On the first day of March, stock markets experienced the strongest rally in four months. On Tuesday, the optimism had faded somewhat for a number of reasons. China’s central bank spokesman is worried about bubbles in the housing market and foreign financial markets. This could be a signal for a tightening of the PBC policy soon. The markets are concerned because easy money policies are the primary source of economic and share price growth.

Such a hard turn could be the same mistake that the Fed made about 100 years ago when it raised interest rates too quickly out of fear of overheating. Eventually, it led to the Great Depression. Developed countries have drawn on this experience and do not express fears of bubbles a year after the biggest economic collapse in peacetime. If the PBC warnings are followed soon by real action, the markets’ optimism may noticeably fade. Moreover, it could prove rather unhelpful against the backdrop of a historically sharp spike in corporate defaults in China. This is a somewhat toxic combination that could quickly erode global optimism, especially on the European continent.

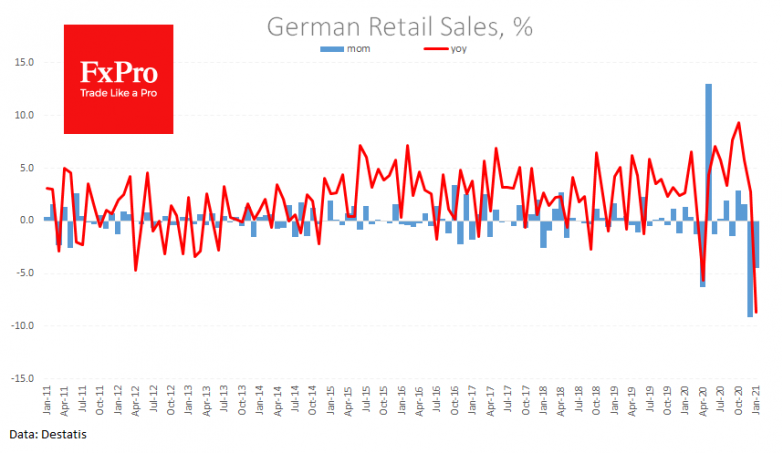

Worse still, data out of Europe today is also setting a negative mood. Retail sales across Germany collapsed by 4.5% in January after falling by 9.1% a month earlier. This two-month drop is a third more than during the first wave of the pandemic in March-April 2020. By last year’s figures, sales had collapsed by 8.7%.

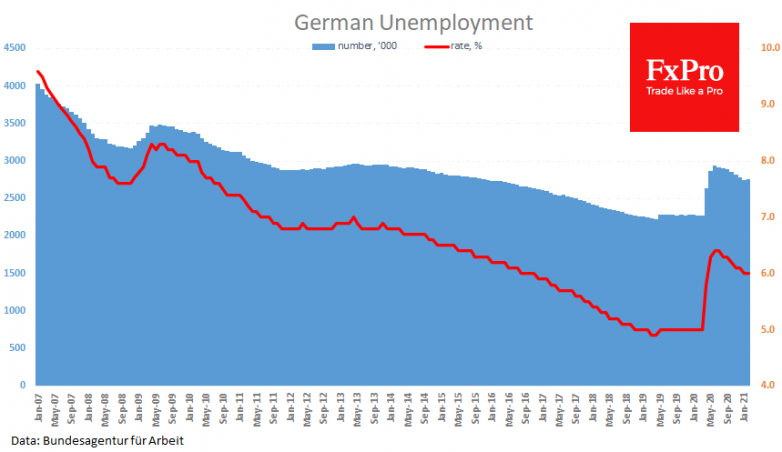

Germany saw an unexpected rise in the number of unemployed people in February, breaking a seven-month string of job cuts. Figures for Spain also disappointed, showing a drop of 44k (4 times the forecast) after 76k a month earlier. The labour market in Spain continues to suffer from the crisis.

With such a macroeconomic backdrop, it comes as no surprise that EURUSD tested 1.2000 earlier on Tuesday, falling to its lowest level in almost a month. Fears of policy tightening in China and unexpectedly weak data in Europe make the dollar an attractive target for medium-term buying on the back of a faster, more vivid economic recovery in the US.

Interestingly, commodity currencies are finding strength against the dollar for the third day in a row, forming a clear hierarchy of market priorities from best to worst: commodities – dollar – euro – defensive CHF, JPY.

The FxPro Analyst Team