It’s a quieter week in the US though we have a few major central bank meetings and decisions to contend with.

But global financial markets could be injected with fresh volatility due to Federal Reserve Chair Jerome Powell’s semi-annual testimony to Congress.

This week also features some Fed speeches and key economic data:

Monday, June 19

- AUD: RBA meeting minutes

Tuesday, June 20

- CNH: China loan prime rates

- JPY: Japan industrial production

- USD: Fed speeches

Wednesday, June 21

- EUR: Eurozone new car registrations

- CAD: Canada retail sales

- GBP: UK May CPI

- USD: Federal Reserve Chair Jerome Powell testimony

Thursday, June 22

- CHF: Swiss National Bank rate decision

- EUR: Eurozone consumer confidence

- GBP: BoE rate decision

- USD: Federal Reserve Chair Jerome Powell testimony, Fed speech

Friday, June 23

- EUR: Eurozone S&P Global Manufacturing & Services PMI

- JPY: Japan CPI

- GBP: UK S&P Global/CIPS Manufacturing PMI

- USD: S&P Global Manufacturing PMI, St. Louis Federal Reserve Bank President James Bullard speech

Markets will continue to process the FOMC’s decision to pause or “skip” a rate hike at their June meeting last week. According to the CME Fed Watch tool, there is now a 74% chance of a 25bp rate rise at its next meeting in late July with a 26% possibility of no change. But markets then see a 22% chance of rates at 5 to 5.25% at its following meeting on 20 September.

The Fed decision was seen as a “hawkish hold” due to the new dot plot from officials indicating two more rate hikes this year. But markets have a different opinion again from the FOMC. There is clearly a broad range of views on the committee and Chair Powell will be grilled about the Fed’s policy stance by politicians on Capitol Hill this week. Policymakers are now hugely data dependent and will look like erring on the side of defeating inflation by additional policy tightening until we see a material slowing in inflation near to target which probably also means a higher jobless rate. A more cautious view would see more dollar selling after three straight weeks of losses.

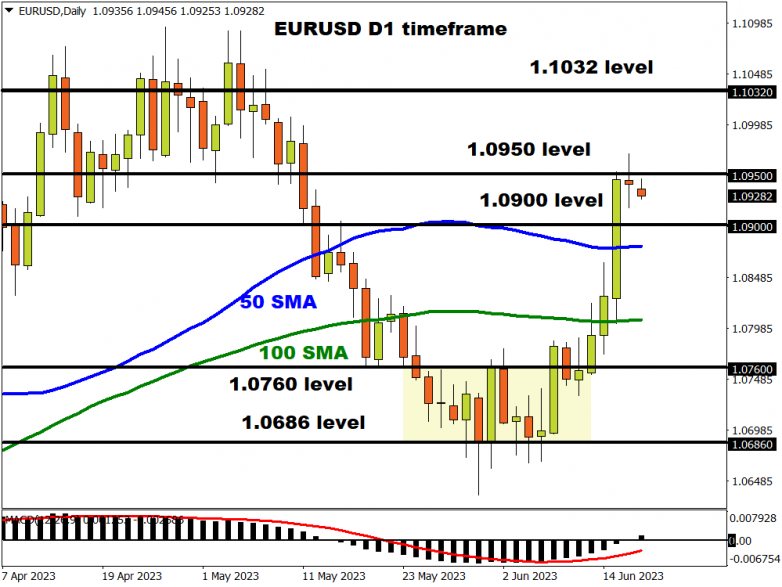

The eurozone will get a first sense of how the month of June is shaping up in terms of economic activity, as the PMI and consumer confidence data is released. Last month brought a pretty bleak report on the economy as the PMI indicated that services experienced slower growth and manufacturing a sharper contraction. The upside was around fading inflation expectations. So far, there’s little indication that activity has picked up from there. The euro will be hoping to hold onto its recent bullish advance as it nears strong long-term resistance around 1.1032.

After some unwelcome inflation and wage data, markets now expect the Bank of England to take rates close to 6% over the coming months. That equates to almost six additional rate hikes and is very close to the highs we saw during the ‘mini budget’ crisis last year. The question for Thursday’s BoE meeting, where a 25bp hike is highly likely, is whether the bank pushes back against investor expectations. Forward-looking inflation measures point to price pressures dropping noticeably through the summer. The 14-month highs in cable are closing in on resistance at the 200-week simple moving average at 1.287.

The People’s Bank of China will decide on Tuesday whether to cut its loan prime rates, following the recent 10-bps cuts to its medium-term lending facility and seven-day reverse repo rate. The Reserve Bank of Australia, meanwhile, will publish the minutes of its June policy meeting the same day. The aussie has been on a roll lately, as the RBA pivots further to the hawkish side and Beijing steps up its efforts to stimulate the Chinese economy, which is the biggest market for Australian exporters. Further gains could be in store for the currency if the minutes reinforce bets for more rate hikes by the RBA and China sticks to its pledge to boost growth.