Today’s macro schedule (GMT 3)

- 13:00 UK: CBI retail sales (April)

- 16:00 US: S&P/Case-Shiller home price (February); 17:00 CB consumer confidence and Richmond Fed manufacturing (April)

- 23:00 Canada: BoC Governor Tiff Macklem speech

Current outlook

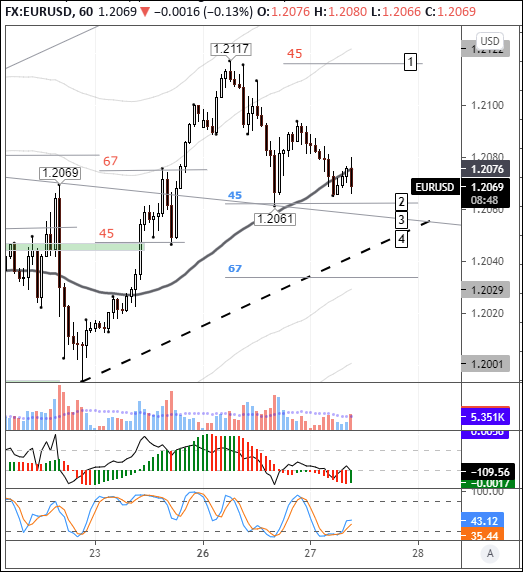

On Monday, the euro dipped during the European session to the support line formed by the 45-degree angle (2) and the balance line (55-day SMA). The price action rebounded from that mark to 1.2094. Today in Asian trading, the price action reverted downward, as buyers apparently lacked the stamina to muster a rally. Major currencies are trading in the red.

At the time of writing, the euro was trading at 1.2071. Technically, the pair is poised for a move up to 1.2116 (1). The 10-year US bond yield is at 1.576%, and has been rangebound at 1.532-1.595% over the past four days. The market now awaits the FOMC meeting and Fed Chair Powell's speech.

The euro completed a smooth correction and looks set to recover. Growth is held back by euro crosses and overall strength in the dollar. Euro pairs show multidirectional dynamics. The euro is being used to buy into the Canadian dollar, the yen, the Australian dollar and the US dollar.

The price action is holding above the 45-degree angle (2), with fairly high odds of a move up to 1.2116 (2) ahead of Powell's press conference. The trendline on the bar at 6:00 GMT crosses through 1.2041 (4). That said, if buying is sluggish, players should retreat to the trendline.

Bottom line: on Monday, EURUSD corrected to the balance line and the 45-degree angle (2). The retracement is enough to extend the uptrend with a target of 1.2116 (1). Today’s European economic calendar is essentially a blank slate. Buyers need to jump in during the European session, otherwise they will be forced to retreat to the 1.2041 trendline (4).

The upcoming Fed meeting and Powell’s speech, in the absence of a decline in UST yields, act as a restraining factor for upside in the euro. Furthermore, the euro is under pressure from lockdowns in Europe.