The dollar posted another fresh cycle high yesterday at 108.41 before easing off in the US session.

This saw EUR/USD briefly touch parity and below before pulling back while GBP/USD fell to 1.1808 before also rebounding to close largely unchanged on the day.

All eyes are on the latest inflation data out of the US which is released this afternoon.

It’s the biggest risk event on the calendar these days, even though the Fed’s preferred inflation measure is the core PCE data. Economists polled by Reuters expect an acceleration in US CPI to 8.8% on annual basis. The monthly number is forecast to rise one-tenth to 1.1%. The core reading, which excludes volatile items like food and energy, is set to remain unchanged at 0.6% while the core annual figure is expected to slow marginally to 5.7% from 6%.

Is US inflation peaking?

Economists say this slight slowdown is driven by the reduced impact from clothing and used cars. Indeed, they say that goods prices are under pressure, although these have a marginal weight in the CPI basket of around 10 to 15%. Business surveys like the S&P Global PMI, which showed that companies raised their selling prices at the slowest pace in almost a year also point to a potential softening in price pressures.

But an elevated inflation print will bolster the need for the already fully priced in 75bp rate hike by the Fed at its meeting later this month.

Front-loading and inflation-fighting credibility is key for policymakers, even if this pushes the economy into recession. This means the dollar should remain supported, especially as the general risk mood is so unstable and the greenback benefits form safe haven flows.

Bank of Canada joins the jumbo hikers

Consensus is unanimous in expecting a 75bp rate hike from the BoC, 90 minutes after the US CPI release. But money markets are rather more undecided and price in around 86bps, so half of another quarter point.

A continued pledge to be data dependent with a view to returning the 1.5% current rate to the upper end of the 2-3% neutral rate range or above as soon as possible is also predicted.

CAD remains the best performing major currency year-to-date after king dollar.

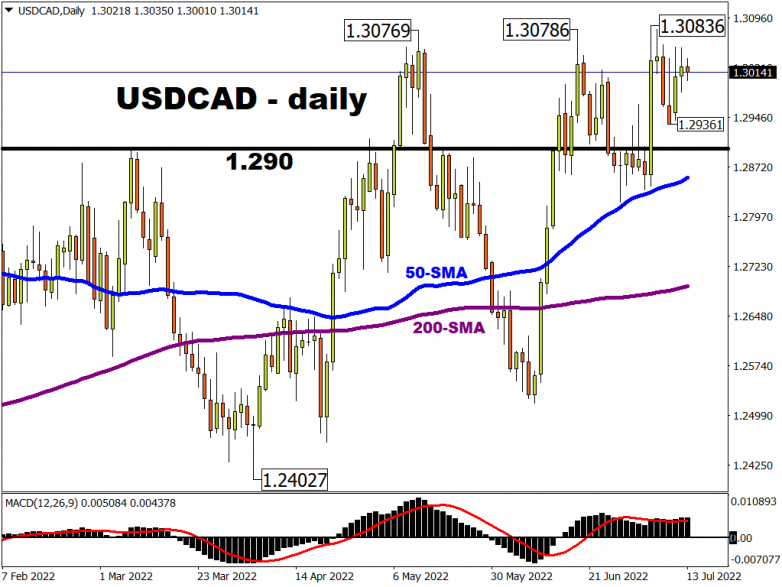

Strong economic growth, yields and the commodity backdrop have helped the loonie. But the short-term outlook remains challenging given the global economic slowdown. USD/CAD has major resistance around the May, June, and July tops at 1.3077/83. Support is 1.2936 and 1.29.