This week sees some interesting central bank meetings including the European Central Bank and the Reserve Bank of Australia.

We also get the latest US inflation data to round off what could be a volatile few sessions in the first full trading week of June:

Monday, June 6

- AUD: Australia May inflation gauge

- CNH: China May Caixin Services PMI

Tuesday, June 7

- AUD: Reserve Bank of Australia (RBA) rate decision

- EUR: Germany April factory orders

- GBP: UK May services PMI (final)

- Gold: World Bank releases “Global Economic Prospects” report

Wednesday, June 8

- EUR: Germany April industrial production

- Gold: OECD publishes Economic Outlook

- US crude: EIA weekly US crude inventories

Thursday, June 9

- CNH: China May external trade

- EUR: ECB rate decision

- USD: US weekly initial jobless claims

Friday, June 10

- CNH: China May CPI and PPI

- RUB: Bank of Russia rate decision

- CAD: Canada May unemployment rate

- USD: US May consumer price index, June consumer sentiment

Markets ramp up ECB rate hike expectations

The ECB is expected to keep its policy rates unchanged at its meeting in Amsterdam. But it will be a historic rendezvous as the Governing Council is set to announce the end of QE and its large-scale asset purchase program.

This will open the door to a deposit rate rise in July with money markets recently increasing their bets on a potentially bigger 50bp move.

There are around 125bps of rate hike now priced in by the end of the year, and only four more meetings left after Thursday’s get-together.

Following the recent hawkish rhetoric and consensus-beating inflation data, are markets getting carried away with the end of negative rates now in sight?

Certainly, a larger rate hike would go against the dovish side of the Governing Council who wish to see a more gradual tightening path, and that includes the base case set out by Chief Economist Lane, and President Lagarde. That said, another blockbuster CPI print could sway the doubters to act faster and sooner.

The euro has been in consolidation mode since breaking above 1.0636, the pandemic March 2020 low. That level looks like decent support, while the 1.08 barrier above represents a cluster of resistance, including this year’s March low.

RBA all set to pull the trigger, but by how much?

The RBA meeting will see another rate hike, though the size of that increase is up for debate.

Having raised rates for the first time since 2010 by 25bps to 0.35% at its last meeting, the bank could raise by another quarter point, 40bps or 50bps. The latter two moves would fully unwind the emergency rate cuts from the Covid crisis in 2020.

Multi-decade low unemployment and high inflation well above the target rate back up a prolonged tightening cycle, with some economists wanting policymakers to signal their intentions early on by front-loading rate hikes.

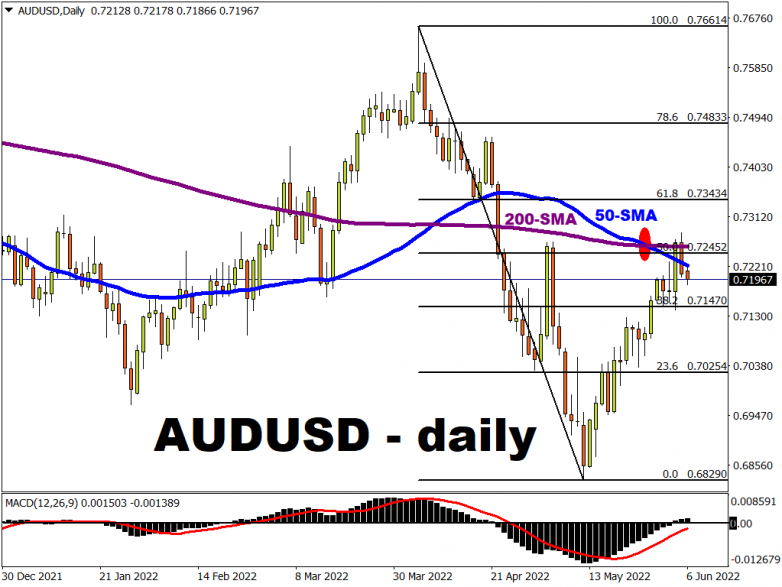

The aussie has been helped recently by the better risk mood and the news that China has been lifting some of their lockdown restrictions. Commodity prices are also back on the march which helps the iron-ore-rich nation.

AUD/USD is currently trading around the 200-day simple moving average at 0.7256 with momentum still bullish. Support sits below at 0.7147, the 38.2% Fib level of this year’s high/low move.