PREVIOUS TRADING DAY EVENTS – 29 May 2023

Announcements:

- The Debt Deal is waiting to be approved. U.S. President Joe Biden is pushing for things to move on fast.

“I never say I’m confident about what the Congress is going to do, but I feel very good about it,” Biden told reporters on Monday. “I’ve spoken with a number of the members. I spoke to McConnell. I spoke to a whole bunch of people. And it feels good. We’ll see when the vote starts,” he said, referring to Senate Minority Leader Mitch McConnell.

Biden and McCarthy show confidence that the deal will be approved soon. It involves federal spending through 2025 and suspending the debt ceiling until Jan. 1, 2025. In exchange for Republican votes for the suspension, Democrats agreed to cap federal spending for the next two years.

The U.S. Secretary of Treasury Jannet Yellen has announced previously that the U.S. debt default deadline has been extended until the 5th of June. Supporters of this deal have only a week to get the agreement through Congress before the possible June 5 default.

Source: https://www.bloomberg.com/news/articles/2023-05-29/biden-mccarthy-work-lawmakers-to-pass-deal-as-us-default-looms

______________________________________________________________________

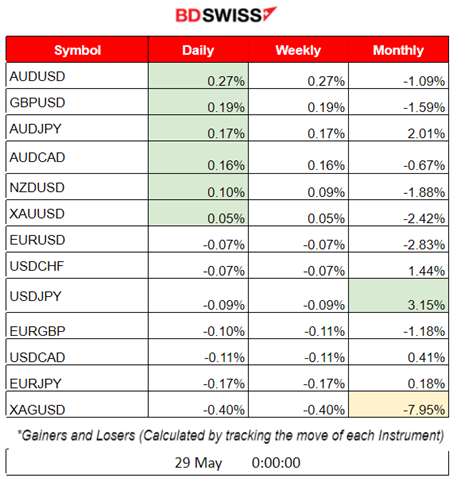

Summary Daily Moves – Winners vs Losers (29 May 2023)

- AUDUSD has been leading yesterday but with not much of a move, with 0.27% gains.

- This month USDJPY is on top with 3.15% gains. XAGUSD is still losing massively with a nearly 8% drop.

______________________________________________________________________

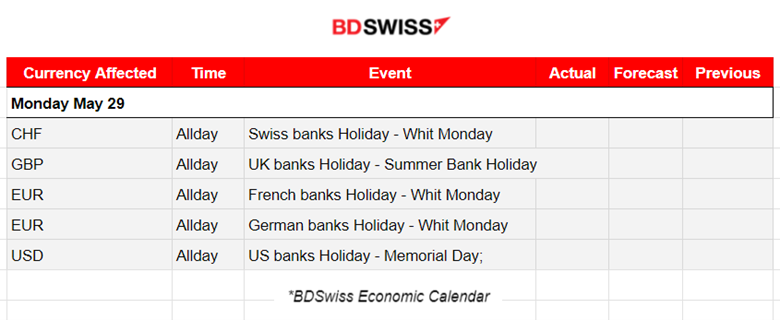

News Reports Monitor – Previous Trading Day (29 May 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special figure releases.

- Morning – Day Session (European)

No important figure releases as most regions have a holiday. Stock Exchanges were closed so no important movements took place.

General Verdict:

- Abnormally low liquidity and abnormally high volatility. FX pairs have not moved much from their 30-period MAs.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (29.05.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

EURUSD experienced low volatility overall due to holidays and because no figures were scheduled to be released. After 9:00 during the European Session, the pair moved downwards, however, it is a path around the mean with no high deviations from it.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The index started on the 24th of May to show a reversal in price as it moved upwards crossing the 30-period MA and continuing with its upward path. The other U.S. indices, US 30 and S&P 500 formed similar paths indicating resilience in dropping but moving more sideways. However, on the 26th of May, all indices jumped ahead of the Memorial Day holiday for the U.S. on the 29th. The CFD derives its price from the futures and this is why there was pricing yesterday, and the index moved sideways with low volatility and no surprises.

______________________________________________________________________

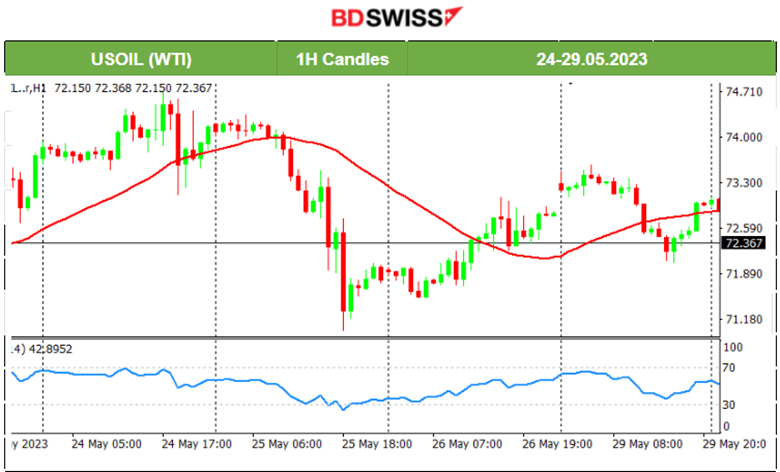

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude experienced a price reversal as it dropped rapidly on the 25th of May, crossing the MA and moving further downwards with a nearly 3 USD drop. After this high deviation from the MA, a retracement followed when important resistance levels broke near 72.1 USD/b.The retracement continued even higher than the 50% fibo level. It later moved sideways with high volatility around the mean, with near max 10 USD deviations.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

USD has appreciated greatly recently and drove the Gold (XAUUSD) price downwards. It eventually formed a triangle formation as depicted on the chart, having significant support levels near 1938 USD/oz, which was tested many times. It eventually broke today. With no fundamentals taking place affecting the USD, until Friday, we might see further drop for Gold. Technical Signal has chances to drop more than 15 USD, at least until then and if no significant news for the U.S. comes out creating a distortion for this analysis.

______________________________________________________________

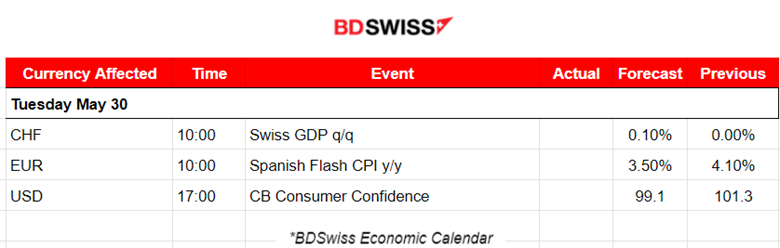

News Reports Monitor – Today Trading Day (30 May 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no important scheduled releases.

- Morning – Day Session (European)

At 10:00, there are some important figure releases that might cause more than typical volatility. The Swiss quarterly GDP figure (released about 60 days after the quarter ends) might have an impact. 0.1% growth is expected. We do not think that there is going to have a great impact on the CHF pairs, maybe a very small intraday shock. The same case is expected for the Spanish Flash CPI y/y. The EUR might be affected slightly.

U.S. CB Consumer Confidence at 17:00 might cause an impact and an intraday shock for the USD pairs. If the FX pairs do not deviate greatly during the day from the mean, that impact would probably be significant.

General Verdict:

- Slow day again with low volatility and no major news affecting the USD.

- Some figures are to be released but will probably experience no major shocks.

______________________________________________________________

Source: BDSwiss