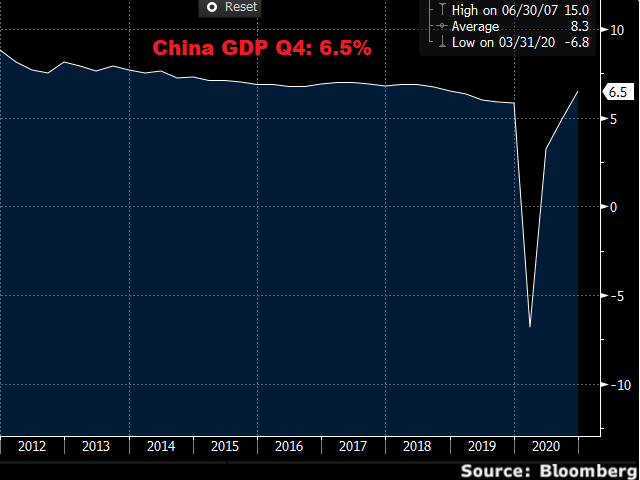

Investors started the week on a cautious note despite data showing that China’s economy bounced back strongly in the final quarter of 2020.

The world’s second-largest economy reported 6.5% growth in Q4, making it one of the few economies to achieve a rapid turnaround amid the global pandemic. Given how U.S. markets were closed on Monday due to the Martin Luther King holiday, there was little movement in the FX space.

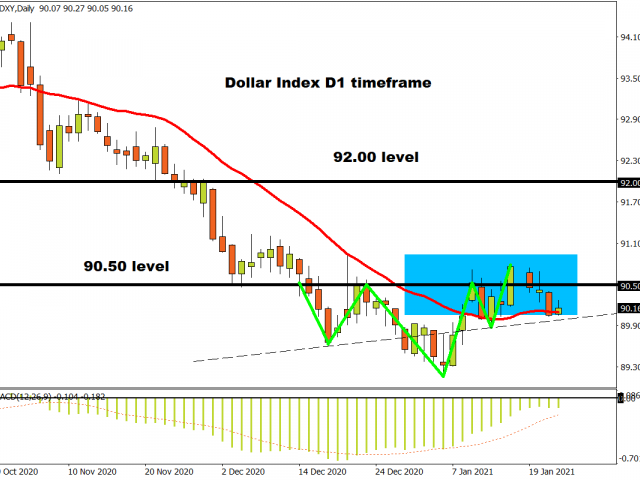

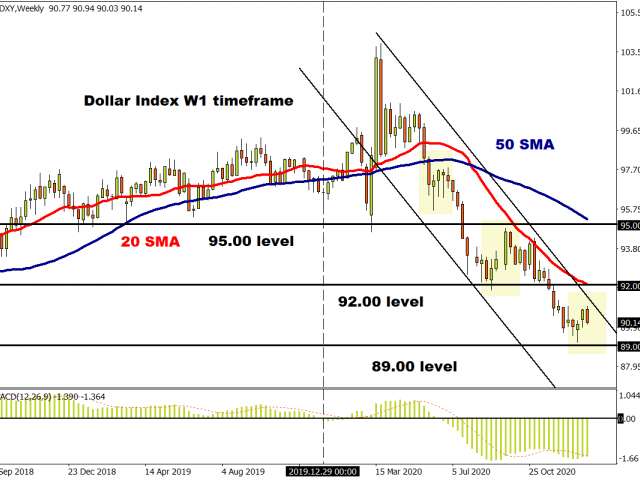

However, the not so ‘mighty’ Dollar caught our attention as prices hovered above the 90.50 level.

After being constantly bullied and mistreated by G10 currencies, the Dollar seemed to be staging a comeback on Monday. We questioned whether this would be another dead cat bounce or a rebound back to glory…

The Dollar descended back into the abyss thanks to reflation hopes and expectations over the Federal Reserve maintaining its ultra-accommodative monetary policy stance.

It was all about earnings on Tuesday with Netflix and US banking heavyweights in focus.

Fun fact - by the end of 2020, Netflix’s global base of paid subscribers hit 203.66 million which is roughly above Nigeria’s current population!

On Wednesday, the major talking point was Biden’s inauguration and possible impacts it could have in markets.

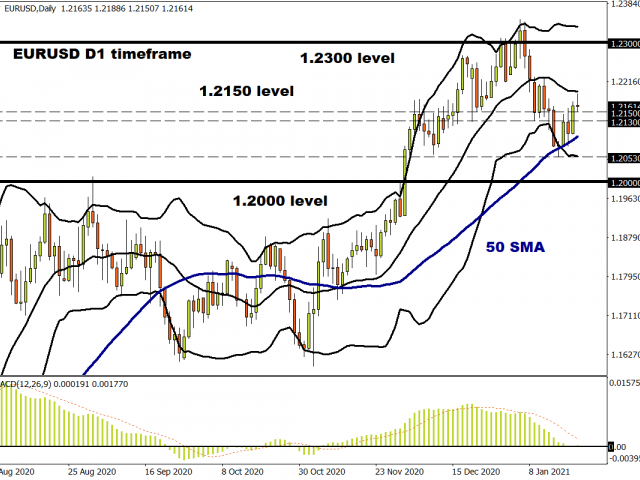

There were a couple of technical setups discussed ahead of Biden’s big day, ranging from the EURUSD, GBPUSD, and even AUDUSD.

US stocks rallied to record highs on Wednesday evening as equity bulls approved the latest occupant of the White House, President Joe Biden.

As the peaceful presidential transition fuelled the risk-on mood, the Greenback fell against most high beta currencies and extended its slide to the end of the week.

In Europe, the European Central Bank left interest rates unchanged. The pandemic is expected to weigh on the economy in the first quarter so ample financing remains essential, while the bank is monitoring FX rates very carefully.

A sense of caution returned to markets on Friday as surging coronavirus cases dampened the positive mood. Given how 97 million people have been infected globally, COVID-19 remains a key theme that continues to drain investor confidence.

The week ahead promises to be lively as investors brace for a series of key events and economic data from major economies.

World leaders will be under the spotlight, earnings from big tech firms will be released while the FOMC interest rate decision and data from major economies could spark market volatility.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.