The Bank of Canada meeting is being given more attention now after the surprise rate hike by the Reserve Bank of Australia on Tuesday.

Another hawkish surprise from a major central bank in the run-up to the FOMC meeting could cause markets to ramp up hawkish speculation, especially due to Canada’s closely linked economic dynamics with the US.

Consensus sees no change at today’s meeting, but money markets price in a near coin toss chance of a 25bp rate hike.

Stronger-than-expected GDP and CPI data have supported expectations around the BoC keeping rates higher for longer, while minutes from its last meeting show discussions around raising rates due to concerns about persistent inflation.

The job market remains buoyant and consumer spending remains the main growth engine. That said, the bank has stated previously monetary policy operates with a long and varied lag.

This means policymakers expect consumption to moderate through this year as restrictive monetary policy works it way through the economy more broadly.

The CAD is the best performing G10 currency over the past month, aside from the greenback.

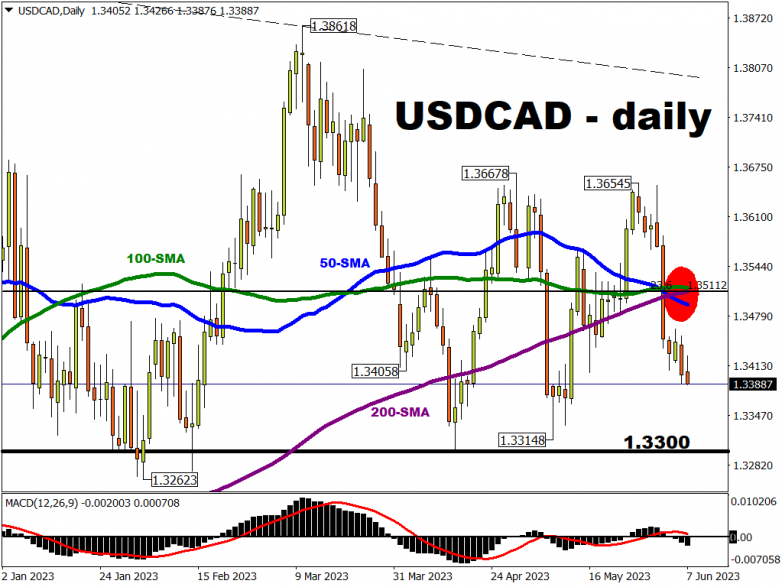

A hike by the BoC could see a break of near-term trendline support and loonie bulls would eye up major support below around 1.330.

Anything less than a hawkish hold and USD/CAD will jump back up towards 1.350; a zone where several widely-watched simple moving averages are congregating around the 23.6% Fibonacci level from this FX pair’s long-term ascent between June 2021 through October 2022.