GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, after failing to test the long-term 38.2% fibo at 1.3166, the asset is forming a new pullback to the upside. However, it doesn’t mean that the descending tendency is over. Convergence on MACD is another signal in favour of the ascending correction. A breakout of the local low at 1.3194 will lead to a further downtrend towards the long-term target. The key resistance is at 1.3834.

The H1 chart shows a more detailed structure of the current growth towards 23.6% fibo at 1.3345. After a slight pullback, the correctional uptrend may continue to reach 38.2% and 50.0% fibo at 1.3438 and 1.3514 respectively.

EURJPY, “Euro vs. Japanese Yen”

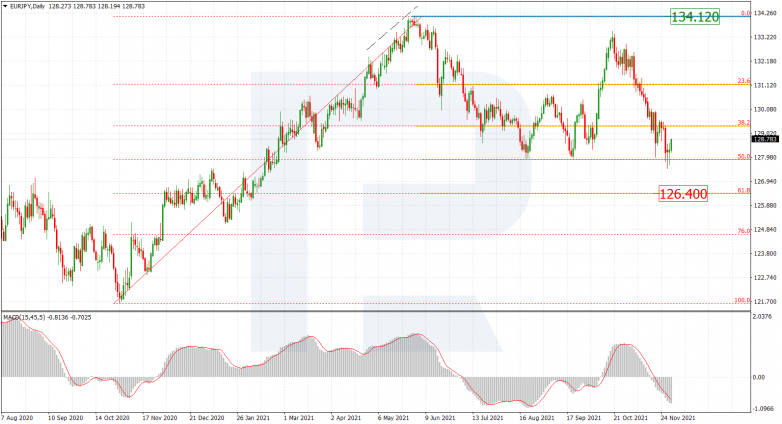

The daily chart shows that after falling and reaching 50.0% fibo, EURJPY is correcting upwards. After the pullback is over, the asset may continue falling towards 61.8% fibo at 126.40. Later, the market may start a new uptrend to reach the high at 134.12.

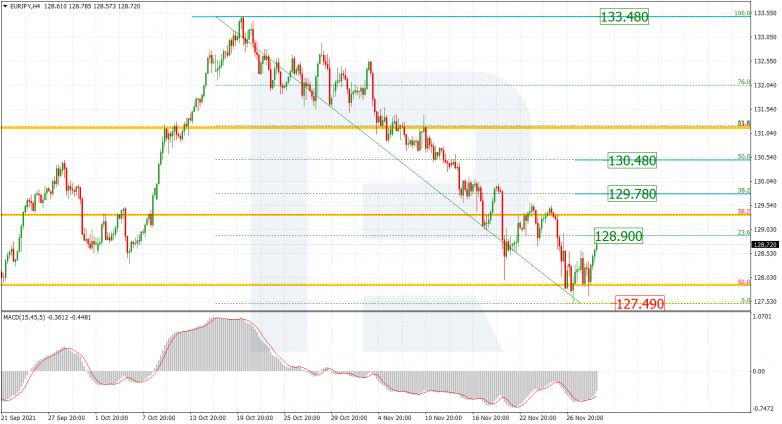

As we can see in the H4 chart, after testing and breaking the mid-term 50.0% fibo, EURJPY is correcting upwards; right now, it is approaching 23.6% fibo at 128.90 and may later continue towards 38.2% and 50.0% fibo at 129.78 and 130.48 respectively. The support is the low at 127.49.