Risk-off sentiment has dominated global markets in recent weeks. Headlines around some of the more speculative areas of the market like cryptos, have abounded in this environment.

Here are the scheduled economic data releases and events that could further sway market sentiment over the coming week:

Monday, May 16

- JPY: Japan April PPI

- CNH: China April industrial production, retail sales, property sales, unemployment rate

- EUR: EU Commission releases Spring economic forecasts

- USD: New York Fed President John Williams speech

Tuesday, May 17

- AUD: RBA releases May policy meeting minutes

- GBP: UK March unemployment and April jobless claims

- EUR: Eurozone 1Q GDP and employment

- USD: US April retail sales and industrial production

- USD: Fed speak

- Fed Chair Jerome Powell

- Chicago Fed President Charles Evans

- Cleveland Fed President Loretta Mester

- Philadelphia Fed President Patrick Harker

- St. Louis Fed President James Bullard

- Q1 earnings: Walmart, Home Depot, Vodafone, JD.com

Wednesday, May 18

- JPY: Japan 1Q GDP

- GBP: UK April CPI and PPI, BOE MPC member Catherine Mann speech

- US crude: EIA weekly US crude inventories

- CAD: Canada April CPI

- USD: Philadelphia Fed President Patrick Harker speech

- Target Q1 earnings

- Tencent Q1 earnings

Thursday, May 19

- JPY: Japan April external trade

- AUD: Australia April unemployment

- ZAR: South Africa Reserve Bank rate decision

- EUR: ECB publishes April meeting accounts

- USD: US weekly initial jobless claims

- Xiaomi Q1 earnings

Friday, May 20

- JPY: Japan April CPI

- GBP: UK April retail sales, May consumer confidence

- EUR: Eurozone May consumer confidence

The Fed tightening story has much to do with this as the liquidity tap is constricted and policymakers rush to reinforce the central bank’s inflation-fighting credibility. If recession concerns grow louder, they may transcend inflation worries.

This means the bid in the dollar could weaken broadly as the 3.20% 10-year US Treasury yield (and 105 in DXY) becomes strong resistance to more upside.

UK data may test Bank of England

Elsewhere sees the usual mid-month cluster of UK figures. Inflation is the major release with expectations of a double-digit headline print later this year. The BoE is already anticipating this in its forecasts. Another fall in the unemployment rate next week is likely to highlight the tightness of the jobs market. This adds to wage and price pressures, though the MPC seems more preoccupied by falling growth.

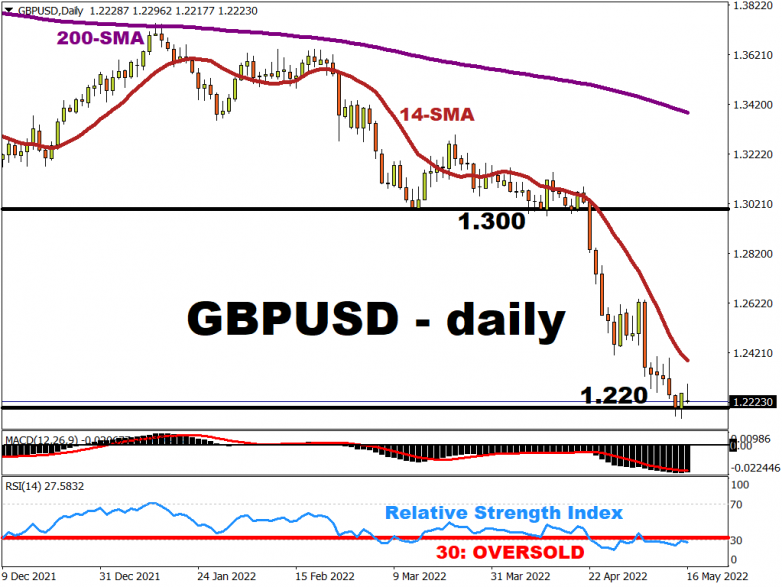

The beleaguered pound (and the euro too) are eyeing up major levels. The weak undertone in GBP/USD sees the bears targeting 1.20, after a fourth consecutive week of declines. Long term retracement support sits just above here.