We are accustomed to fairly subdued trading sessions ahead of key risk events. But yesterday saw the greenback gain a bid and advance against most of its major peers.

The euro suffered the most as European energy prices jumped higher following news that Russia may cut natural gas supplies further. Risk assets took a turn for the worse which gave investors another reason to buy king dollar.

Ranges are still fairly tight with summer flows light which is to be expected at this time of year. European traders especially are running flat trading books during the holiday season, that means volumes will be a fraction of the size of normal trading activity. Markets are expected to remain choppy in this environment, and volatility will be heightened into today’s FOMC meeting.

75bp expected, what will Powell’s guidance deliver?

There is no fresh dot plot or economic forecasts to be released at the latest Fed meeting so all the attention will be on the post-meeting statement language and tone set by Chair Powell. He is expected to be relatively hawkish, indicating the bank’s desire to bring inflation back to its 2% target as quickly as possible through continued aggressive policy tightening, even if that causes some economic pain.

The last few meetings have seen Powell signal the expected size of the next rate move.

But with two fresh jobs reports between now and the next FOMC meeting, it seems likely that Powell will not want to risk attaching his colours to a tightening mast in late July. The continued strength of the labour market will likely serve as evidence that economy can bear more policy tightening.

The strength in core inflation also leaves little room for complacency, even if the recent falls in gasoline prices offer hope that 9.1% is “peak inflation”.

Money markets are pricing in another 125bps or so of rate hikes after an assumed 75bp rate hike at this July meeting. That takes the terminal rate up to 3.25%-3.5%, which is a recent low point.

A strident Fed could push this up higher once more, as the relative hawkishness of the world’s most important central bank stands out among its peers.

USD looking to push higher

Several U.S investment banks including Goldman Sachs and Morgan Stanley believe the risk over the FOMC meeting is that the market moves to price more Fed tightening in the coming quarters. Recent research from the Federal Reserve Board of Governors suggests a roughly 35% probability of a US recession by the end of 2023 – likely a lower likelihood than many investors have in mind.

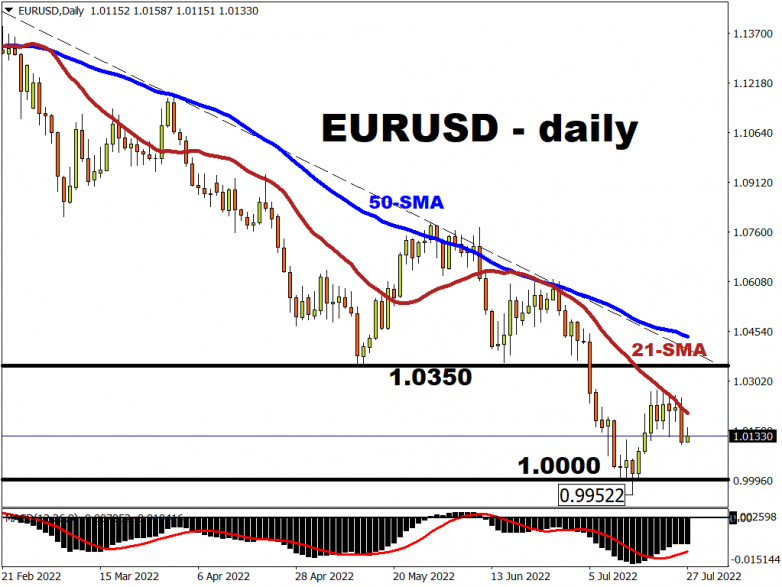

This would give the dollar a lift and push EUR/USD closer towards parity.

The ongoing gas crisis in Europe only adds support to the gloomy outlook for the single currency. The recent mid-month low is 0.9952. Resistance above sits around the 21-day simple moving average at the 1.02 zone.