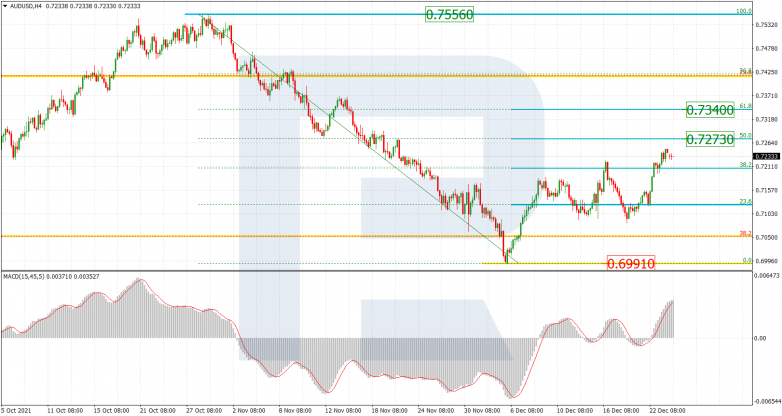

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the daily chart, after falling and reaching 38.2% fibo, the descending wave has been followed by a new short-term correction. After this pullback is over, AUDUSD may resume trading downwards to reach 50.0% fibo at 0.6758. The key resistance remains at the high at 0.8007.

The H4 chart shows a more detailed structure of the current correctional uptrend, which has already reached 38.2% fibo. The upside targets may be 50.0% and 61.8% fibo at 0.7273 and 0.7340 respectively. The support is the low at 0.6991.

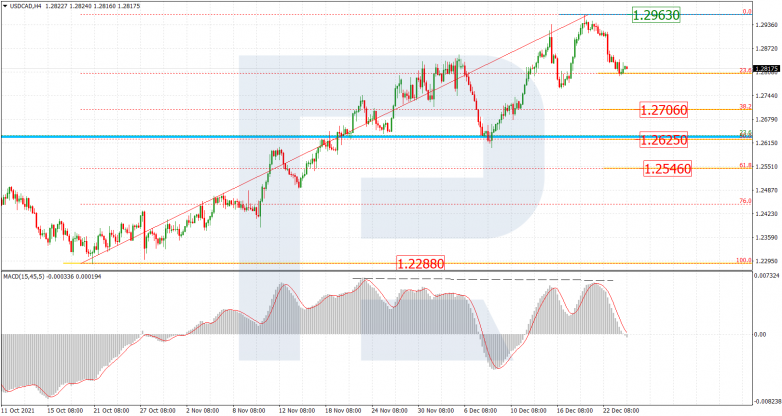

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the daily chart, the asset continues trading upwards and has already tested the previous high. In the nearest future, USDCAD is expected to start a slight correction, which may later be followed by a further mid-term uptrend towards 38.2% and 50.0% fibo at 1.3023 and 1.3336 respectively. The key support remains at the low at 1.2007.

In the H4 chart, the decline has reached 23.6% fibo after divergence on MACD. The next downside targets may be 38.2%, 50.0%, and 61.8% fibo at 1.2706, 1.2625, and 1.2546 respectively. A breakout of the local resistance at 1.2963 will result in a further uptrend.