The EURUSD pair ticked up 0.08% to 1.1328 on Monday, December 27. After slipping to 1.1303, price action rebounded to 1.1332. The gains were driven by a rally in the US stock market. The S&P 500 surged to 4,791.18 yesterday, setting an all-time high. Sentiment is on the mend despite the rapid spread of the Omicron strain.

Volumes have been subdued in the FX market, so the uptrend ran out of steam.

Today’s macro agenda (GMT 3)

Today is Boxing Day in New Zealand, Australia, the UK, and Canada. Markets are closed.

Current outlook

Asian trading has been relatively low-key today. Most major currencies have been creeping higher. Market sentiment remains patchy and liquidity remains low. Today’s economic calendar is a blank slate.

Technical analysis

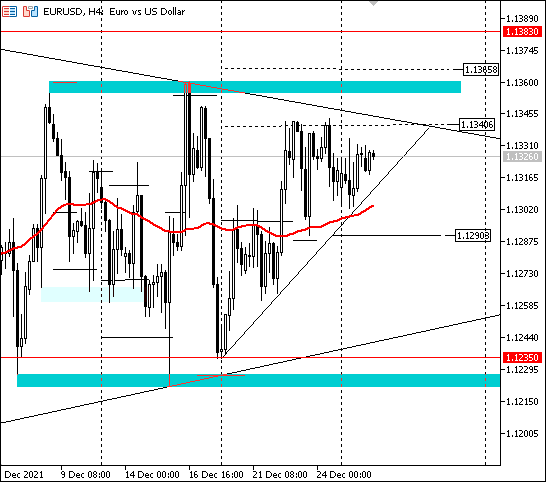

By the time of writing, EURUSD pair was trading at 1.1323. Horizontal support is at 1.1305, and along the trendline at 1.1316. The boundaries of the local range narrowed to 1.1316-1.1340.

Traders cannot figure out which way the market is moving amid an empty economic calendar and holiday-thinned trading. Over the next two days, we expect the trading range to expand to 1.1290-1.1360.

Bottom line: the euro closed slightly higher on Monday. The gains were driven by a rally in the US stock market. Sentiment remains conflicted amid low liquidity. The trading range should expand to 1.1290-1.1360 over the next couple of days.