On Monday, Brent fell more than 7% to $67.4 per barrel. The selloff took place on higher volumes and showed a frightening amplitude during the NY session. On Tuesday morning, the price consolidates near $68.3, showing no apparent signs of a rebound.

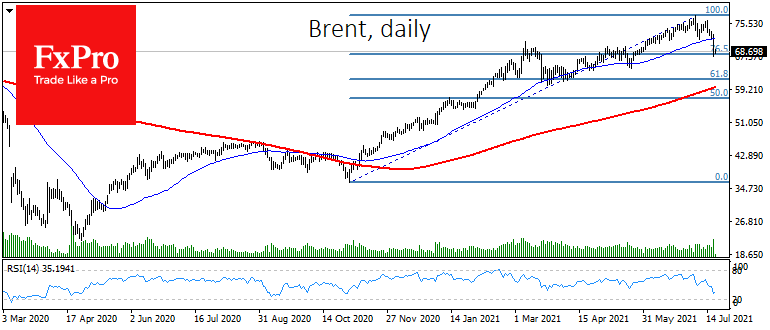

Right now, Brent is balancing at the 76.5% retracement line of the November-to-July rally, finding support at the first Fibonacci level. If the pressure on these levels does not ease in the coming hours, the way for a rapid decline to $60-61 will open. This area consolidates several technical levels, including the 200-day moving average, the March support and the 61.8% retracement.

During the latter stages of the recent uptrend, it was getting more challenging for Brent to reach new highs. In July, we saw a “sell the high” pattern. All that despite a favourable macroeconomic backdrop that kept the sellers in check. A combination of two significant factors triggered a severe selloff at the start of the week.

OPEC sparked increased volatility with their agreement of 400K BPD monthly increase in quotas and higher base production levels for five countries. Due to such a case, the chances of oil shortages in the coming quarters have fallen sharply.

The cartel’s decisions are quite clear. For a long time, its members could afford not to rush to increase production, quietly watching the price rise and inventories shrink, as supply in the USA remained relatively stable. This has changed in recent weeks, and we have seen its systematic increase, putting the battle for market share back on the agenda.

Another factor that has intensified the strain on oil is the corrective sentiment in global stocks. These are caused, among other things, by concerns about the economic impact of rising contagion, even in countries with a high proportion of vaccinated people.

Technically, the bulls’ capitulation has been fuelled by a fall below the 50-day moving average, below which oil has not traded since November 2020, i.e. the entire period of the previous rally. The depth of the correction depends on many factors. In short term is worth paying attention to the dynamics of assets near the following essential levels. Brent’s move under $67 would open the way to a drop to $60-61 soon. If there is sufficient demand at current levels, we can expect a quick recovery of interest and consolidation.

The FxPro Analyst Team