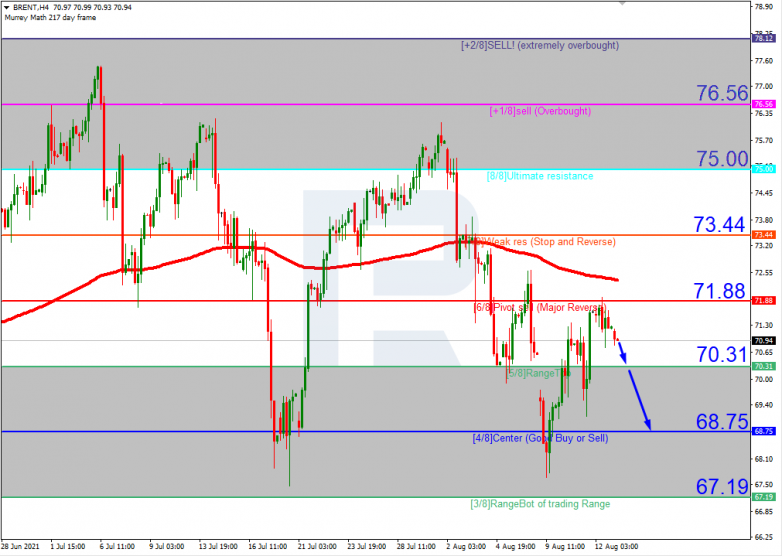

On H4, the quotations are trading under the 200-days Moving Average, indicating a downtrend. We may expect testing of 5/8, breaking through it, and falling to the support level of 4/8. The scenario can be cancelled by breaking through 6/8 upwards. In this case, the price might grow to the resistance level of 7/8.

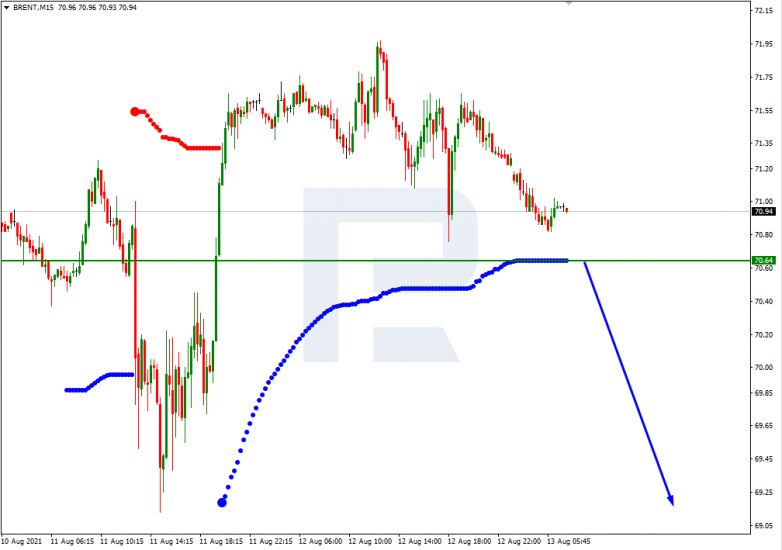

On M15, falling of the price can be supported by a breakaway of the lower line of VoltyChannel.

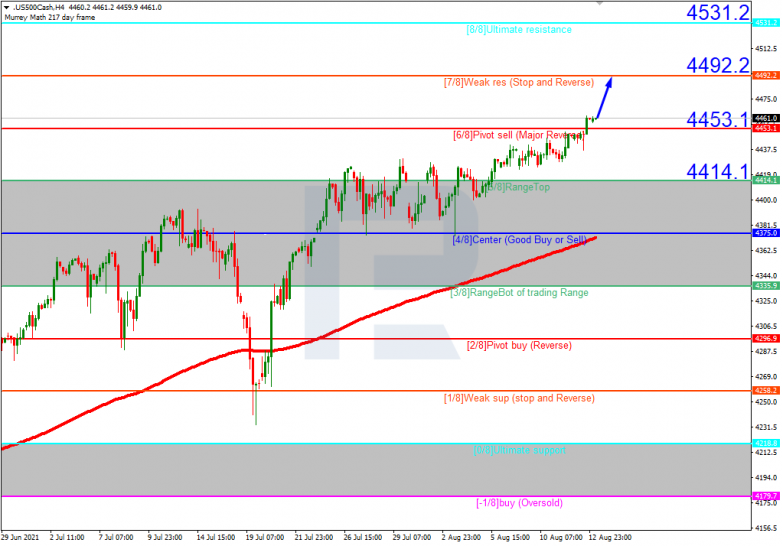

S&P 500

On H4, the quotations are trading above the 200-days MA, wh ich means the uptrend is dominating. We should expect further growth to the resistance level of 7/8. The scenario can be cancelled by a breakaway of 6/8 downwards. This might lead to a correctional decline to the support level of 5/8.

On M15, the upper line of VoltyChannel is broken, which confirms the uptrend and a high probability of growth to 7/8 on H4.