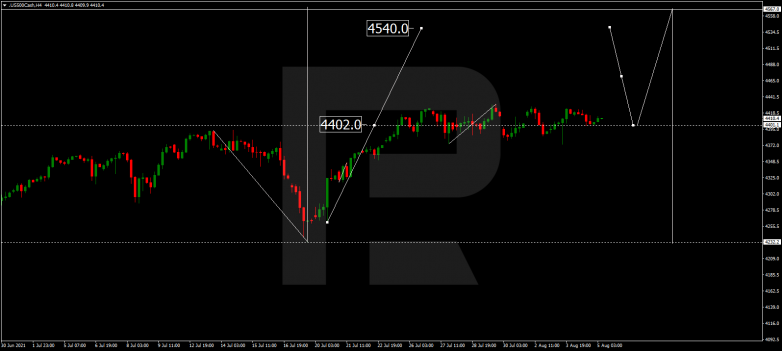

EURUSD, “Euro vs US Dollar”

The currency pair completed a link of growth to 1.1892 and dropped to 1.1838. Today the market is trading in a narrow range at these lows. We expect the range to extend to 1.1827, then another wave of growth to develop to 1.1922.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair completed a link of growth to 1.3965 and dropped to 1.3905. At a certain moment, the market formed a consolidation range and broke through it downwards. Today we expect a decline to 1.3852, followed by growth to 1.3905. With a breakaway of this level upwards a pathway to 1.4000 will open.

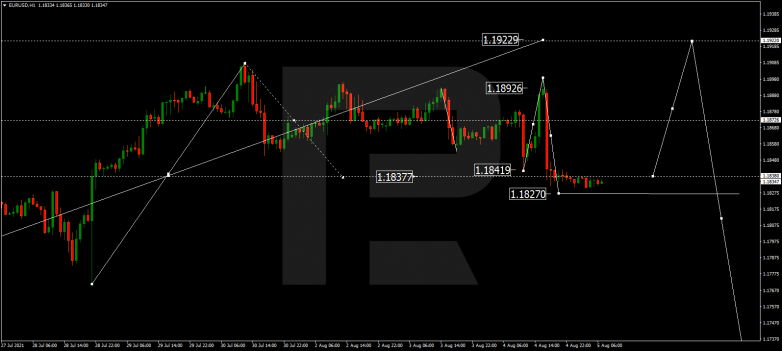

USDRUB, “US Dollar vs Russian Ruble”

The currency pair keeps developing a consolidation range at the lows of the wave of decline. Today we expect a link of growth to 73.30, followed by a decline to 72.60. With a breakaway of this level downwards, a pathway to 72.16 will open.

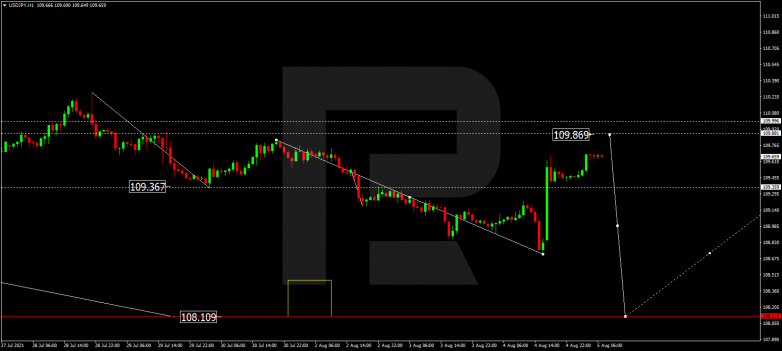

USDJPY, “US Dollar vs Japanese Yen”

The currency pair performer a wave of decline to 108.72 and a correction to 109.60. At the moment the market is trading in a narrow consolidation area. We expect the range to extend to 109.86, then — a decline to 108.10.

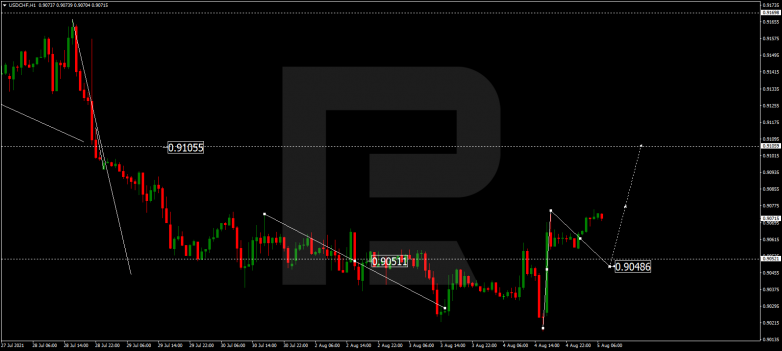

USDCHF, “US Dollar vs Swiss Franc”

The currency pair keeps developing a consolidation range around 0.9050. The market is supported by the lower border of the range at 0.9020. The quotations have performed growth to 0.9040 and are forming a consolidation range above this level. They might later grow to 0.9105 and drop to 0.9050.

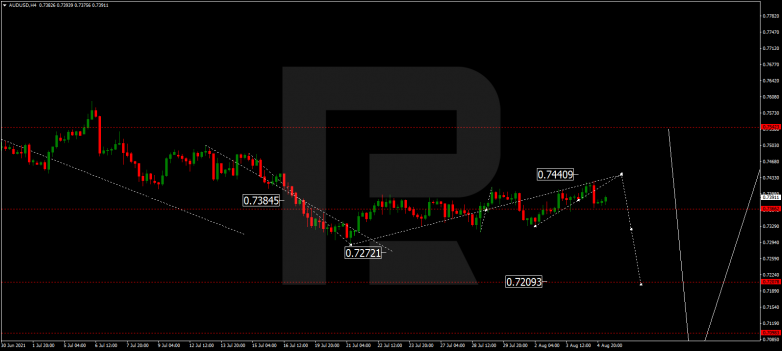

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair keeps trading in a channel of a correctional structure, aiming at 0.7440. After this level will be reached, another wave of decline might start developing to 0.7272. With a breakaway of this one downwards, a pathway to 0.7200 should open.

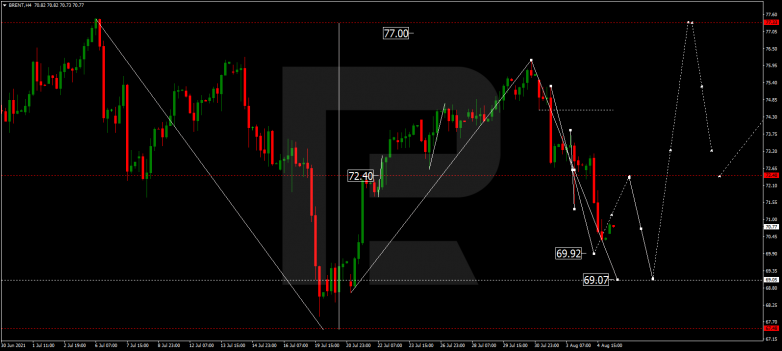

BRENT

Oil demonstrated a decline to 72.60. At a moment, the market formed a consolidation range around this level, and if it is broken away downwards, the correction might continue to 69.07. Today the quotations might drop to 69.96, then grow to 72.60, test the level from below, and fall back to 69.07. There the wave of decline should be over. Next thing, we expect a wave of growth to 77.33.

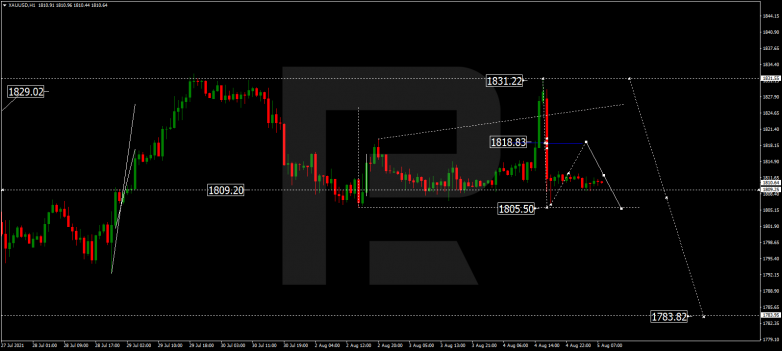

XAUUSD, “Gold vs US Dollar”

Gold has performed a structure of growth to 1831.22 and, bouncing off this level downwards, keeps declinig to 1805.50. Today we expect this level to be reached, followed by a link of growth to 1818.80. Then we expect a decline to 1805.00. And with a breakaway of this one downwards, a pathway to 1783.83 will open.

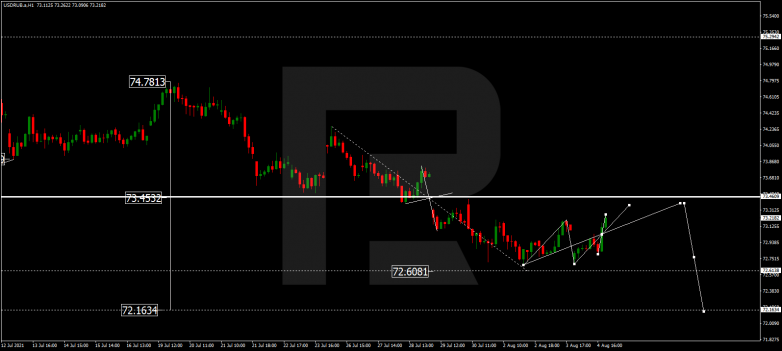

S&P 500

The stock index keeps trading in a narrow consolidation range around 4400.0 without any trend. With an escape upwards, a pathway for a wave of growth to 4500.5 will open. With an escape downwards, a link of correction to 4333.0 might follow. Then we expect growth to 4500.5, and this is the main scenario.