The calendar is fairly light Stateside with Monday’s ISM services PMI the only real top-tier data.

Money markets have settled on the “skip” theme where the Fed keeps rates unchanged at its meeting next week but with more chance (80%) of a July 25bp rate hike.

Friday’s hot jobs data has ticked one box for a rate move while next week’s inflation data could seal the deal.

Note however that we have now entered the blackout period for Fed speakers so there will be no commentary from officials on the wires.

Hence, with little scheduled “spark” on the USD side of the equation this week, AUD and CAD traders will be eyeing key central bank decisions due this week:

Monday, June 5

- CNH: China May Caixin services PMI

- EUR: Eurozone April PPI; May services PMI (final); ECB President Christine Lagarde speech

- US: US April factory orders; May ISM services index, services PMI (final)

- Apple set to release mixed-reality headset at Worldwide Developers Conference (WWDC)

Tuesday, June 6

- AUD: Reserve Bank of Australia rate decision

- EUR: Eurozone April retail sales; Germany April factory orders

Wednesday, June 7

- AUD: Australia 1Q GDP; RBA Governor Philip Lowe speech

- CNH: China May forex reserves, external trade

- EUR: Germany April industrial production

- Crude: US weekly crude inventories

- OECD releases global economic outlook

- CAD: Bank of Canada interest rate decision

Thursday, June 8

- JPY: Japan 1Q GDP (final)

- AUD: Australia April trade balance

- EUR: Eurozone 1Q GDP (final)

- USD: US weekly initial jobless claims

Friday, June 9

- CNH: China May CPI and PPI

- CAD: Canada May unemployment

1) Reserve Bank of Australia: Tuesday, June 6th

The bank will most likely stand pat after it recently confused markets somewhat as it turned more hawkish than many expected even as inflation was weakening.

That picture may have now reversed but traders may have to wait until the August meeting after the second quarter inflation data for a clearer picture, with markets predicting the next RBA hike to happen in August as well. The faltering recovery in China of late has also not helped the heavily linked Australian economy.

After falling to more than six-month lows, the aussie has rebounded back into the March - May range above 0.65.

Strong support resides around 0.65 with the 50-day simple moving average (SMA) above currently at 0.66629.

2) Bank of Canada: Wednesday, June 7th

The Bank of Canada will also be of interest with the non-negligible 40% chance of a rate hike.

The bank has been on pause since March holding rates at 4.5%, but GDP saw a decent rebound recently and the labour market is heating up again.

The last statement warned that policymakers were prepared to raise rates further to combat inflation risks, though they also stated that monetary policy operates with long and varied lags.

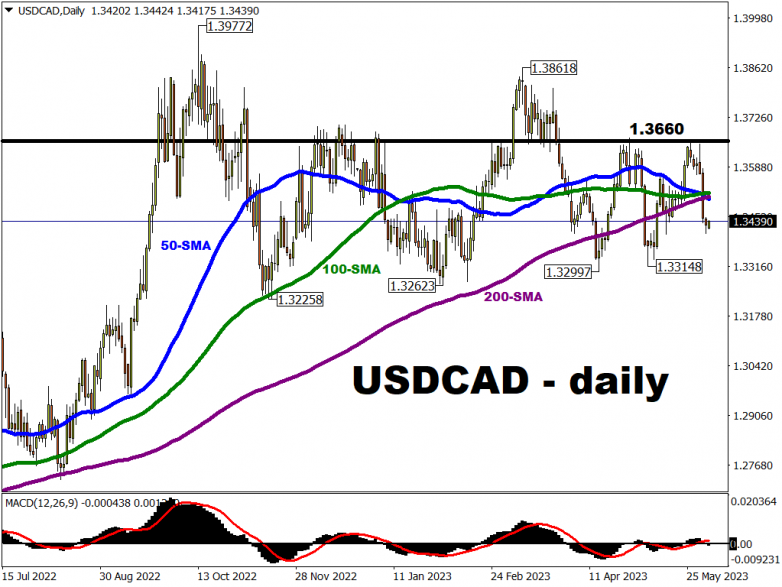

USD/CAD has been trapped in a range over the past few weeks, as evidence by key simple moving averages (SMA) converging.

Recent cycle lows around 1.33 should offer strong support, though the upside is currently capped by resistance around the 1.3660 – 1.3700 region.