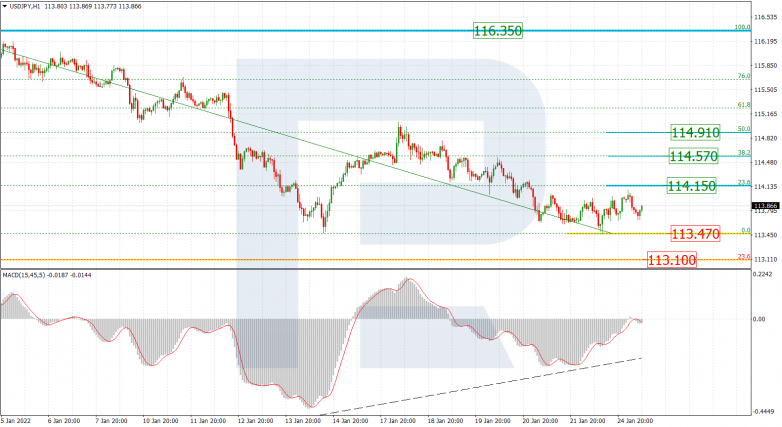

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, after growing and reaching 50.0% fibo, the asset is trading to the downside. This movement may be considered another descending impulse within the downtrend; its closest target is the low at 1.1186, a breakout of which may lead to a further decline towards the long-term 76.0% fibo at 1.1047. At the same time, it is clearly seen that EURUSD is slowing down and that’s may be a signal in favour of a pullback or even a new growth to reach 61.8% and 76.0% fibo at 1.1499 and 1.1570 respectively.

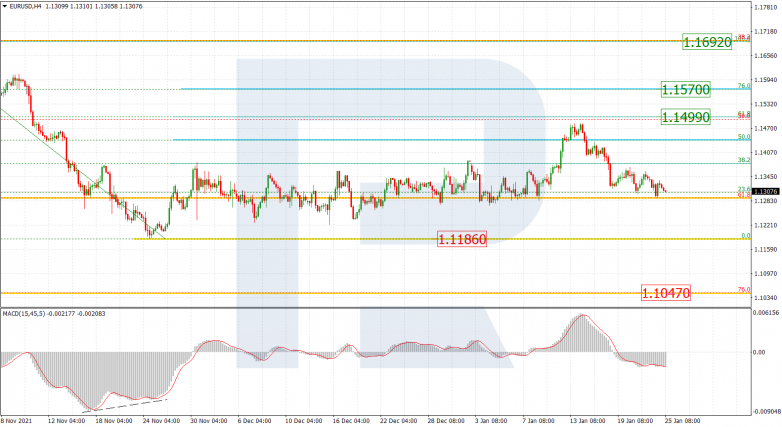

The H1 chart shows that the descending wave has already tested 61.8% fibo and may later continue towards 76.0% fibo at 1.1257. At the same time, convergence on MACD may hint at a possible pullback to reach the local high at 1.1483.

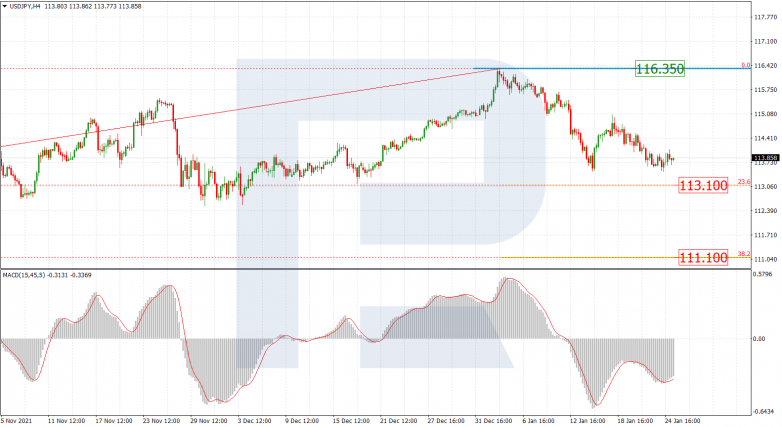

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, USDJPY is correcting to the downside and trying to test 23.6% fibo at 113.10. The next downside target may be 38.2% fibo at 111.10. The resistance remains at the high at 116.35.

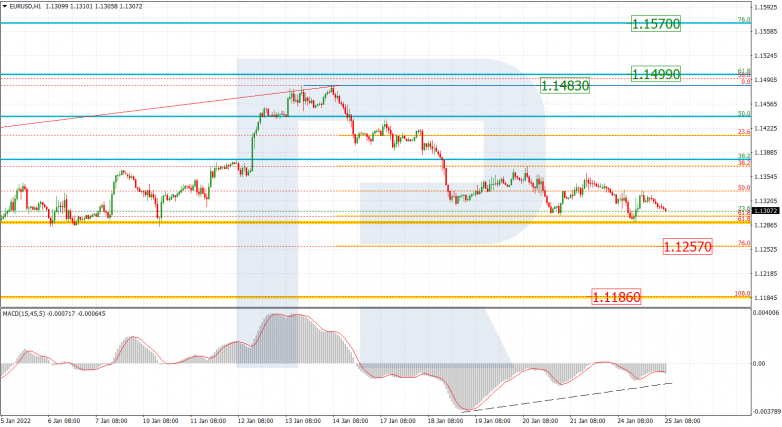

In the H1 chart, local convergence made the pair stop falling and start a new correctional uptrend towards 23.6%, 38.2%, and 50.0% fibo at 114.15, 114.57, and 114.91. The local support is the low at 113.48.