The EURUSD pair logged gains on Thursday, May 20, up 0.47% to 1.2227. The single currency trended higher from the opening of Asian trading right up until the close of the North American session. The gains reflected increased demand for risk assets. Investors overreacted to the Fed minutes released on Wednesday.

The upward momentum got a boost from the release of US labor market data, which bolstered traders' optimism about the prospects for US energy demand. Euro crosses were on the buy side, as a result of which they easily retraced to the 1.2226 level. A high was recorded in Asian trading around 1.2239.

Last week, the number of Americans who applied for first-time unemployment benefits decreased by 34,000 to 444,000 (vs. 450,000 expected) This is the lowest reading since the outbreak of the Covid-19 pandemic.

Today’s macro agenda (GMT 3)

- 10:15 to 11:30 flash PMI and services sector readings in France, Germany, the Eurozone, and the UK (May)

- 15:00 ECB President Christine Lagarde speech

- 15:30 Canada: retail sales (March)

- 16:45 US: flash PMI and services sector readings (May)

- 17:00 US: existing home sales (April); Eurozone CCI (May)

- 18:00 BoC Governor Tiff Macklem speech

- 20:00 US: Baker Hughes weekly oil rig count

Current outlook

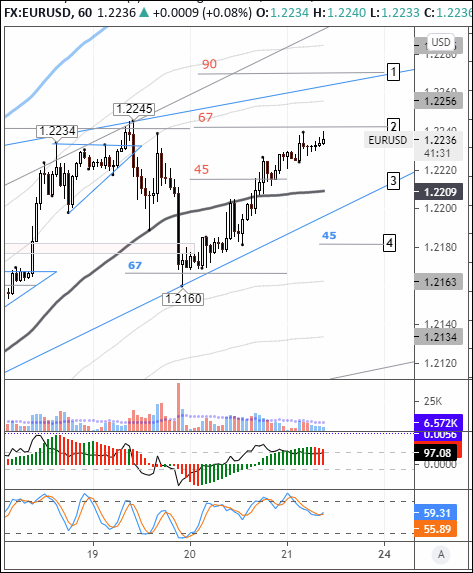

At the time of writing, EURUSD was trading at 1.2237 amid mixed performance across major currencies. The franc, euro, pound and yen are trading in positive territory. The single currency is drawing support from rising crosses. If positive sentiment wins out until the close of the European session, the euro can be expected to reach 1.2265 (1), where the 90-degree angle meets the projection from the 1.2177 and 1.2245 tops.

The price action could pick up or slow down in the wake of European macro stats and Christine Lagarde’s speech. Flash PMI and services sector readings are due out shortly after the opening of European trading. Similar indicators will be released stateside during the North American session.

Bottom line: buyers pared Wednesday’s losses and are ready to move up to 1.2265, with support from rising crosses. The price action may accelerate or decelerate after European stats and Christine Lagarde’s speech.