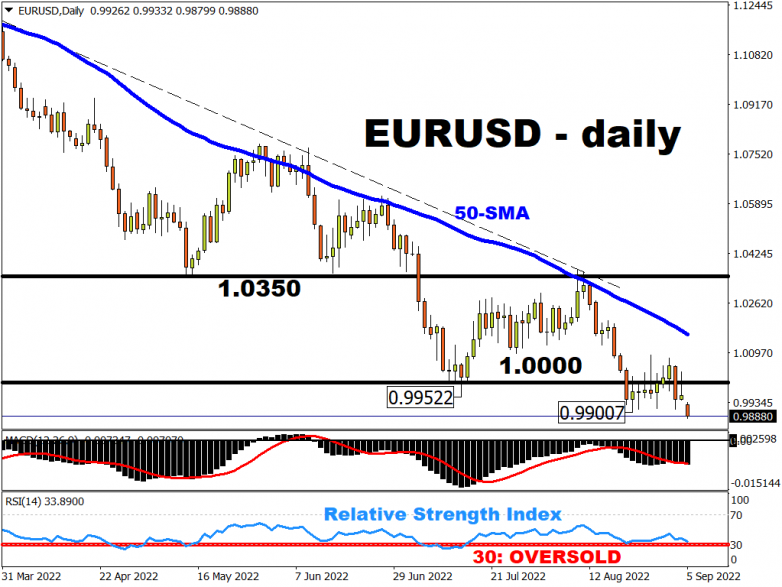

Euro traders have wasted no time in sending the shared currency to a fresh 20-year low against the US dollar, with EURUSD trading below 0.99 at the time of writing.

This comes after Russia on Friday announced an indefinite halt to gas supplies sent to Germany via the crucial Nord Stream pipeline.

This latest development complicates the European Central Bank’s fight against inflation, with a crucial policy decision due on Thursday, amidst these key economic data releases and events slated this week:

Monday, September 5

- JPY: Japan August services and composite PMIs (final)

- AUD: Australia August inflation, services and composite PMIs (final)

- CNH: China August Caixin services, composite PMIs

- EUR: Eurozone July retail sales, August services and composite PMIs (final)

- Brent: OPEC meeting

- GBP: New UK Prime Minister to be announced

- US markets closed for Labor Day

Tuesday, September 6

- AUD: Reserve Bank of Australia policy decision

- EUR: Germany July factory orders

Wednesday, September 7

- AUD: Australia 2Q GDP

- CNH: China August external trade

- EUR: Eurozone 2Q GDP (final), Germany July industrial production

- GBP: Bank of England Governor Andrew Bailey to appear before Treasury Committee

- CAD: Bank of Canada rate decision

- USD: Fed Beige Book, Cleveland Fed President Loretta Mester speech

- Apple’s “Far Out” event: latest iPhone and Apple watch release

Thursday, September 8

- JPY: Japan 2Q GDP (final)

- AUD: Australia July external trade, RBA Governor Philip Lowe speech

- EUR: European Central Bank rate decision

- USD: US weekly jobless claims

- USD: Fed Speak - Fed Chair Jerome Powell, Chicago Fed President Charles Evans, Federal Reserve Bank of Minneapolis President Neel Kashkari

- US crude: EIA weekly oil inventory report

Friday, September 9

- CNH: China August CPI and PPI

- CAD: Canada August unemployment

This worsening energy crisis is only set to damage the Eurozone’s economic performance, and such souring sentiment is clearly dragging down European assets, as already seen in the euro an in DAX futures at the time of writing.

A spike in energy prices today would only feed into European inflation that’s already at a record high (Eurozone’s headline CPI grew 9.1% in August). Such elevated consumer prices would typically mean that more rate hikes are coming, though the fight against inflation also tends to see growth negatively impacted. Some EU members are potentially already in recession while the ECB is expected to take the deposit rate into positive territory for the first time since 2011.

Markets have been swayed by the recent heavy hawkish rhetoric from numerous ECB officials who are looking for a 75 basis point rate hike, with markets now pricing in a 63% for such a jumbo-sized hike being announced this week.

Still, the euro’s fast-dwindling hopes of resurfacing back above parity over the near-term could be decided on Thursday.

Markets will be closely watching the ECB’s rhetoric about how it might react with its intended rate hikes, or perhaps shy away from the hawkish statements, amid the tremendous uncertainties surrounding this energy crisis.

Ultimately, should the ECB tolerate more demand destruction by incurring more jumbo-sized rate hikes, that may not be enough to alleviate the downward pressure on EURUSD. Euro bears could then be tempted to mimic the retesting of the 0.97-0.96 support region, as was the case back in the second half of 2002.