The dollar has been on the defensive this week and confounded those who thought last week’s Fed meeting served to offer more support for the world’s premier reserve currency.

A hawkish Chair Powell and softer economic growth outside the US are two “pillars” one prominent US investment bank have recently cited for their bullish view on the dollar.

Certainly, the former remains supportive but the improved risk sentiment this week, with the possibility of China relaxing its zero-Covid policy, has given markets some hope to latch on to.

The DXY fell for a third day, a losing streak which markets haven’t faced up to since August.

- The five-week trading range looks challenged as prices have moved to the lower end and the July high at 109.14.

- Just below here sits the 100-day simple moving average as next support at 108.87.

- The 50-day simple moving average, which has acted a decent support to the basket of six major currencies for most of this year, turns resistance to a move higher at 111.16.

Majors breaking levels

There are numerous reasons being given for the current correction in the greenback.

As money markets still price in a higher and later Fed peak, the more elongated Fed tightening cycle is spurring a drop in volatility.

We note that seasonal trends are typically USD-negative through the final quarter of the year. There can be liquidity issues as we move closer into the end of the year, but these are not seen as problematic at this time.

On little news this week, some of the majors are breaking out of recent ranges or confirming previous recent moves.

-

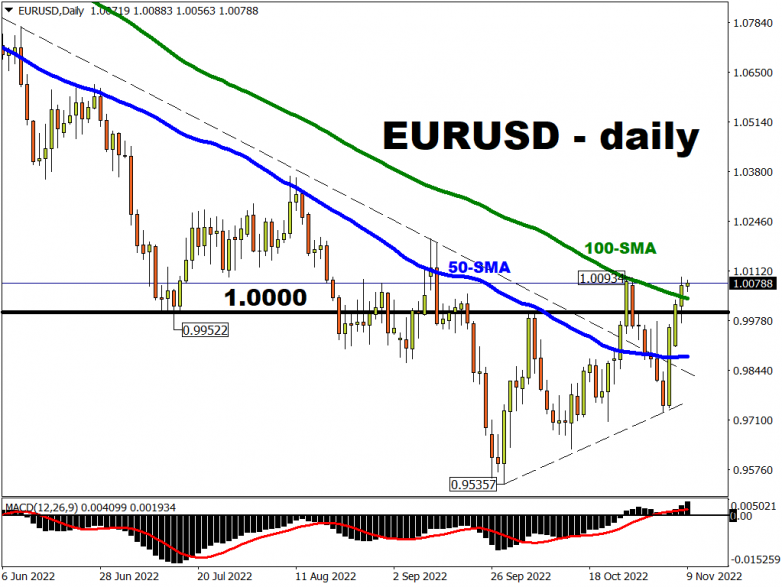

EUR/USD has been battling with the parity mark and the mid-July low at 0.99522 for several sessions. There have been a chorus of ECB speakers who now suggest there is a broad consensus for additional rate hikes being implemented swiftly.

The major has now finally pushed above the 100-day simple moving average at 1.00377. The weekly close will be important as that will have navigated Thursday’s US inflation data which is expected to remain elevated and sticky.

-

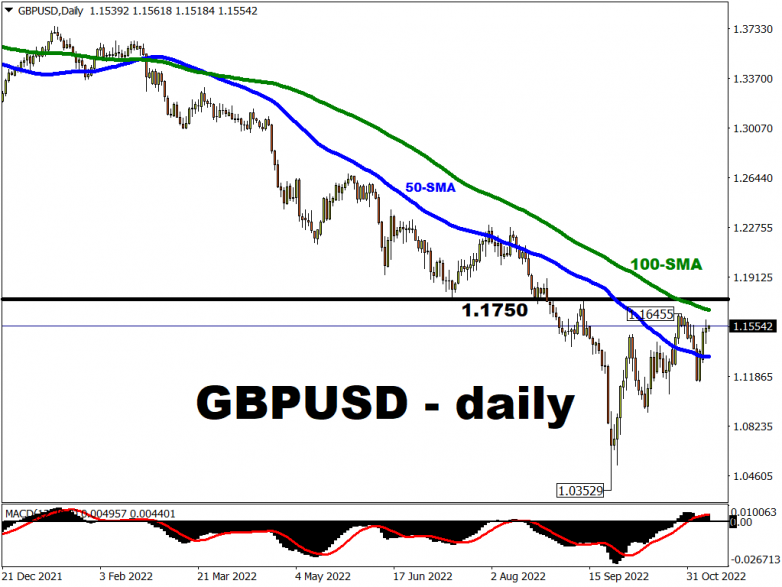

GBP/USD is teasing us and peered beyond its long-term bearish channel again as it tries to get close to the October highs around 1.1645.

The 100-day simple moving average sits above here at 1.16721.

- Meanwhile, USD/JPY fell for a third day to the 50-day simple moving average at 145.385 as the yen benefits from narrowing yield differentials.

A further move lower below the initial “line in the sand” for intervention at 145.90 will see the major back to its August/September range.