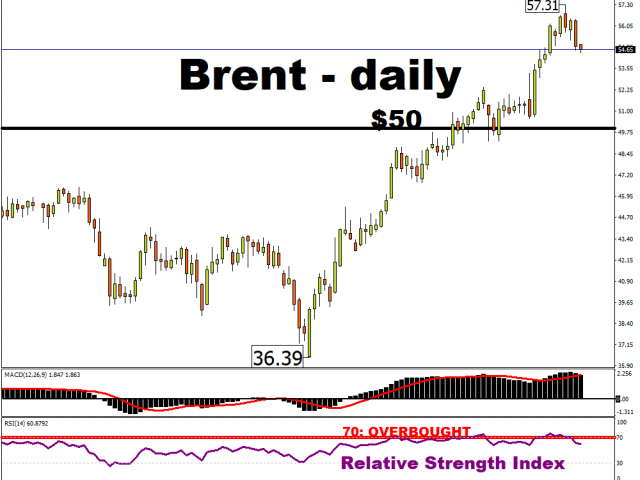

Should the manufacturing sectors in these countries prove resilient, that could help Oil prices climb on hopes that the global economic recovery has not been severely derailed by Covid-19’s resurgence.

EIA crude inventories data will also be released on Friday, and Oil bulls will also want to see another major drawdown in US crude inventories, which have already fallen to their lowest since March.

Brent futures posted their first weekly decline of the year last week, and are continuing to trim their year-to-date gains on Monday. Still, the recent pullback may be deemed as healthy, given that Brent oil has spent most of 2021 so far in “overbought” territory.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.