The dollar took a sharp tumble yesterday following a second set of benign US inflation data.

The greenback is now down over 9% from its multi-year highs seen in late September as markets bet on the Fed pivot and smaller rate hikes, starting from this evening’s FOMC meeting.

The Fed is still expected to raise rates by 50bps, but this is a downshift from the consecutive 75bp rate increases seen in its last four meetings.

The weaker-than-expected US CPI figures will reinforce the “peak inflation” narrative and the view that the interest rate top is in sight.

The headline m/m print rose 0.1% in November which harks back to those days when CPI was pretty much a non-risk event. Indeed, the core monthly reading last month of 0.2% was consistently the median forecast in Bloomberg surveys for 53 straight months until the pandemic hit in March 2020.

The weakness was broad-based with goods inflation dipping again while services inflation remains elevated but dipped slightly. The latter includes stickier shelter costs which have a time lag before they hit the CPI.

Fed Dot Plot in focus

Markets will zero in on the latest Fed “dot plot” at its meeting today. This is a survey of officials on where they believe interest rates will be in years to come, in response to forecasts for inflation, unemployment and gross domestic product.

Rate estimates in the survey are expected to have increased meaningfully from September’s 4.6% average and show a central bank that is prepared to keep policy tighter for longer. Money markets put the terminal rate now around 4.8% in May next year. This moved lower yesterday from near 5% after the lower inflation data.

Chair Powell’s press conference will also grab the attention with questions around how high the peak will last and when rate cuts may commence next year.

Historically, the Fed has typically stayed at the terminal rate for an average of 6.5 months, though the range has been between three to 15 months. Certainly, there will be much interest on Powell’s thoughts around falling price pressures and easing financial conditions.

ECB and Bank of England meetings incoming

Half point rate hikes are anticipated from the European heavyweights on Thursday.

President Lagarde is expected to be relatively hawkish with the economy resilient and core inflation still high. Details on the potential start to the bank’s quantitative tightening plan could spark volatility.

The euro broke higher yesterday with the March 2020 low at 1.0635 a significant level of interest. If we can close decisively above here, then 1.07 will be targeted by euro bulls.

Stronger wage growth seen in UK data yesterday contrasted with higher jobless claims and vacancies while CPI has come in weaker than expected this morning.

Any risk of a more aggressive hike should keep GBP supported on dips in the near term.

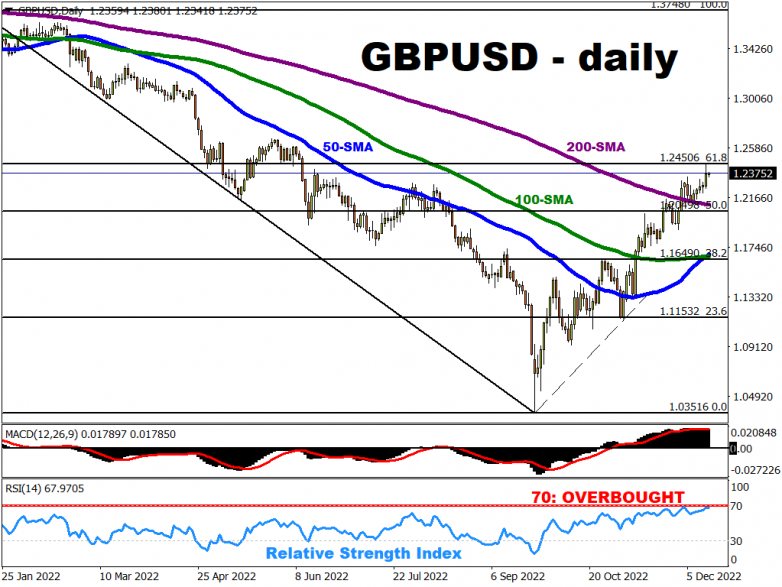

Cable got close to a major Fib level (61.8%) of this year’s decline at 1.24506. Strong support is seen at the 200-day simple moving average at 1.2110.