Do we want to hear about last night’s Fed meeting and how they are in wait and see mode ahead of the Yellen avalanche of incoming debt? Or how leaving the pace of their bond buying unchanged could be interpreted as an indirect light-tapering scenario further down the road? Or inflation expectations look overdone which signals market inflation bullishness is about to peak?

Of course not!

The “topic du jour” is of course the feverish battle between the Reddit WSBs (Wall Street Bets) crew and the hedge funds.

This has whipped up volumes to record levels on Wall Street with more than 23 billion shares changing hands yesterday, which smashed the previous record made during the 2008 GFC by nearly 20 per cent. Armed with stimulus cheques and zero-commission trading apps, new day traders are forcing funds to not only cut their short positions but also sell shares in companies to cut their leverage and reduce their gross exposure to the market.

It seems short sellers are having to rethink their modus operandi whilst they ride out this fire, fuelled by social media and traders who may have only a minor understanding of two-way risk.

With year-to-date gains for GME or around 1,745%, we don’t’ need a rocket scientist to tell us this will not end well for some market participants, with no doubt the SEC involved sooner rather than later…

Dollar helped by stock selloff

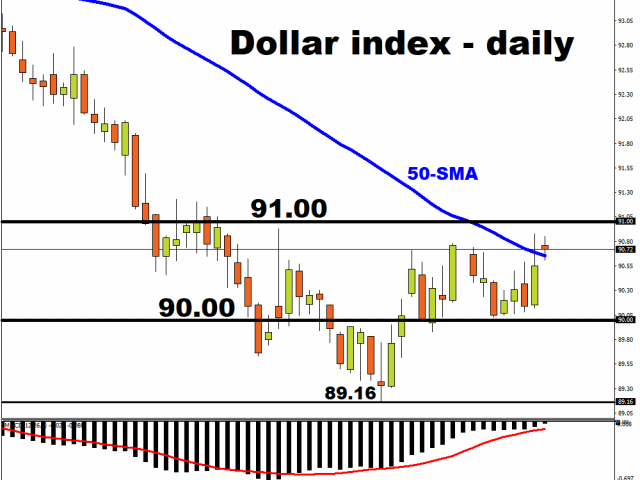

In the real world, the dollar is flat on the day as it struggles to break free from the 50-day SMA and push past this month’s high at 90.95. With the VIX off its highs from yesterday, dollar bulls could be feeling a little sorry for themselves with the negative risk sentiment we’ve seen recently and the disappointing move north.

If the stock market fall is simply a correction within a medium-term trend of an ongoing recovery, the USD shouldn’t benefit for too much longer. The cautious Fed and its continuation of ultra-loose policy indicates deeply negative real rates are with us for a long while yet.

Dollar bears will need to beat strong support around 90 to see more downside in the medium-term.

EUR/GBP teasing the bears

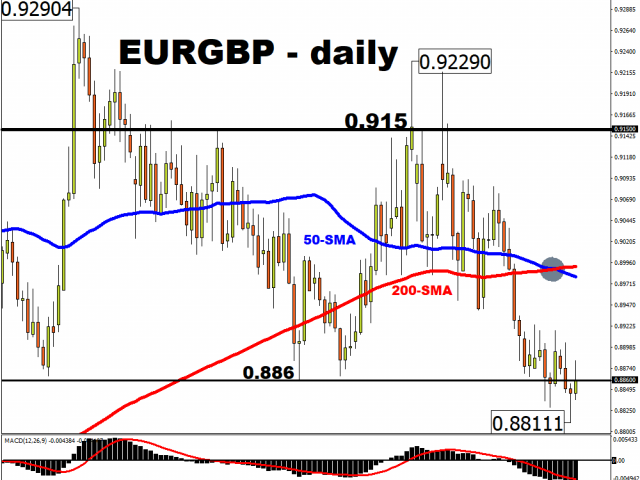

ECB officials have been actively fighting against the strong euro in recent days stating that the markets are underestimating the odds of a rate cut. There is now a 70 percent chance of a 10 basis point move this year, but we should remember that the trade-weighted single currency is currently below its six-month average so it seems slightly odd to us to be jawboning your currency down when there may be more pressing times ahead.

Meanwhile the UK is pushing ahead with its vaccination programme even as the row between the EU and Astra Zeneca continues. Our “vaccine” trade (EUR/GBP) has been teasing us recently as it strives to break down conclusively.

Although bearish momentum still looks to be in play with a series of lower highs and lower lows, patience is needed!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.