The drama of the fiscal situation in the world’s biggest economy continues to be front and centre in the minds of investors. The approaching debt ceiling deadline is causing caution with a deal needed between warring Democrats and Republicans to prevent the US government running out of money by the end of month and avoiding an unprecedented default. The most recent meeting between President Biden and Republican House Speaker was described as “productive” but there appears to be a lot of work to do before the so-called X-date.

The dollar has been trading a little firmer as it tries to print three consecutive weeks of gains which last happened back in February. Changing the long-term downtrend in the greenback will be tough, though the break of seven-month bear trend resistance looks good for now. There is generally some optimism in the air that a deal will be reached soon with numerous FX volatility measures still relatively low. There has been a clear rise in US short-term rates with the two-year yield pushing up to the highest since early March yesterday before falling away. But this has primarily come on the back of hawkish Fedspeak.

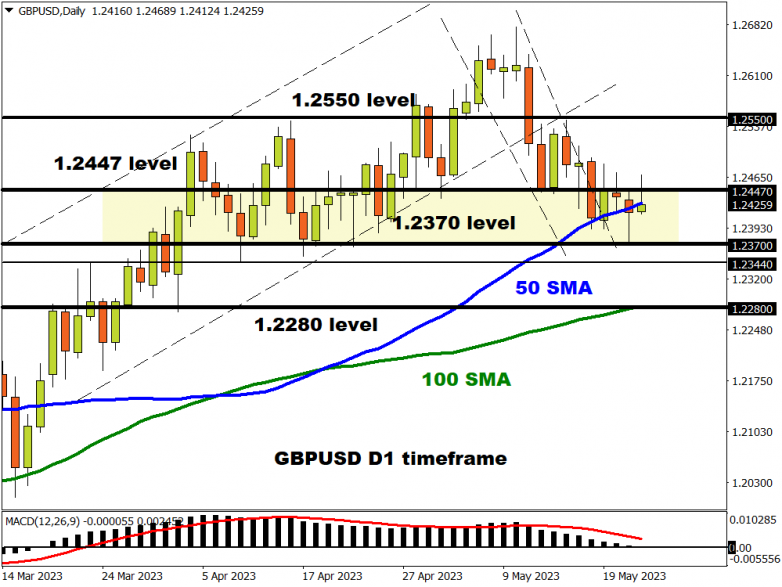

GBP/USD holding above the 50-day moving average

The UK finally saw softer single-digit CPI data this morning after seven straight months of ten-something headline prints. But the core remains very hot and of deep concern to the Bank of England who will be having fears of high prices becoming entrenched. Yesterday’s PMI data also confirmed that the much bigger services side of the economy still has decent momentum and may cause elevated price pressures. Cable is trading around the 50-day simple moving average, but support comes in around 1.2370 and then the April low at 1.2344. Bulls will look to move above and close on a weekly basis beyond the January top at 1.2447.

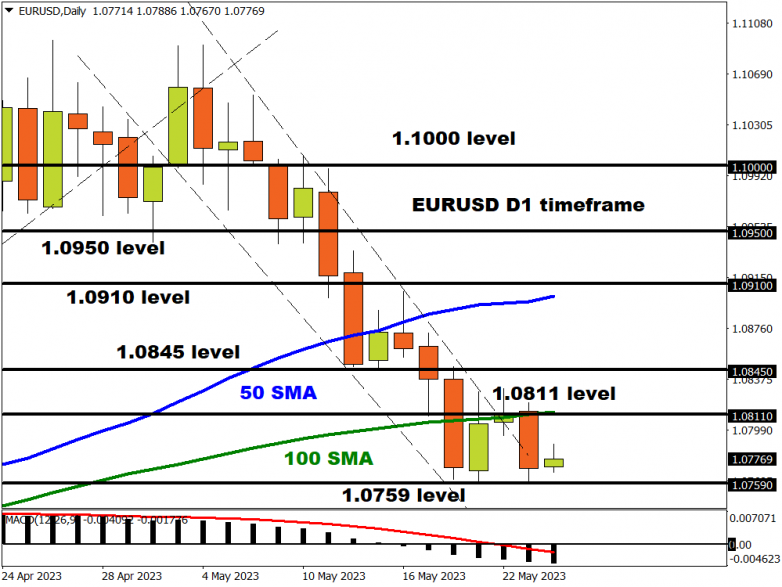

Mixed Eurozone PMI data

EUR/USD took a tumble after overall weaker than expected PMI data from the region. While French services data softened and German services strengthened, the composite Eurozone number missed expectations even though it remains healthily above the 50 boom/bust line at 53.5. This denotes still positive momentum with service sector inflation staying solid. Markets still have a 25bp rate hike nailed on for the ECB meeting in June. Gains in EUR/USD have been capped in the low 1.08s and by the 100-day simple moving average at 1.0811. Short-term trend momentum is bearish with support at last week’s low at 1.0759.