US stock futures are on the rise as the world awaits the new US Commander-in-chief.

While another septuagenarian takes the oath on the steps of the White House, markets see the risk-friendly scenario continuing on the back of the upcoming $1.9 trillion stimulus package. New Treasury Secretary Yellen reinforced this sentiment with her pledge yesterday to ‘act big’ on support measures.

In essence, this is the dream ticket for stocks: a scenario of moderate growth and inflation with the Fed unlikely at this stage to disturb this Goldilocks picture with a shock interest rate increase that would hurt companies’ earnings prospects.

Indeed, Chair Powell said as much last week when he stated that the central bank wouldn’t respond ‘too early’ to any economic recovery.

The Dollar is trading mixed overall having bounced off its lows made earlier in today’s session. We mentioned yesterday it was worth hearing what Yellen had to say on the greenback and she did not repeat the long-standing ‘strong USD policy’ as we suspected. Instead, she stated that the US isn’t seeking a weaker currency and opposes any country that does, which has in fact been the de facto policy of the US Treasury over a number of years.

Netflix propels Nasdaq

The technology-laden Nasdaq has steamed through 13,000 even as the closer cooperation between The Fed and the US Treasury might have been expected to hurt the megacap tech stocks. 13,097 is the record close from 8 January and key for further upside.

Netflix results have certainly boosted the index after the streaming giant passed 200 million subscribers in its latest earnings update and promised share buybacks. The stay-at-home poster child says it will no longer raise debt to fund its spending spree on TV shows and films as it added some 8.5 million paying customers just in the quarter to December 2020. The stock is up some 15% today and breaking to new record highs.

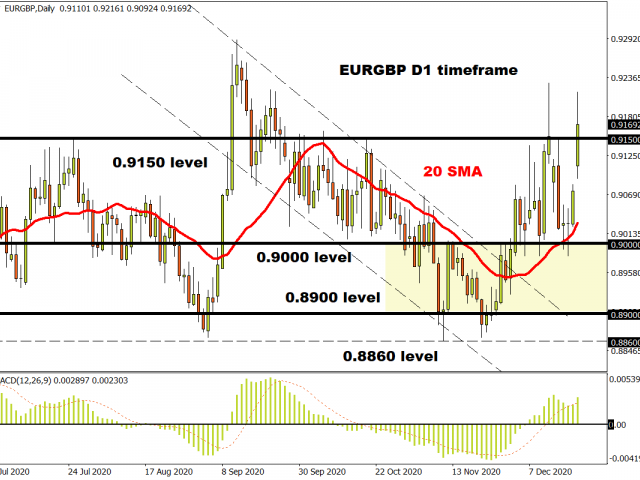

EUR/GBP – the Vaccine Trade

The Euro is struggling to maintain its mild upward momentum as Germany extended its nationwide lockdown into mid-February. Although developments in Italian politics were rosier with PM Conte surviving a no confidence vote, EUR/GBP is also likely acting as a headwind as it dropped through key technical support.

The UK’s fast-paced vaccination efforts lie in contrast to European countries like France who are somewhat lagging in their rollout efforts. This has pushed the pair through the 0.8860 zone with prices punching above 0.9150. If bulls fail to keep prices above this level, there is little support until the 0.9000 area.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.