Here’s a list of major economic data releases and events due in the days ahead:

Monday, July 17

- CNH: China key policy rate decision; 2Q GDP; June industrial production and retail sales

- EUR: Speech by ECB President Christine Lagarde

- USD: US July Empire Manufacturing

Tuesday, July 18

- AUD: RBA meeting minutes

- USD: US June retail sales, industrial production

- CAD: Canada June CPI

- SPX500_m: Earnings from Bank of America, Morgan Stanley

Wednesday, July 19

- NZD: New Zealand 2Q CPI

- EUR: Eurozone June CPI (final)

- GBP: UK June CPI

- WSt30_m: Earnings from Goldman Sachs, IBM

- SPX500_m: Earnings from Netflix, Tesla

Thursday, July 20

- AUD: Australia June unemployment, business confidence

- CNH: China loan prime rates

- EUR: Eurozone July consumer confidence

- USD: US weekly jobless claims

Friday, July 21

- JPY: Japan June national CPI

- GBP: UK June retail sales; July consumer confidence

- CAD: Canada May retail sales

This week’s inflation data out of G10 economies comes on the back of last week’s focus on the US CPI data, which undershot expectations on nearly all measures.

This had a major impact on the dollar, which had its worst week in eight months, with the DXY index falling 2.2% over the past five sessions.

But the greenback is oversold on various technical measures so it will be interesting to see how much of a pullback we see after the recent six straight days of losses until Friday’s positive session.

Still, the disinflation narrative is growing with long dollar positioning evaporating, which in turn may carve out more upside for other G10 currencies, including the Japanese Yen.

Japan’s “core core” CPI may allow BoJ tweak

Japan CPI will be another key report as speculation is growing about a possible tweak in policy by the Bank of Japan (BoJ), potentially at its upcoming meeting at the end of this month.

Headline and core CPI appear to have plateaued in Japan but the so-called “core core” rate continues to climb.

Here are the median forecasts among economists:

-

National CPI: 3.2% year-on-year

-

National CPI (excluding fresh food): 3.3% year-on-year

-

National CPI (excluding fresh food and energy): 4.2% year-on-year

Friday’s data could be important in helping policymakers make up their minds if they should lift or remove the upper limit on the 10-year JGB yield.

An upside surprise could fuel speculation of a July policy move further boosting the yen.

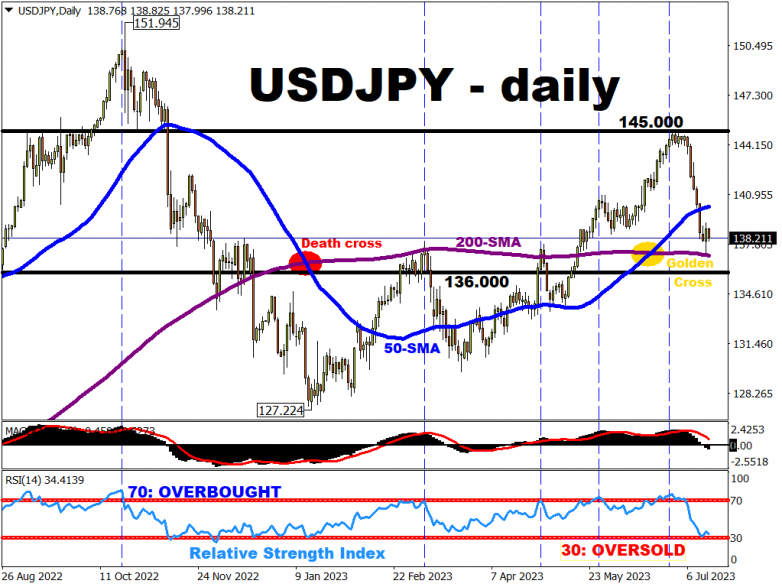

That may translate into USDJPY potentially breaking below its 200-day simple moving average (SMA) resistance-turned-support level and towards 136.00.

Fundamental traders may even disregard the bullish signal that may emanate from this FX pair’s recent “golden cross”.

However, a lacklustre set of CPIs out of the world’s third largest economy may in turn allow the BoJ to persist with its dovish policy stance.

An outlook that takes into account an unchanged BoJ policy stance may see USDJPY pushing back up towards its 50-day SMA around the psychologically-important 140 mark, especially also if the US Dollar also sees a technical pullback.

At the time of writing, Bloomberg’s FX model forecasts a 73% chance of USDJPY trading within the 136.0 – 140.0 range over the next one-week period.