On Friday, January 22, all major currencies closed in the red, while the euro closed in positive territory. The single currency drew support from euro crosses throughout the day. By the end of the session, the EURUSD pair increased by 0.07% to 1.2170. The euro locked in gains during the European session after macro data came out of Germany. Investors were pleased to note that the lockdown exerted only a slight impact on business activity in the country.

Eurozone business activity fared only a bit worse than the previous readings, but this could not change market sentiment due to weak data points out of the UK (retail sales as well as manufacturing and services PMIs), which pushed the euro up through the EURGBP cross.

During the North American session at 14:45 GMT, strong Markit US manufacturing and services PMI readings came out. The index of business activity in the service sector in January reached 57.5 (vs. the 53.6 forecast). The index of business activity in the manufacturing sector for the same period clocked in at 59.1 (vs. 56.5). Both data points exceeded market expectations and the previous readings, reminding investors that the US economy continues to recover even as the pandemic resumes. But even this data failed to halt euro buying.

Today’s macro agenda (GMT 3)

- 12:00 Germany: IFO business climate, IFO current conditions, IFO expectations (January)

- 11:45 and 19:15 Eurozone: ECB President Christine Lagarde speech

Current outlook

At the time of writing, the euro was trading at 1.2160. The main EURGBP cross is still on the buy side. Major currencies are all trading in positive territory. Today’s top performers include the aussie ( 0.48%), the kiwi ( 0.32%) and sterling ( 0.31%). These currencies experienced a pullback near the end of the week amid risk aversion, and today they are showing a correction.

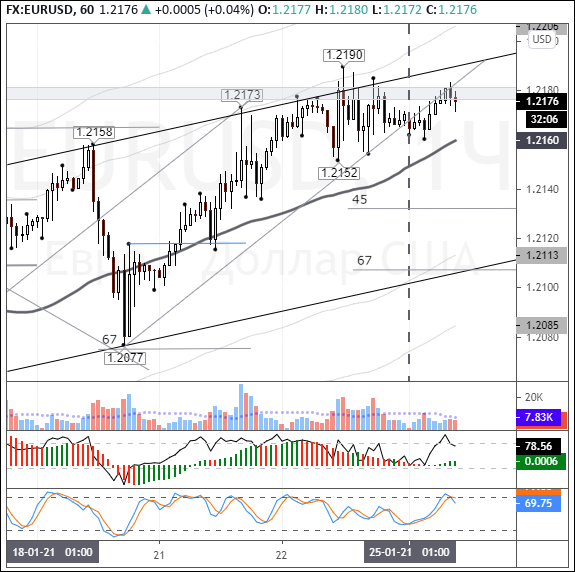

Since major currencies closed in the red and the key pair was in positive territory on Friday, today the euro may come under pressure from corrections in euro crosses. Buyers halted selling near the upper line of the current channel. Instead of falling, a sideways trend in the range of 1.2155-1.2187 shaped up. Today, players are advised to watch the euro from the sidelines, in order to figure out whether other currencies will be able to pare their losses or whether the dollar rally will move ahead.

Resistance is in the 1.2180-1.2192 range. The balance line is at the current hour (7:00) at 1.2160. If buyers are able to hold the price action above 1.2150 until Tuesday, then there is a likelihood that the 1.22 level will be tested, with support from crosses at 1.2234. If pressure on crosses increases, then buyers will have to retreat to 1.2133 (45-degree angle) in order to accelerate gains. We believe the euro was lucky to hold above 1.2170 ahead of the weekend. A breakout of the 1.2158 horizontal level (January 20, 2021 high) would significantly increase the odds of the euro falling back to 1.2117.