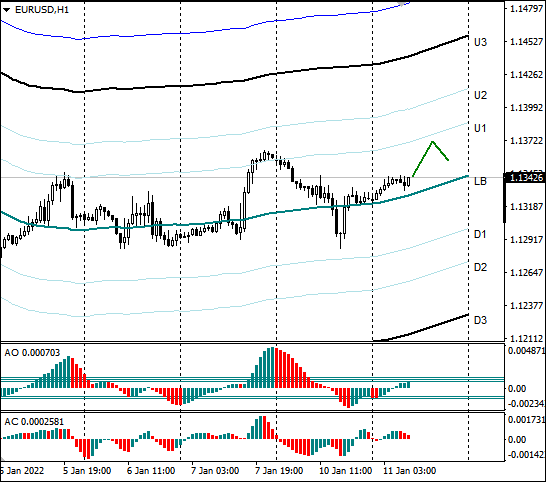

The single currency logged losses on Monday, January 10, down 0.32% to 1.1325. Against the backdrop of declining US index futures and rising 10-year UST yields, the key pair declined to 1.1285. The price remained in the November 30, 2020 range and bounced off the 1.1335 support level. The daily candle closed with a bearish body and a long lower shadow.

Today’s macro agenda (GMT 3)

- 12:00 Italy: retail sales (November)

- 13:20 Eurozone: ECB President Christine Lagarde speech

- 17:00 US: Cleveland Fed President Loretta Mester speech

- 17:30 Kansas City Fed President Esther George speech

- 18:00 US: Jerome Powell confirmation hearing before the US Senate Banking Committee

Current outlook

By the time of writing, the single currency was hovering at 1.1336, while major currencies were trading in positive territory against the US dollar. Fears of faster monetary policy tightening by the Fed persist in the markets. Traders have shifted their focus to Wednesday’s US consumer inflation print, which could exert an impact on monetary policy expectations.

The 10-year UST yield stands at 1.76% (a two-year high). If the yield enters a correction, EURUSD will continue its ascent to the 1.1360-1.1375 range. The upper bound of the monthly sideways range lies at 1.1385. Once price action reaches 1.1360, selling can be expected to resume. Heightened volatility is anticipated during today’s speeches by Lagarde and Powell.

Bottom line: The euro closed slightly in the red on Monday. The market continues to be heavily impacted by Fed liftoff expectations in March. On Tuesday, look for a surge in volatility during speeches by ECB President Christine Lagarde and Fed Chair Powell. The euro’s target zone is 1.1360-1.1375.