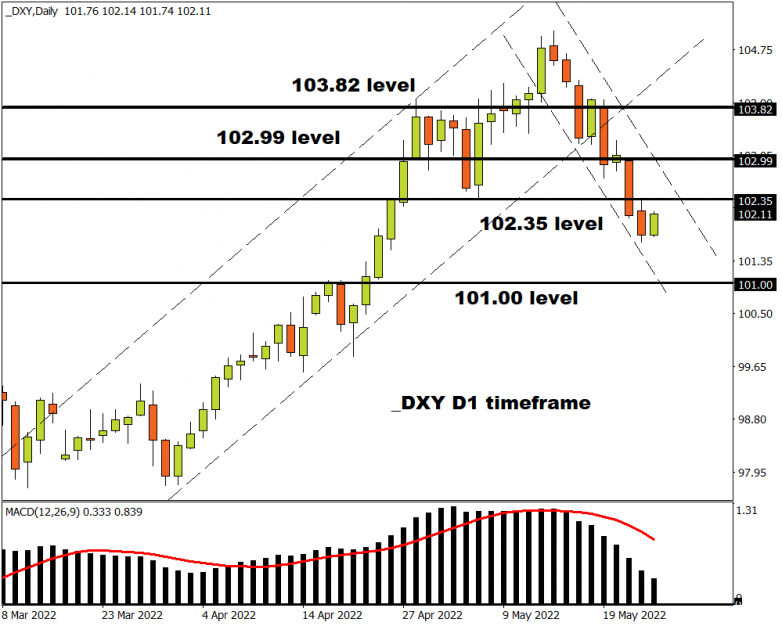

It’s been another busy session after Wall Street closed lower due to more tech-led selling. Yesterday saw US bond yields fall as growth concerns and the risks of recession remained front and centre for many investors. The mighty greenback was mixed against its G10 peers, although the broad-based DXY has rebounded this morning from the prior day’s losses and is attempting to reclaim the 102 level.

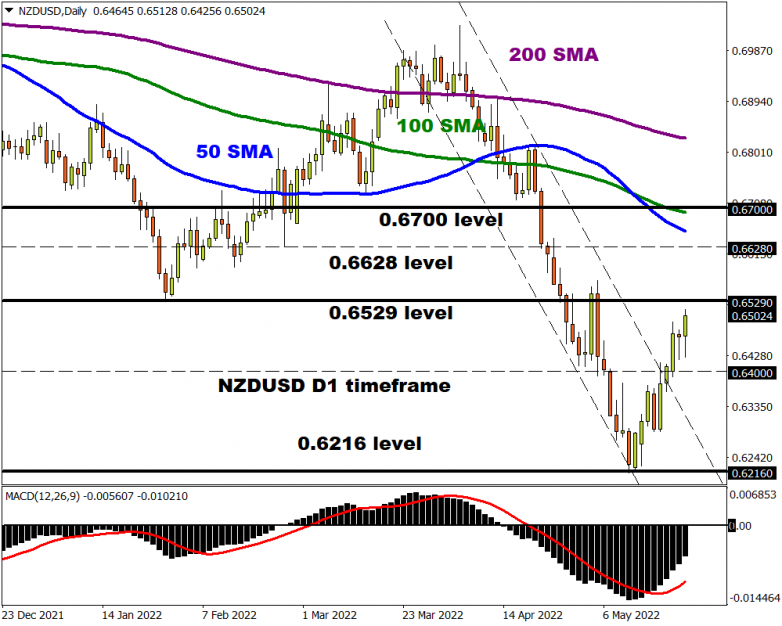

Overnight, the RBNZ hiked the official cash rate (OCR) by 50bps to 2% as expected. This was its fifth-rate hike in a row. But the bank also pointed to more aggressive front-loading of future rate moves and it said the terminal rate, the peak OCR, would reach 3.75% in the first quarter of 2023, higher than previously thought. Policymakers did highlight the hugely uncertain global economic environment, but broad-based inflationary pressures and a tight labour market warrant faster tightening.

NZD FX has gained support this morning, though the current picture of slowing growth and tightening conditions is the conundrum being faced by several central banks. Technically, NZD/USD has rallied since falling to 0.6216 a few weeks ago, a level last seen in June 2020. This year’s January low is key resistance at 0.6529 and the midway point of 2022’s high and low sits at 0.6628. Initial support is the 23.6% Fib level at 0.6410. This matches trendline resistance, now turned support, from the April high.

Euro gains ease as markets turn to more ECB speakers

Both the euro and yen appreciated yesterday, with the former trading to a high of 1.0749 before closing near the top. The world’s most popular currency pair has faded some of the gains this morning that were driven by the latest ECB hawkish rhetoric which is coming thick and fast. EUR/USD is endeavouring to maintain 1.07 status.

We have a string of speeches from ECB officials including President Lagarde. The market will be looking for more comments and hints around the recent more aggressive central bank speak. This comes after Lagarde pre-committed to a rate hike of 25bps in July. Yesterday, she repeated her expectations that the ECB’s deposit rate will be at zero or “slightly above” by the end of the third quarter.

FOMC Minutes in focus

Later today, we get the release of the FOMC minutes for the May meeting where rates were raised by 50bps. They are likely to show a range of views on whether highly “restrictive” policy rates are to be needed to control inflation and what are the Fed’s longer term balance sheet plans. The market is set on two more half point moves at its June and July meetings and there is now a 60% chance of a 25bp move in September. Bond yields have been falling recently so stabilisation may support the dollar.

Initial resistance on the DXY index is 102.35. This comes ahead of the pandemic high at 102.99. The January 2017 top resides at 103.82 which has capped upside previously. Long-term trendline support comes in just above the key psychological level of 101.